CU economists: Slow growth but no recession most likely 2025 scenario

BOULDER — Economic growth is likely to continue to slow in 2025, but University of Colorado economists don’t expect recessionary conditions to arise in Boulder or beyond in the new year.

The U.S. economy “grew very favorably in the most recent quarter” to wrap up 2024 and looks to continue to expand at a pace “not much over 2%” in 2025, University of Colorado senior economist Richard Wobbekind said Tuesday evening at the Boulder Chamber’s 2025 Boulder Economic Forecast event.

“To say there aren’t a lot of risks in the economy would be a super-mild understatement,” he said, but ”hardly (any economic data) indicates recession,” despite an impression among some in the business community that an economic downturn is imminent.

SPONSORED CONTENT

Confidence in the economy among Colorado business leaders rose to start the new year compared with both the first quarter of last year and the end of 2024, according to the University of Colorado Leeds Business Confidence Index. But for the first time in two decades, Colorado business leaders are feeling less confident in the near-term prospects for the state economy than they are for the national economy as a whole.

The index rose 3.3 points from the fourth quarter of last year to a score of 50. An LBCI score — which is based on impressions of the state economy, national economy, industry sales, industry profits, industry hiring and capital expenditures — of 50 is neutral.

Colorado business leaders gave the national economy a confidence score of 50.3 and the state economy a score of 50.1.

“I think it relates to the uncertainty about the Colorado economy,” Wobbekind said, noting that Colorado has a high concentration of industry sectors that could be looked upon less favorably by President Donald Trump’s new administration — climate technology, for example.

Immigration “could be a bigger issue” in Colorado than other states, he said, given the relatively high share of immigrants among the state’s population. If a significant number are forced out of the state, it could be a blow to an already tight labor market in which there are more jobs than workers to fill them.

Colorado has “had a really good story to tell” since the Great Recession, CU Business Research Division executive director Brian Lewandowski said, ranking among the nation’s best in a number of key economic categories. “The last 15 years have been ours,” but over the past few years, Colorado has “slipped in the ranking a bit” — the state’s real GDP growth ranked 38th in the nation last year — as “other states are starting to play catch up.”

Colorado is expected to add about 36,700 jobs in 2025, good for a 1.2% growth rate.

“Slower growth … may be the new reality for Colorado as population growth, especially through net migration, remains slow, creating headwinds for labor force and job growth,” according to the 60th annual Colorado Business Economic Outlook report, which was compiled by the Business Research Division and unveiled last month at a forum in Denver.

The Centennial State “has demonstrated one of the strongest economies over the medium-term horizon. Comparing growth from 2008-2023, Colorado has the 5th-fastest real GDP and employment growth rates, 6th-fastest population and labor force growth rates, 3rd-fastest personal income and per capita personal income growth rates, and the highest home-price appreciation in the country,” the outlook report said. “Over the short term, though, Colorado’s performance has slipped in the rankings, demonstrating the difficulty in maintaining growth for a sustained period of time.”

