Wells: Time to reset our expectations for residential real estate

Change has come quickly to the housing market.

As the Federal Reserve works to get a grip on inflation — now running at its highest rate in four decades — real estate across the U.S. is feeling the effects.

The Fed’s policy decisions (more on that topic later) have helped to drive average mortgage interest rates on 30-year loans from 3% at the start of the year to more than 6% as of mid-June. Consequently, the once blistering pace of housing demand is starting to cool.

SPONSORED CONTENT

But while rising interest rates are bringing about a shift in the real estate market conditions, it doesn’t mean real estate is in trouble. People will always need to buy and sell homes. All the factors that influence buying and selling — job change, relocation, starting families, marriage, divorce, and more — all still apply.

What the new market conditions mean is that buyers and sellers need to adjust their expectations.

Market perceptions vs. reality

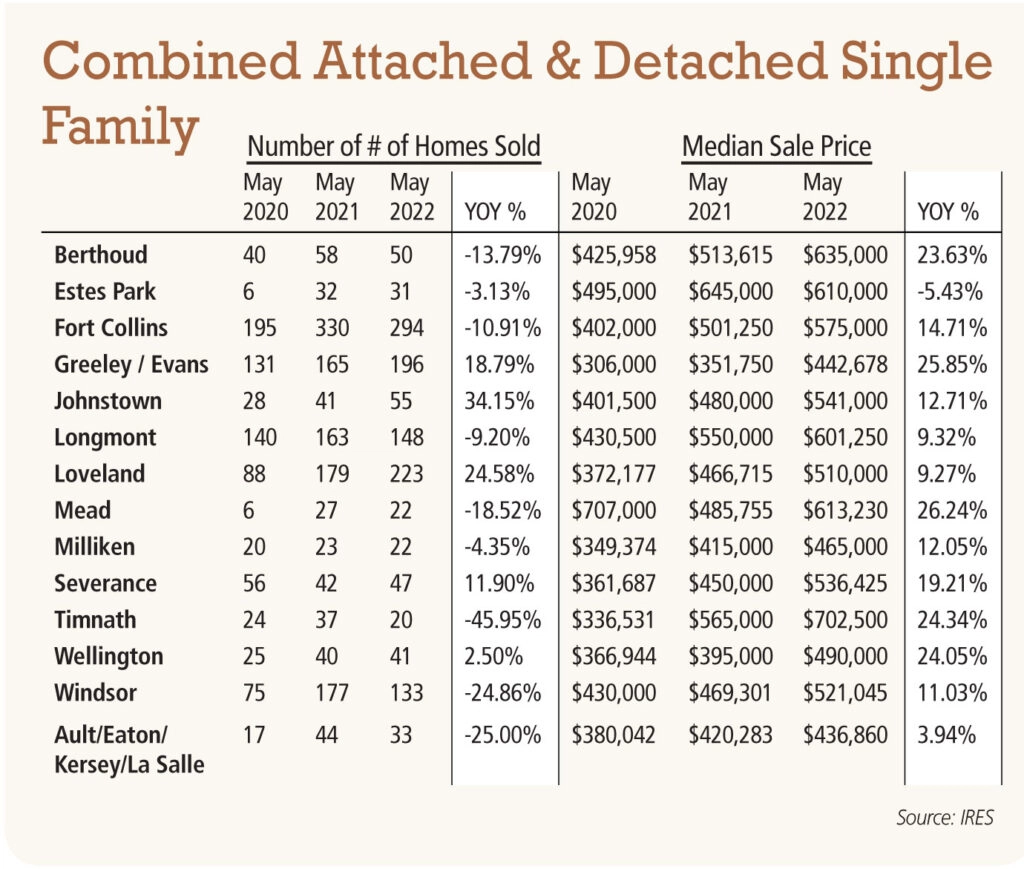

Few local real estate markets in the U.S. have matched the level of demand that we’ve experienced in Northern Colorado in recent years. That demand has helped create a perception among sellers that they should see multiple offers well above list price.

While it’s true that homes in certain price ranges may still generate bidding battles, it shouldn’t be the assumption for sellers. Many would-be buyers have been forced to the sidelines, as they face the realization that higher interest rates have impacted their ability to afford monthly loan payments.

Historically, it takes 60-90 days for consumer expectations to catch up to the reality of changing market conditions. We’re experiencing that adjustment period right now in the real estate market.

Tracking the Fed

At the start of 2022, many economists and forecasters predicted mortgage rates would rise to about 5% by the end of the year. We have quickly blown by that projection.

This unexpected jolt to long-term rates stems primarily from the Fed’s decision to reduce its balance sheet and its holdings of mortgage-backed securities. During the Great Recession of 2008-2009, the Federal Reserve stepped in to support financial markets, especially housing, by purchasing mortgage-backed securities. And with the onset of the pandemic, the Fed ramped up these purchases again in 2020 to support the housing economy.

These purchases had the effect of bringing interest rates down, enticing borrowers and driving consumer demand. These purchases have added up to $2.7 trillion worth of mortgage-backed security holdings, making up one-third of the Fed’s entire balance sheet. But in the wake of inflationary pressures, the Fed is shifting gears with the goal of curbing demand. Its announcement to sell off these securities is what’s stirring upward volatility in long-term rates and dampening the real estate markets.

What’s next for real estate?

Is the housing market going to collapse? No, and here’s why.

First, supply and demand are the primary drivers of the market. Today, we are not only undersupplied in housing, but we have a long way to go to reach market equilibrium, which is about six months of inventory. Next, tighter lending rules after the Great Recession have made sure borrowers are on stronger footing. And finally, homeowners are sitting on record equity. We don’t face the same risk from a surge of foreclosures impacting property values. More homeowners will be rate-locked into their homes extending the typical 7-9 year tenure.

Advice for sellers and buyers

If you’re looking to sell, accept the new realities of the market and price your property appropriately. Keep an eye on recent sales activity, both in your immediate neighborhood and the broader marketplace. Shifting conditions mean comparable sales have aged quickly, so hire a professional to guide you through the current dynamics and absorption in the market.

If you’re looking to buy, educate yourself on the wide range of options for financing, such as interest rate buydowns and longer rate locks. Also, keep in mind why you are buying the house – the lifestyle factors as well as the investment. Most people don’t remember the exact amount they paid for their house or the interest rate. What they remember is why they bought a home — that it was a place to find safety and security and build memories.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at bwells@thegroupinc.com or 970-430-6463.

Change has come quickly to the housing market.

As the Federal Reserve works to get a grip on inflation — now running at its highest rate in four decades — real estate across the U.S. is feeling the effects.

The Fed’s policy decisions (more on that topic later) have helped to drive average mortgage interest rates on 30-year loans from 3% at the start of the year to more than 6% as of mid-June. Consequently, the once blistering pace of housing demand is starting to cool.

But while rising interest rates are bringing about a shift in the real estate market conditions, it…