Indicators paint blurry picture of Colorado’s third-quarter economy

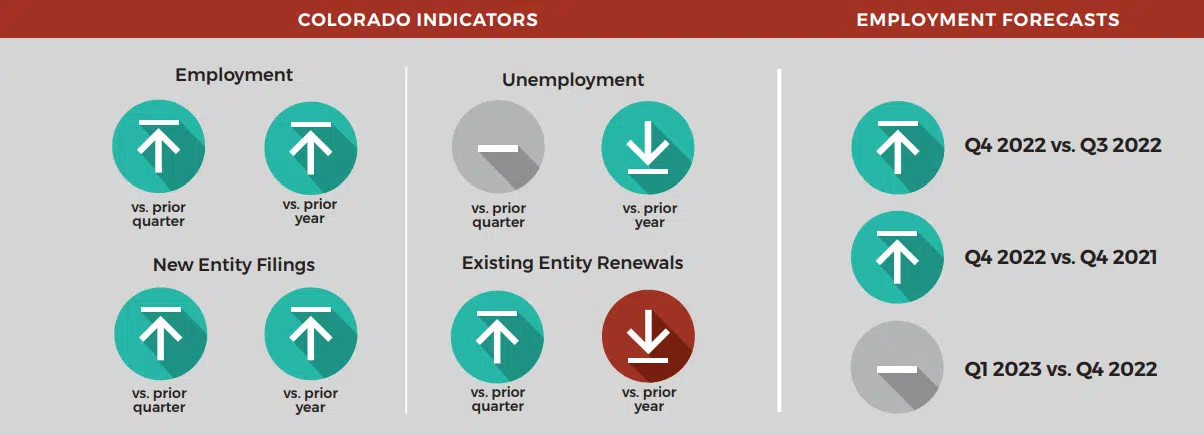

DENVER — Prices are up, but unemployment is down. New business filings are through the roof, but are being outpaced by dissolutions. Industries are adding workers, but the fastest-growing jobs are the ones that pay the least.

Mixed signals reigned during the third quarter of 2022, according to the Colorado Secretary of State’s Quarterly Business and Economic Indicators report prepared with help from the Business Research Division at the University of Colorado Boulder Leeds School of Business, painting a muddled picture of the state of business affairs heading into the end of the year.

What does appear to be clear is that…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!