Lawsuit claims Crocs leaders misled investors about Heydude performance

An investor in Crocs Inc. has sued the casual-footwear company’s board of directors and executives, accusing the leadership team of misleading investors about the financial performance of Heydude, a footwear brand Crocs bought for $2.5 billion in 2021.

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!

Processing your subscription now!

If you canceled your payment, click here to close this window.

If you processed a payment and this page does not reload in 10 seconds, please reach out to Bruce Dennis at 303-630-1953 for additional assistance.

Related Posts

-

Investors were going crazy for clogs during early trading Thursday as Crocs Inc. (Nasdaq: CROX)…

-

Eleven federal agencies — including the National Center for Atmospheric Research, National Renewable Energy Laboratory,…

-

Weld County officials have learned that keeping and growing its operations in downtown Greeley would…

-

A once-thriving and ambitious hotel management and development company that aspired to grow beyond Northern…

-

A trifecta of governmental bodies is considering an ambitious plan to co-locate new facilities to…

-

The Greeley City Council is going to take a little more time to wade through…

-

Spreading the word about the reopening of a business that had been closed since it…

-

The University of Colorado is spearheading the establishment of an incubator for quantum-technology startup companies…

-

Negotiators with King Soopers and United Food and Commercial Workers Local 7 are meeting Wednesday…

-

S&W Seed's stock price grew like a weed Tuesday, sprouting more than 30% on news…

-

Rare earth metals are critical components of many electronic devices, but the elements, which have…

-

Core Spaces LLC, a Chicago-based student-housing developer, is the buyer that is expected to take…

-

Colorado State and Utah State universities sued the Mountain West Conference this week, claiming that…

-

The relationship between grocery giants Albertsons and Kroger Co. appears to have passed its sell-by…

-

Judges in Oregon and Washington issued injunctions Tuesday halting, at least for the moment, a…

-

“Slower growth … may be the new reality for Colorado as population growth, especially through…

-

Capstone at Centerra has been sold, but a marketing official for says she anticipates no…

-

In a decision that could again tip the balance of power in Loveland city government,…

-

The Windsor Downtown Alliance is on some shaky ground after the Windsor Town Board on…

-

Several towns in fast-growing Northern Colorado may soon be able to give the green light…

-

Dreams for a massive hockey arena, hotel, convention center and indoor water park are easy…

-

A Utah development company has purchased Greeley’s Elk Lakes Shopping Center at U.S. Highway 34…

-

Edison’s Ice Cream will occupy the approximately 1,600-square-foot space at 172 N. College Ave. in…

-

Airplane manufacturer Boeing will eliminate 63 jobs across Colorado operations in Arapahoe, Denver, El Paso…

-

Gastamo Group LLC, the Denver-based restaurant group behind popular concepts such as Birdcall and Park…

-

After 65 years, the family-owned Bandimere Speedway will get a spark of new life, and…

-

Veloce Energy Inc., a startup company that develops modular devices to make electrification easier is…

-

The Colorado Educational and Cultural Facilities Authority approved the documents necessary to issue bonds for…

-

BOULDER — Kura Sushi USA Inc., the American subsidiary of a Japanese rotating sushi bar…

-

Domenic’s Bistro and Wine Bar will close after dinner this Sunday at 931 E. Harmony…

-

Group Publishing Inc., a 50-year-old Loveland-based provider of curriculum materials for youth and adult Sunday-school…

-

Longmont will be the first city in the nation to join a United Nations program…

-

The state of the Future Legends Sports Complex in Windsor is in general mismanagement, neglect…

-

If there was ever one thing plaguing communities in Northern Colorado, hands down, it would…

-

Experts who spoke Tuesday at the Boulder Chamber’s Economic Summit weren’t shy about touting the…

