Ball raising millions for potential cap ex projects, ‘strategic alliances’

WESTMINSTER — Ball Corp. (NYSE: BALL) launched a public offering of euro-denominated senior notes Monday with the intent to raise about 750 million euros, or roughly $833.4 million.

The aluminum-can giant “intends to use the net proceeds from the offering, together with cash on hand, for general corporate purposes, which may include the refinancing or repayment of debt, potential investments in strategic alliances and acquisitions, working capital, pension contributions or capital expenditures,” Ball wrote in a regulatory disclosure. “Prior to the application of such proceeds, Ball intends to repay outstanding borrowings under its U.S. dollar revolver, without a reduction in commitment, using a portion of the net proceeds from the offering, together with cash on hand. The exact allocation of such proceeds and the timing thereof is at the discretion of Ball’s management.”

BNP Paribas, Deutsche Bank Securities Inc., Crédit Agricole Corporate and Investment Bank and UniCredit Bank GmbH are the global coordinators and joint book-running managers of the offering of the notes, the filing said.

SPONSORED CONTENT

Ball Corp. (NYSE: BALL) launched a public offering of Euro-denominated senior notes Monday with the intent to raise about 750 million euros, or roughly $833.4 million.

Related Posts

-

How could the Trump administration’s steep tariffs on imports from China trickle down to tourism-dependent…

-

A state economic official and an RBC broker told the Colorado Economic Development Commission Wednesday…

-

A judge has denied an “emergency motion" by the owner of the troubled Future Legends…

-

Failing to get the Town of Windsor to extend temporary certificates of occupancy that expired…

-

Boulder business owners and advocates are pushing back on a petition effort that aims to…

-

Citing a litany of bounced checks, alleged misrepresentation of financial means, incomplete work and deteriorating…

-

There is a familiar playbook for former professional football players when they retire from the…

-

Noodles' revamped menu, which features about a dozen new or reimagined dishes, is available at…

-

The Broomfield ski area operator posted higher sales and earnings despite recording fewer visitors and…

-

Boulder-headquartered Meati Foods, a mushroom-based whole-food proteins producer, plans to lay off 150 workers and…

-

Pindustry, a Greenwood Village-based bowling, arcade and live-music concept, is coming to Broomfield.

-

Although they expressed concern about whether federal research funding would continue, panelists at a Longmont…

-

Weld County officials have learned that keeping and growing its operations in downtown Greeley would…

-

The Greeley City Council is going to take a little more time to wade through…

-

Spreading the word about the reopening of a business that had been closed since it…

-

The University of Colorado is spearheading the establishment of an incubator for quantum-technology startup companies…

-

Negotiators with King Soopers and United Food and Commercial Workers Local 7 are meeting Wednesday…

-

S&W Seed's stock price grew like a weed Tuesday, sprouting more than 30% on news…

-

Rare earth metals are critical components of many electronic devices, but the elements, which have…

-

Core Spaces LLC, a Chicago-based student-housing developer, is the buyer that is expected to take…

-

Colorado State and Utah State universities sued the Mountain West Conference this week, claiming that…

-

The relationship between grocery giants Albertsons and Kroger Co. appears to have passed its sell-by…

-

Judges in Oregon and Washington issued injunctions Tuesday halting, at least for the moment, a…

-

“Slower growth … may be the new reality for Colorado as population growth, especially through…

-

Capstone at Centerra has been sold, but a marketing official for says she anticipates no…

-

In a decision that could again tip the balance of power in Loveland city government,…

-

The Windsor Downtown Alliance is on some shaky ground after the Windsor Town Board on…

-

Several towns in fast-growing Northern Colorado may soon be able to give the green light…

-

Dreams for a massive hockey arena, hotel, convention center and indoor water park are easy…

-

A Utah development company has purchased Greeley’s Elk Lakes Shopping Center at U.S. Highway 34…

-

Edison’s Ice Cream will occupy the approximately 1,600-square-foot space at 172 N. College Ave. in…

-

Airplane manufacturer Boeing will eliminate 63 jobs across Colorado operations in Arapahoe, Denver, El Paso…

-

Gastamo Group LLC, the Denver-based restaurant group behind popular concepts such as Birdcall and Park…

