National economic concerns strain Colorado business confidence heading into fourth quarter

BOULDER — After months of projecting confidence that Colorado’s economy will be in full bounce-back mode by late 2021, state business leaders are now tempering their expectations heading into the fourth quarter.

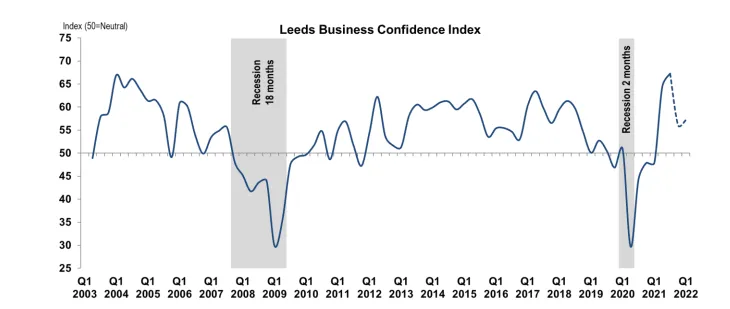

The University of Colorado Boulder Leeds Business Research division’s quarterly Business Confidence Index, released Thursday, indicates that while leaders still have a positive impression of most aspects of the economy, concerns over the national business climate are dragging down overall confidence.

The quarterly report marks Colorado business leaders’ expectations for the state and national economies, industry sales, industry profits, hiring and business spending. More than 260 business leaders responded to…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!