-

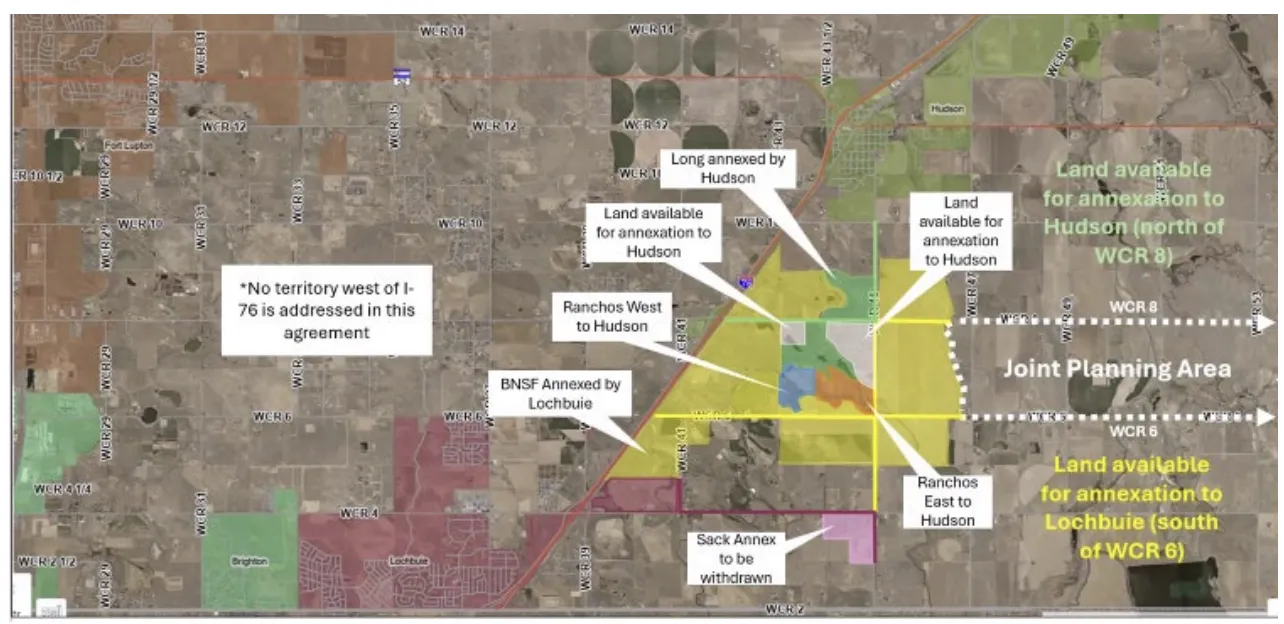

The months-long tug-of-war between Hudson and Lochbuie fighting over control of the BNSF Railway Co.…

-

WELD COUNTY — Magnum Feedyards has operated for more than 30 years in eastern Weld…

-

Vail Resorts plans to lay off 14% of its corporate workforce and about 1% of…

-

The Le Peep location in the Village Shopping Center will close after business hours on…

-

The United Food and Commercial Workers Local 7 is calling on local, state and federal…

-

Having been banned for 11 years, recreational marijuana sales are coming back before Windsor voters…

-

A day after Boulder officials informed the owners, management and residents of Ash House that…

-

Little more than a year after Boulder’s historic Marpa House was turned into rental housing…

-

The saga over a local memory care center potentially being taken over by its bank…

-

Boulder is one step closer to winning the opportunity to host the Sundance Film Festival…

-

A Weld District Court judge put the Future Legends structures under receivership Tuesday, after Future…

-

Homebrewing enthusiast Brandon Shaw, a longtime resident of Northern Colorado, has taken over ownership of…

-

The Esh family, which has owned Esh’s Market in Loveland for 22 years, has purchased…

-

The Airport Neighborhood Campaign ran a successful petition drive for two ballot measures related to…

-

As the Boulder City Council mulls its options for raising the city’s minimum wage, the…

-

Ambrosia Biosciences Inc., a recently formed drug-discovery company, has raised a $16 million Series A…

-

Windsor developer Martin Lind has acquired approximately 220 more acres of land in west Greeley…

-

Contrary to speculation in some social-media platforms that Whole Foods had withdrawn from the proposed…

-

The University of Northern Colorado Board of Trustees unanimously approved documents that will allow the…

-

WELD COUNTY — Days before entering another round of court-ordered mediation, the towns of Hudson…

-

Larimer County officials late Wednesday said they were surprised and disappointed to learn through media…

-

It didn’t take long for the Greeley City Council to give its blessing for city…

-

The proposed new arena in Greeley would be able to seat 8,500 to 9,000 people…

-

German pharmaceutical manufacturer Corden Pharma International GmbH plans to invest nearly $500 million over the…

-

Vivo Living, a 210-unit attainable-housing building in Longmont that for decades had been a hotel…

-

DENVER — Bankruptcy filings in Colorado increased 26% in June from the same period a…

-

Brighton City Council on Tuesday tossed a heaping helping of sales and use tax love…

-

Elevate Quantum beat a group from Illinois to win a phase two Tech Hub designation,…

-

The Old West-themed performers who entertained tourists for years have ridden off into the sunset,…

-

A Weld County District Court judge has ordered the towns of Hudson and Lochbuie into…

-

The communities along the U.S. Highway 36 corridor have taken major steps beyond the shadows…

-

Cheri Witt-Brown, CEO of Greeley-Weld Habitat for Humanity, and others will unveil what will be:…

-

A Shamrock Foodservice Warehouse retail store will open on July 18 in a Louisville building…

-

Loveland will extend incentives to Hensel Phelps to help with its headquarters relocation to the…

-

BizWest honored four winners of its 2023 IQ awards in an event held Thursday at…

-

Agfinity, Colorado's largest agriculture cooperative, will officially open the doors to its new corporate headquarters…

