Insurance rates will climb along the Front Range, whether you have claims or not

Two years of global natural catastrophes and years of population growth are about to drive up the price of property insurance across the region.

Brett Kemp, president of Flood and Peterson, told a group of executives at a BizWest roundtable in June that insurance premiums and deductibles for properties have risen rapidly over a short period of time.

“The insurance market has changed overnight,” he said.

Mike Brown, director of market solutions for Flood & Peterson in Fort Collins, said the reinsurance market was soft for several years due to a healthy supply of reinsurance companies willing to take on the risk of the insurers that dealt with consumers. The last “hard market” period ended around 2012, he said.

SPONSORED CONTENT

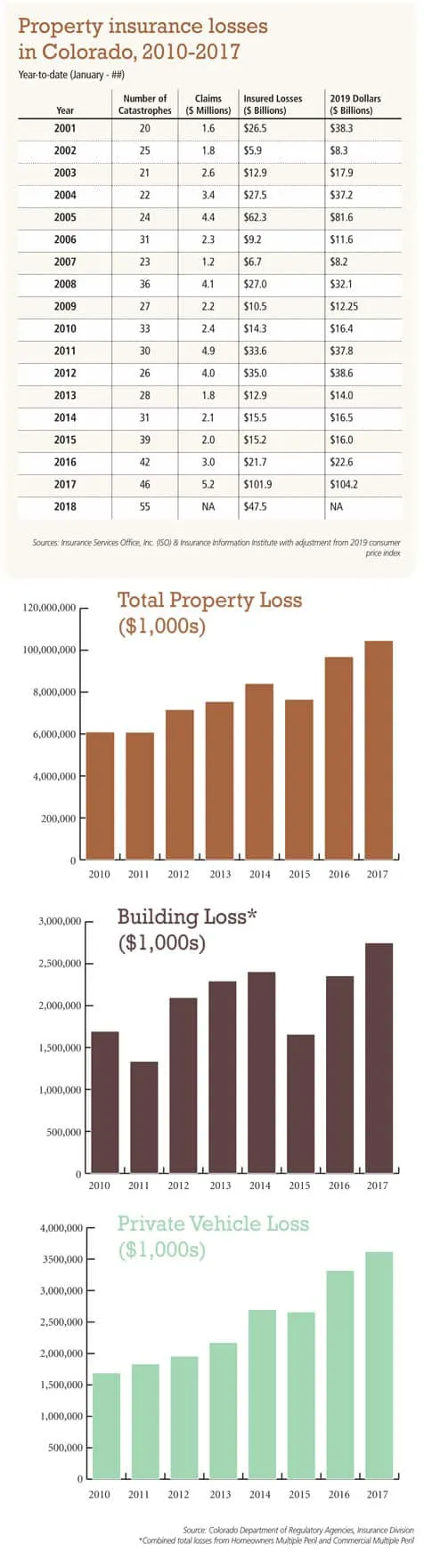

But two years of major global catastrophes have caused losses to spike, including last year’s Camp Fire in California and Hurricanes Harvey, Irma and Maria battering the southeast throughout 2017.

In April, reinsurance company Swiss Re published a report estimating global insured losses from natural disasters between 2017 and 2018 totalled $219 billion, the highest ever in a two-year period. Swiss Re estimated 60 percent of the losses in 2018 were from “secondary perils” caused by extreme weather events, such as river flooding, ice storms and wildfires.

Those losses made reinsurers increase their premiums to consumer insurers to manage their own risk, and the insurance companies are going to pass those price hikes onto their customers or not renew certain types of protection they previously offered.

“So it wasn’t just one year, it was bad. It was a bad year, plus another bad year combined,” Brown said. “Add traditionally soft pricing to that, leading up to that, and now all of a sudden, the reinsurance market sort of dried up to a certain extent.”