-

After 65 years, the family-owned Bandimere Speedway will get a spark of new life, and…

-

Veloce Energy Inc., a startup company that develops modular devices to make electrification easier is…

-

The Colorado Educational and Cultural Facilities Authority approved the documents necessary to issue bonds for…

-

BOULDER — Kura Sushi USA Inc., the American subsidiary of a Japanese rotating sushi bar…

-

Domenic’s Bistro and Wine Bar will close after dinner this Sunday at 931 E. Harmony…

-

Group Publishing Inc., a 50-year-old Loveland-based provider of curriculum materials for youth and adult Sunday-school…

-

Longmont will be the first city in the nation to join a United Nations program…

-

The state of the Future Legends Sports Complex in Windsor is in general mismanagement, neglect…

-

If there was ever one thing plaguing communities in Northern Colorado, hands down, it would…

-

Experts who spoke Tuesday at the Boulder Chamber’s Economic Summit weren’t shy about touting the…

-

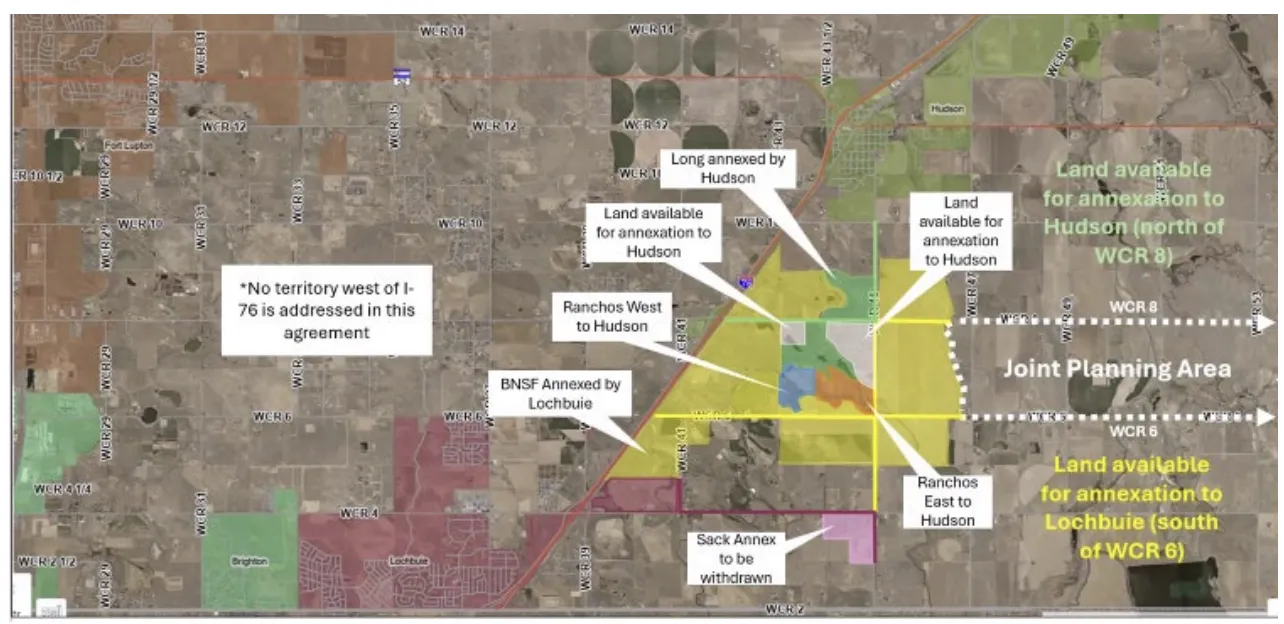

The months-long tug-of-war between Hudson and Lochbuie fighting over control of the BNSF Railway Co.…

-

WELD COUNTY — Magnum Feedyards has operated for more than 30 years in eastern Weld…

-

Vail Resorts plans to lay off 14% of its corporate workforce and about 1% of…

-

The Le Peep location in the Village Shopping Center will close after business hours on…

-

The United Food and Commercial Workers Local 7 is calling on local, state and federal…

