The Group: Floodgates may open in second half of 2024

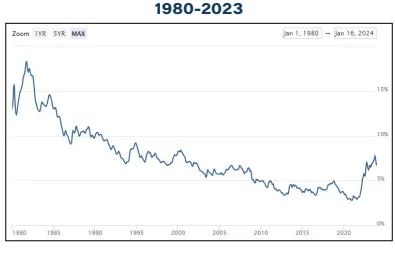

LOVELAND — The Group Inc. Real Estate company expects that mortgage rates will moderate at least by the second half of 2024.

That will open the floodgates.

Buyers who have been waiting will flood the market.

Sellers may, again, begin to experience multiple offers on their properties.

That’s the forecast for residential real estate in Northern Colorado in the coming 12 months.

A look back

Brandon Wells, president of The Group, led…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!