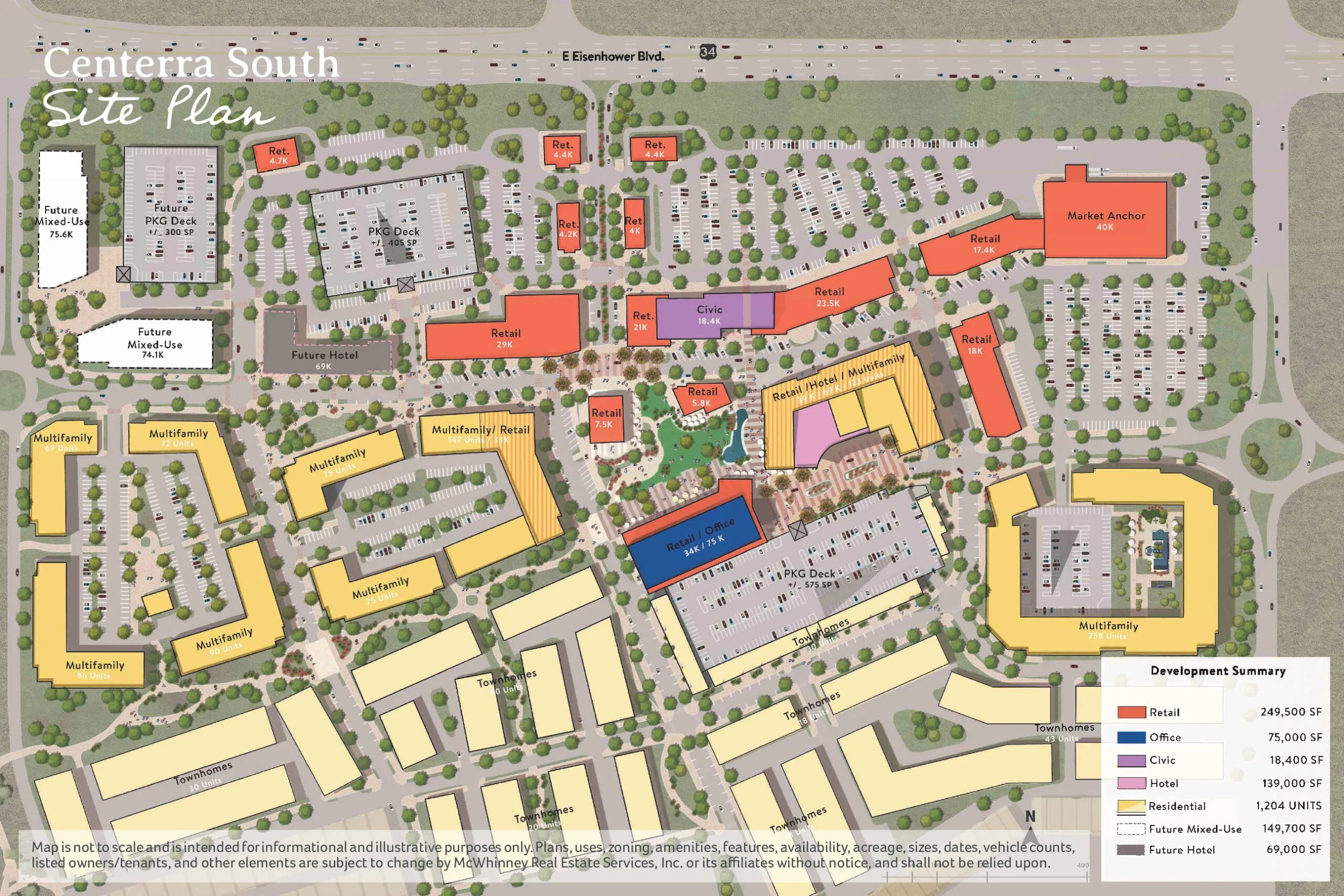

The Centennial State is “fairly weak in construction” of both residential and commercial buildings compared with top-performing states, Wobbekind said.

Residential building permits in Boulder County have been “pretty flat” since 2019, Lewandowski said. While the Marshall Fire recovery has boosted permitting for a few years in some parts of the county, that’s “tapering off now.”

Colorado hasn’t “seen the same surge in (the construction of) manufacturing facilities” spurred by the 2022 CHIPS and Science Act, Wobbekind said, a phenomenon that could be blamed in part by the state’s lack of available water and power assets.

Still, Boulder, which punches well above its weight in sectors such as aerospace, biotechnology, advanced manufacturing and venture capital, “is a hub for jobs,” Lewandowski said. “People are in-commuting every day. …We bring in visitors and workers from up and down the Front Range and all over the U.S. This is really a destination.”

Economic growth is likely to continue to slow in 2025, but University of Colorado economists don’t expect recessionary conditions to arise in Boulder or beyond in the new year.