-

Having been banned for 11 years, recreational marijuana sales are coming back before Windsor voters…

-

A day after Boulder officials informed the owners, management and residents of Ash House that…

-

Little more than a year after Boulder’s historic Marpa House was turned into rental housing…

-

The saga over a local memory care center potentially being taken over by its bank…

-

Boulder is one step closer to winning the opportunity to host the Sundance Film Festival…

-

A Weld District Court judge put the Future Legends structures under receivership Tuesday, after Future…

-

Homebrewing enthusiast Brandon Shaw, a longtime resident of Northern Colorado, has taken over ownership of…

-

The Esh family, which has owned Esh’s Market in Loveland for 22 years, has purchased…

-

The Airport Neighborhood Campaign ran a successful petition drive for two ballot measures related to…

-

As the Boulder City Council mulls its options for raising the city’s minimum wage, the…

-

Ambrosia Biosciences Inc., a recently formed drug-discovery company, has raised a $16 million Series A…

-

Windsor developer Martin Lind has acquired approximately 220 more acres of land in west Greeley…

-

Contrary to speculation in some social-media platforms that Whole Foods had withdrawn from the proposed…

-

The University of Northern Colorado Board of Trustees unanimously approved documents that will allow the…

-

WELD COUNTY — Days before entering another round of court-ordered mediation, the towns of Hudson…

-

Larimer County officials late Wednesday said they were surprised and disappointed to learn through media…

-

It didn’t take long for the Greeley City Council to give its blessing for city…

-

The proposed new arena in Greeley would be able to seat 8,500 to 9,000 people…

-

German pharmaceutical manufacturer Corden Pharma International GmbH plans to invest nearly $500 million over the…

-

Vivo Living, a 210-unit attainable-housing building in Longmont that for decades had been a hotel…

-

DENVER — Bankruptcy filings in Colorado increased 26% in June from the same period a…

-

Brighton City Council on Tuesday tossed a heaping helping of sales and use tax love…

-

Elevate Quantum beat a group from Illinois to win a phase two Tech Hub designation,…

-

The Old West-themed performers who entertained tourists for years have ridden off into the sunset,…

-

A Weld County District Court judge has ordered the towns of Hudson and Lochbuie into…

-

The communities along the U.S. Highway 36 corridor have taken major steps beyond the shadows…

-

Cheri Witt-Brown, CEO of Greeley-Weld Habitat for Humanity, and others will unveil what will be:…

-

A Shamrock Foodservice Warehouse retail store will open on July 18 in a Louisville building…

-

Loveland will extend incentives to Hensel Phelps to help with its headquarters relocation to the…

-

BizWest honored four winners of its 2023 IQ awards in an event held Thursday at…

-

Agfinity, Colorado's largest agriculture cooperative, will officially open the doors to its new corporate headquarters…

-

Members of the majority on the Loveland City Council, who met Tuesday night with special…

-

A presentation by Loveland’s city staff to a special City Council meeting on Tuesday will…

-

Legislature passes and sends to the governor a bill to create an osteopathic medical school…

-

A special prosecutor appointed last Friday by the five-member Loveland City Council majority was given…

-

One project nears completion, and another has yet to get out of the starting gate.…

-

Intel Corp. will sell its Fort Collins facility but doesn't plan to abandon the market.…

-

The Loveland City Council on Tuesday will decide whether to accept the terms of a…

-

A public golf resort designed by some of the sports’ big names could blossom in…

-

Gillig, a Livermore, California-based manufacturer of heavy-duty transit buses, is launching a “Colorado Technology Center”…

-

Global business accelerator Techstars has decided to move its headquarters from Boulder to New York…

-

A Seattle-based lender has petitioned Larimer County District Court to collect on an unpaid $11.9…

-

A Georgia developer with designs on transforming the aging Millennium Harvest House hotel into housing…

-

Blumhouse Productions will serve as the exclusive exhibit curator at the yet-to-be-developed Stanley Film Center…

-

LOVELAND — Although post-pandemic challenges remain in several business sectors, a leading economist and leaders…

-

Standup comedy, which for decades has been mostly confined to big-city comedy clubs, is making…