In an interview with BizWest, Kemp said premiums and deductibles are also rising along the Front Range because of rapid population growth. As more people move into Northern Colorado and the Boulder Valley, they bring more cars at risk of pummeling by hail, occupy more homes that could need roof replacements and increase demand for insurance at a time when fewer companies are willing to take on potential for higher payouts.

“If you go east of here 10 years ago, you could have a hailstorm that hit very limited homes. But now, you can have a hailstorm that could hit hundreds of houses and businesses at the same time,” he said.

Stephen Tebo, owner of Boulder-based Tebo Development Co. and one of the largest landowners in the county, told BizWest his yearly premium for his properties will rise from $350,000 to $1.5 million next year, an increase of 76 percent.

Tebo said his insurance company attributed much of that to hailstorm damage causing tens of millions of dollars to buildings across the Front Range, along with rising property taxes in the area. That increased valuation means more risk for insurers to take on.

While Tebo said those tax increases will cost him substantially more than insurance increases, it still causes a logistical problem for any company trying to plan for the future.

“Obviously, we can’t go without insurance, so we just have to pay for it. We don’t have a choice and then eventually it will be passed onto the tenants,” he said.

Swiss Re expects damage caused by natural disasters to rise in the coming years due to climate change, and because more people and assets are becoming concentrated in areas exposed to destructive weather.

Brad Udall, a water and climate scientist at Colorado State University and a co-author of the 2018 National Climate Report, said one of the “weak links” of climate science has been modeling how climate change can turn into future economic damages for insurance and almost every sector in the global economy.

Udall said it’s particularly difficult to estimate when the next major weather event will strike an area based solely on climate data. Instead, a hotter climate can make those weather events cause more damage than they normally would by priming other parts of the environment more susceptible to secondary perils. For example, a more arid environment will dry out trees and flora in a forest, making it prone to a massive wildfire.

He believes insurers will be one of the hardest hit as the economy is affected by climate change, but passing those costs onto customers may change the way people and businesses look at the issue.

He believes insurers will be one of the hardest hit as the economy is affected by climate change, but passing those costs onto customers may change the way people and businesses look at the issue.

“I always expected them to respond in ways that frankly might change public opinion at some point on this topic,” he said. “When you turn climate change from an environmental issue to an economic issue, everyone is going to pay attention.”

It’s not immediately clear how much the shift in reinsurance is going to cost consumers along the Front Range and beyond. Insurance companies vary on their renewal dates with their reinsurers, so the industry likely won’t have a full idea of how much it’ll have to adjust premiums and deductible structures until early 2020.

Until then, insurance advisers are asking customers to talk to them about specifics about their property that could be a risk factor on raising rates, along with local and global market factors that could force increases. Stephanie Newell, personal lines manager at Flood & Peterson, said this is particularly important for customers who haven’t had to use their policy.

“The Idea that people have as business owners and individuals is ‘I haven’t had any claims, so my insurance shouldn’t go up,’ and unfortunately, that’s just not the case anymore,” she said.

While climate change is threatening to alter how the global economy runs, adaptation isn’t the only option. The rapid advent of renewable electricity, carbon capture and other technologies can reduce humanity’s footprint on the environment and maintain the Paris Climate Accord’s goal of keeping global temperature increases to below 2 degrees Celcius above pre-Industrial Era levels, Udall said.

“In addition to adapting to it through insurance, let’s solve it,” he said. “We have the technology, we have the policy, we basically know what we have to do. Some things we don’t know how to do right now, but we have lots of easy steps that could be taken right now.”

Two years of global natural catastrophes and years of population growth are about to drive up the price of property insurance across the region.

Brett Kemp, president of Flood and Peterson, told a group of executives at a BizWest roundtable in June that insurance premiums and deductibles for properties have risen rapidly over a short period of time.

“The insurance market has changed overnight,” he said.

Mike Brown, director of market solutions for Flood & Peterson in Fort Collins, said the reinsurance market was soft for several years due to a healthy supply of reinsurance…