Region’s execs express pessimism for Q2

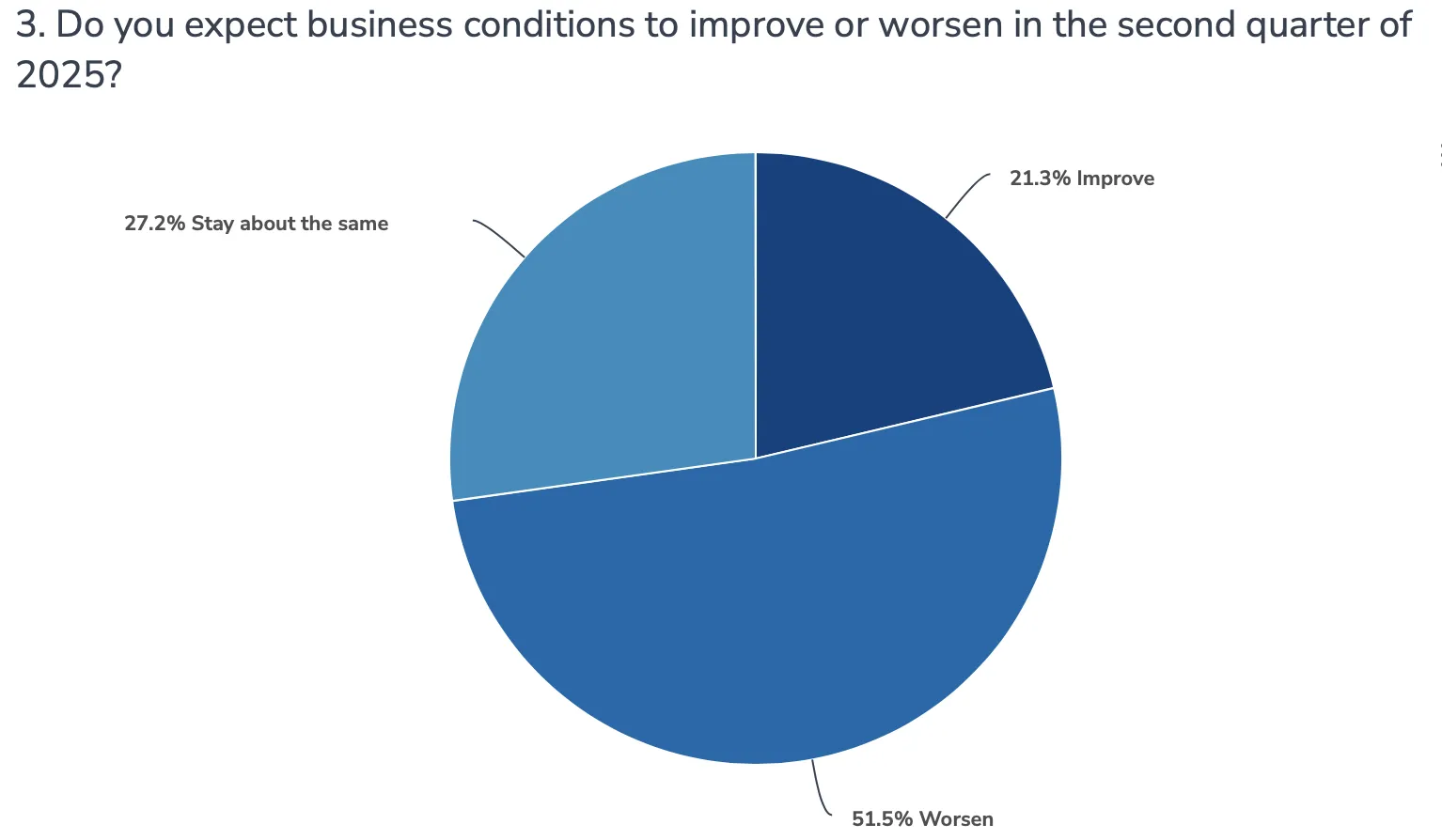

Business conditions are likely to worsen in the second quarter in the Boulder Valley and Northern Colorado, a majority of regional executives say.