-

BOULDER — SomaLogic Inc. (Nasdaq: SLGC) said Thursday evening that its $1 billion merger with…

-

COLORADO SPRINGS — Broadmoor Hotel Inc. has filed lawsuits against JBS USA Inc. and the…

-

LOVELAND — Years of collaboration among city, county, state and federal governments, along with active…

-

ESTES PARK – Just three months ahead of Estes Park’s second annual quirky festival to…

-

LONGMONT — A U.S. District Court judge for the District of Colorado has issued a…

-

BOULDER — Commercial real estate brokers are dealing with some intriguing dilemmas in the retail…

-

LARIMER COUNTY — In what may be the only fully passive home neighborhood in the…

-

A high-profile state ballot measure that would have weakened Colorado’s Taxpayer Bill of Rights while…

-

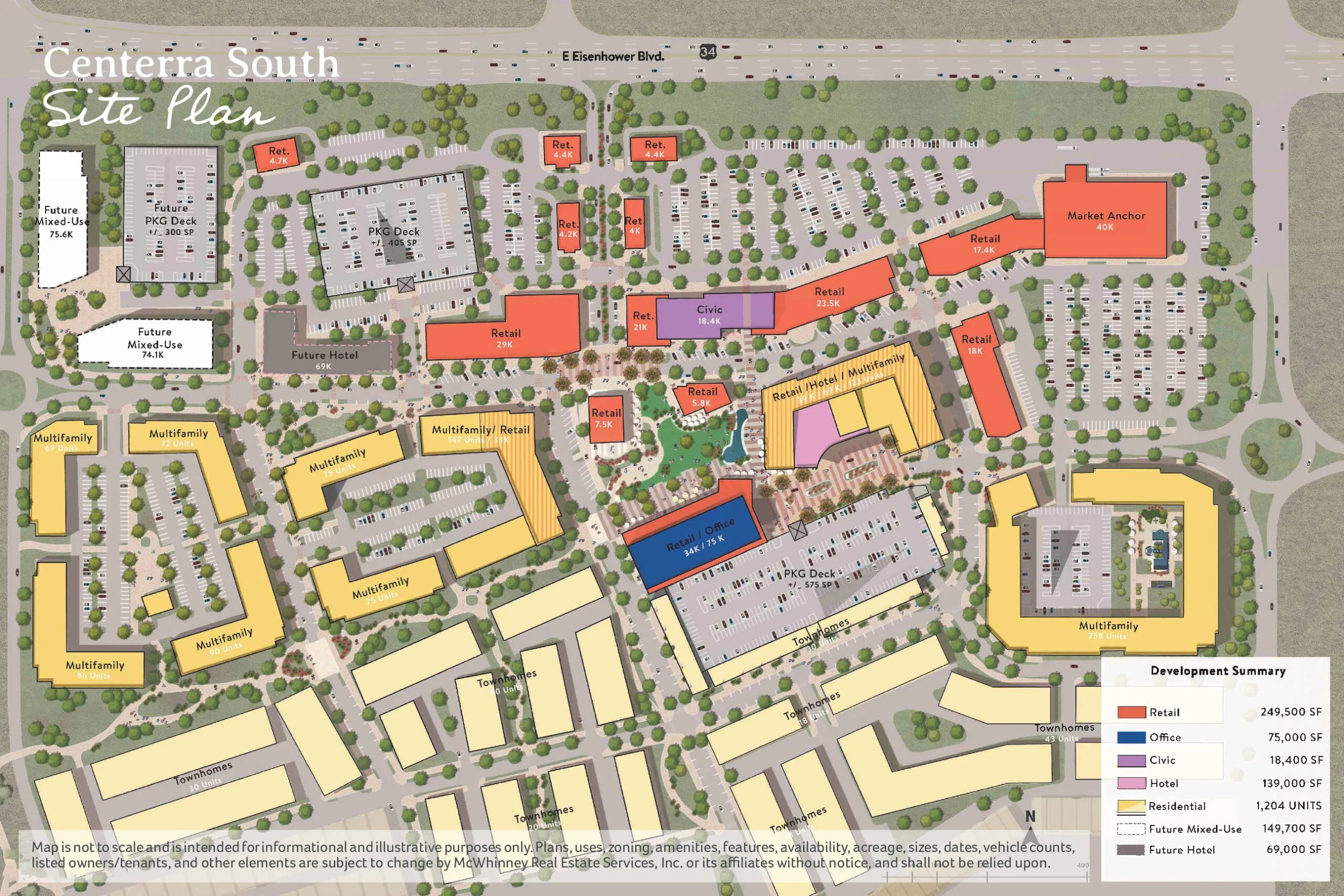

LOVELAND — Centerra South, the new mixed-use commercial and residential development across U.S. Highway 34…