-

Members of the majority on the Loveland City Council, who met Tuesday night with special…

-

A presentation by Loveland’s city staff to a special City Council meeting on Tuesday will…

-

Legislature passes and sends to the governor a bill to create an osteopathic medical school…

-

A special prosecutor appointed last Friday by the five-member Loveland City Council majority was given…

-

One project nears completion, and another has yet to get out of the starting gate.…

-

Intel Corp. will sell its Fort Collins facility but doesn't plan to abandon the market.…

-

The Loveland City Council on Tuesday will decide whether to accept the terms of a…

-

A public golf resort designed by some of the sports’ big names could blossom in…

-

Gillig, a Livermore, California-based manufacturer of heavy-duty transit buses, is launching a “Colorado Technology Center”…

-

Global business accelerator Techstars has decided to move its headquarters from Boulder to New York…

-

A Seattle-based lender has petitioned Larimer County District Court to collect on an unpaid $11.9…

-

A Georgia developer with designs on transforming the aging Millennium Harvest House hotel into housing…

-

Blumhouse Productions will serve as the exclusive exhibit curator at the yet-to-be-developed Stanley Film Center…

-

LOVELAND — Although post-pandemic challenges remain in several business sectors, a leading economist and leaders…

-

Standup comedy, which for decades has been mostly confined to big-city comedy clubs, is making…

-

BOULDER — SomaLogic Inc. (Nasdaq: SLGC) said Thursday evening that its $1 billion merger with…

-

COLORADO SPRINGS — Broadmoor Hotel Inc. has filed lawsuits against JBS USA Inc. and the…

-

LOVELAND — Years of collaboration among city, county, state and federal governments, along with active…

-

ESTES PARK – Just three months ahead of Estes Park’s second annual quirky festival to…

-

LONGMONT — A U.S. District Court judge for the District of Colorado has issued a…

-

BOULDER — Commercial real estate brokers are dealing with some intriguing dilemmas in the retail…

-

LARIMER COUNTY — In what may be the only fully passive home neighborhood in the…

-

A high-profile state ballot measure that would have weakened Colorado’s Taxpayer Bill of Rights while…