That’s according to the second-quarter CEO Roundtable Executive Survey, conducted by BizWest. The quarterly survey focuses on C-level executives in the Boulder Valley and Northern Colorado. BizWest conducts CEO Roundtables in both areas, with executives gathering to discuss trends, opportunities and challenges within their industries.

More than half of respondents, 51.5%, expect worsening business conditions in the second quarter, with 27.2% expecting conditions to be about the same, and 21.3% expecting improvement.

SPONSORED CONTENT

The survey was conducted both before and after the Trump administration announced widespread tariffs on imported goods.

“Risk of a recession (and possible stock market crash) is causing our clients to press ‘pause’ on marketing, branding, and event projects that would create significant business for us,” one respondent said. “Retail is an important sector for us and is already pulling back.”

Only 19.1% of respondents said that business conditions are better than six months ago, with 41.9% saying they have worsened, and 39% saying conditions are about the same.

Three-quarters of respondents said tariffs would negatively affect their business operations, with 27.7% describing them as having a very negative impact, and 47.4% saying tariffs would have a somewhat negative impact. About 19% said tariffs would have no effect and 5.8% said they would have a somewhat positive impact.

A majority of respondents, 59.1%, expect staffing levels to remain about the same, with 21.2% expecting a moderate increase, 0.7% a strong increase, 17.5% a moderate decrease and 1.5% a strong decrease.

Similarly, capital expenditures are expected to remain flat for about half of respondents, with 48.9% anticipating no change, 20.4% expecting a moderate decrease, 10.2% expecting a strong decrease, 16.1% a moderate increase and 4.4% anticipating a strong increase.

Among other considerations for regional executives:

- Minimum wage: New minimum-wage requirements at the state, county or local levels are having no effect on 78.1% of respondents, with 19% describing it as having a somewhat negative effect, 1.5% very negative impact and 1.5% somewhat positive impact.

- Housing availability: 68% of respondents said that housing availability was having a negative impact on their employees, with 51.1% describing it as somewhat negative and 16.8% viewing it as very negative. Respondents who viewed housing as having no effect on their employees totaled 27.7%. About 4.3% of respondents said that housing availability was having a somewhat or very positive impact.

- Construction of new facilities: About 22% of respondents said their companies might require construction of new facilities in 2025, with 4.4% having definite plans, 4.4% somewhat likely, 11% considering one or more projects, 2.2% already under construction and 77.9% not at all likely.

- Office-space requirements: More than two-thirds of respondents — 69.1% — anticipate no change in office-space requirements in 2025, with 0.7% expecting a strong increase, 11.8% a moderate increase, 3.7% a strong decrease, 1.5% a moderate decrease and 13.2% responding “Not applicable.”

Respondents hailed from a variety of industries, including agribusiness, banking and finance, brewing, business services, construction, government, health care, life sciences, manufacturing, natural products, nonprofits, outdoor industry, real estate, renewable energy, traditional energy and technology.

BizWest’s CEO Roundtable program is sponsored by Plante Moran and Berg Hill Greenleaf Ruscitti LLP in the Boulder Valley and Northern Colorado. Bank of Colorado sponsors the program in the Boulder Valley, and Elevations Credit Union sponsors in Northern Colorado.

Respondents were asked the great challenge or opportunity facing their business or organization in the second quarter. Among the responses:

- “Rising labor costs and challenges in finding qualified employees. Concern about the impact of tariffs on equipment/availability & materials for construction projects.”

- “I feel that the impact to our customers is varied based on their industry. The biggest challenge to business owners is the uncertainty a large number of changes are having or are going to have on them.”

- “Increased volatility in markets due to uncertainty as a result of US tariffs; geo political unrest impacting global supply chain; additional socio economic considerations that impact cost of labor and materials that will delay delivery of various commercial real estate projects; may result in workforce reduction among challenges.”

- “Greatest challenge: lack of outside worker competency of consultants and contractors, uncertainty over the direction of interest rates, lack of business confidence. Opportunities: Providing businesses with advice through future uncertainties.”

Business conditions are likely to worsen in the second quarter in the Boulder Valley and Northern Colorado, a majority of regional executives say.