-

BOULDER — SomaLogic Inc. (Nasdaq: SLGC) and California-based Standard BioTools Inc. (Nasdaq: LAB) have agreed…

-

BOULDER — As Colorado’s job growth slows to a level that one University of Colorado…

-

GREELEY — A Weld County District Court judge has ordered that a receiver take over…

-

BRIGHTON — Colorado’s already significant renewable-energy sector is expected to undergo a major growth spurt…

-

BOULDER — A sweeping redevelopment proposal for one of Boulder’s most-traveled corners would put more…

-

Hard rain that fell in broad sheets across the northern Front Range foothills and plains…

-

GREELEY — A 291-acre commercial and residential development that may eventually be home to at…

-

BRIGHTON — Rezoning of the former Kmart Distribution Center at 18875 Bromley Lane to allow…

-

FORT COLLINS — It was once a separate entity. Should it be again? What is…

-

JOHNSTOWN — An Englewood property investor has purchased a new industrial warehouse property in the…

-

LOUISVILLE — Marcel Arsenault was looking for something in particular when he bought the newly…

-

LAFAYETTE — In one of Boulder County’s richest commercial real estate deals of 2023, Real…

-

LOVELAND — An economic-incentive package for a proposed Bass Pro Shops store won unanimous Loveland…

-

LOVELAND — After more than a decade of fishing, Loveland finally may have landed a…

-

WESTMINSTER — Ball Corp. (NYSE: BALL) is selling its Ball Aerospace and Technologies Corp. division…

-

BOULDER — After a debate that lasted nearly four hours on Tuesday, Boulder County commissioners…

-

LONGMONT — It’s a dispute that has flared up frequently as growth overtakes a northern…

-

GREELEY — An energy company that owns and operates 56 solar-, wind– and gas-generation projects…

-

BOULDER — The real estate and development market in the Boulder Valley is still finding…

-

Campbell Soup Co. (NYSE:CPB) will slurp up Sovos Brands Inc. (Nasdaq: SOVO) in a stock…

-

NEVER SUMMER RANGE — The pair of moose seemed quite content, grazing on the abundant…

-

BOULDER — Boulder County officials said Friday that they plan to increase the minimum wage…

-

WESTMINSTER — Ball Corp. (NYSE: BALL) posted improved year-over-year bottom line results, beating Wall Street…

-

BOULDER — A group of Boulder area consumer-packaged goods industry veterans has launched Velocity CPG…

-

BOULDER — After a dozen years in the Pac 12, the University of Colorado Buffaloes…

-

TIMNATH — The Timnath Town Council Tuesday approved on first reading an amendment to the…

-

LOVELAND — Capital Tacos, a national Tex-Mex restaurant chain, will open its first Colorado store…

-

LOVELAND — Majority stockholders of the North Shore Manor Inc. nursing home in Loveland say…

-

BOULDER COUNTY — The pace of legal actions against Xcel Energy Inc., which investigators say…

-

LOUISVILLE — You’ve probably seen the Shamrock Foods Co. delivery trucks — logo of a…

-

ESTES PARK — Somehow, Berenice Nelson just knew. For weeks, she and husband Tory had…

-

LOVELAND — In what proponents say is as significant as electrification of America or the…

-

BOULDER and LOVELAND — Colorado Financial Management Inc., with offices in Loveland, Boulder and Denver,…

-

HUDSON -- Between 300 and 400 skilled construction and laborer jobs will become available later…

-

BOULDER — The city of Boulder and Boulder Community Health have agreed to extend a…

-

BOULDER - The private studios of Boulder's visual artists open up to the public on…