-

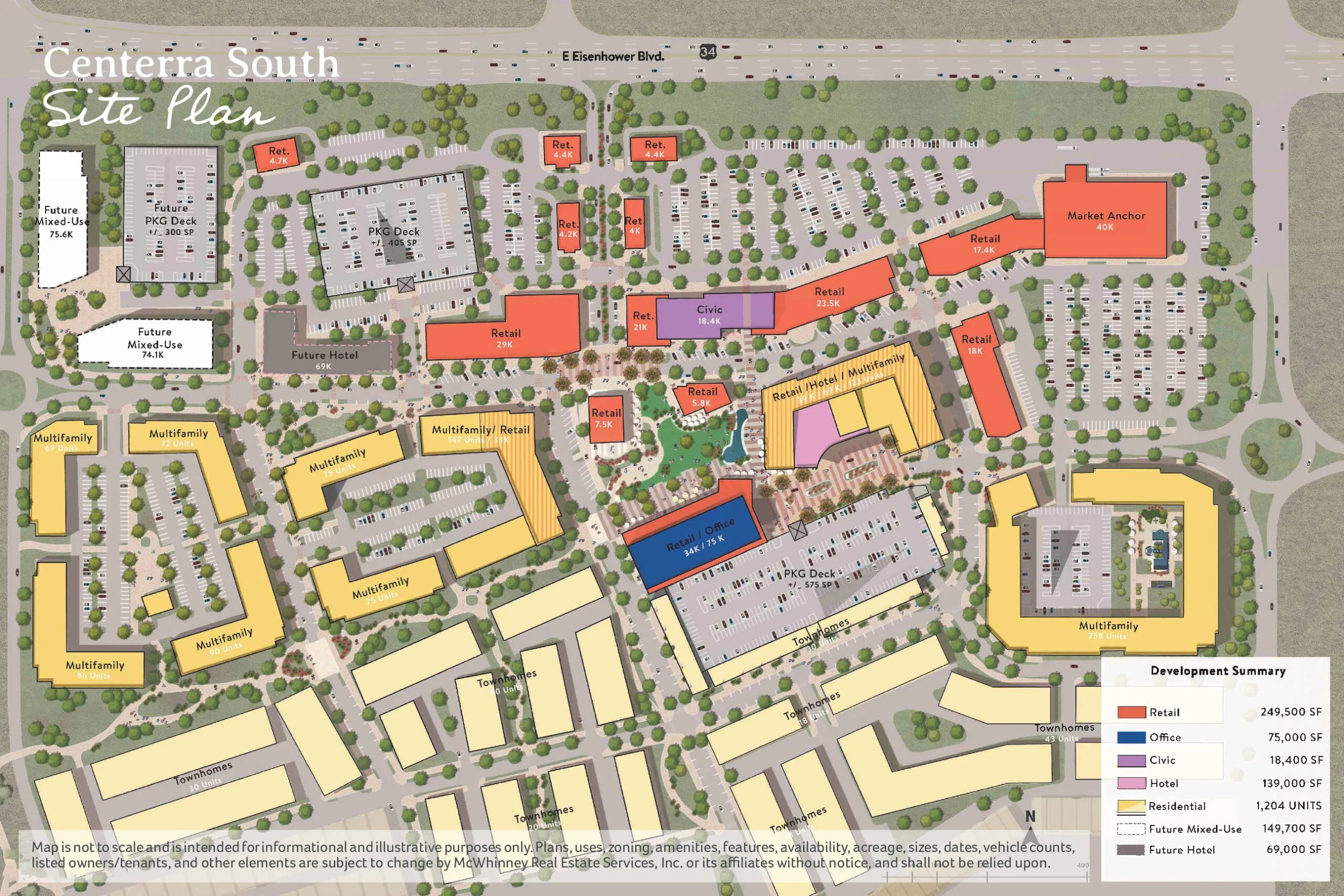

LOVELAND — Centerra South, the new mixed-use commercial and residential development across U.S. Highway 34…

-

BOULDER — SomaLogic Inc. (Nasdaq: SLGC) and California-based Standard BioTools Inc. (Nasdaq: LAB) have agreed…

-

BOULDER — As Colorado’s job growth slows to a level that one University of Colorado…

-

GREELEY — A Weld County District Court judge has ordered that a receiver take over…

-

BRIGHTON — Colorado’s already significant renewable-energy sector is expected to undergo a major growth spurt…

-

BOULDER — A sweeping redevelopment proposal for one of Boulder’s most-traveled corners would put more…

-

Hard rain that fell in broad sheets across the northern Front Range foothills and plains…

-

GREELEY — A 291-acre commercial and residential development that may eventually be home to at…

-

BRIGHTON — Rezoning of the former Kmart Distribution Center at 18875 Bromley Lane to allow…

-

FORT COLLINS — It was once a separate entity. Should it be again? What is…

-

JOHNSTOWN — An Englewood property investor has purchased a new industrial warehouse property in the…

-

LOUISVILLE — Marcel Arsenault was looking for something in particular when he bought the newly…

-

LAFAYETTE — In one of Boulder County’s richest commercial real estate deals of 2023, Real…

-

LOVELAND — An economic-incentive package for a proposed Bass Pro Shops store won unanimous Loveland…

-

LOVELAND — After more than a decade of fishing, Loveland finally may have landed a…

-

WESTMINSTER — Ball Corp. (NYSE: BALL) is selling its Ball Aerospace and Technologies Corp. division…

-

BOULDER — After a debate that lasted nearly four hours on Tuesday, Boulder County commissioners…

-

LONGMONT — It’s a dispute that has flared up frequently as growth overtakes a northern…

-

GREELEY — An energy company that owns and operates 56 solar-, wind– and gas-generation projects…

-

BOULDER — The real estate and development market in the Boulder Valley is still finding…

-

Campbell Soup Co. (NYSE:CPB) will slurp up Sovos Brands Inc. (Nasdaq: SOVO) in a stock…

-

NEVER SUMMER RANGE — The pair of moose seemed quite content, grazing on the abundant…

-

BOULDER — Boulder County officials said Friday that they plan to increase the minimum wage…

-

WESTMINSTER — Ball Corp. (NYSE: BALL) posted improved year-over-year bottom line results, beating Wall Street…

-

BOULDER — A group of Boulder area consumer-packaged goods industry veterans has launched Velocity CPG…

-

BOULDER — After a dozen years in the Pac 12, the University of Colorado Buffaloes…

-

TIMNATH — The Timnath Town Council Tuesday approved on first reading an amendment to the…

-

LOVELAND — Capital Tacos, a national Tex-Mex restaurant chain, will open its first Colorado store…

-

LOVELAND — Majority stockholders of the North Shore Manor Inc. nursing home in Loveland say…

-

BOULDER COUNTY — The pace of legal actions against Xcel Energy Inc., which investigators say…

-

LOUISVILLE — You’ve probably seen the Shamrock Foods Co. delivery trucks — logo of a…

-

ESTES PARK — Somehow, Berenice Nelson just knew. For weeks, she and husband Tory had…

-

LOVELAND — In what proponents say is as significant as electrification of America or the…

-

BOULDER — Which are the most-innovative companies in the Boulder Valley? Attendees of the 2018…

-

It's not easy to thrive in these economic times, but well-run companies with good products…

-

WINDSOR -- Former Greeley city manager Leonard Wiest, three weeks after being ousted from his…