Wells: Housing does not appear to be waiting for the Fed

Housing does not appear to be waiting for the Fed. The Federal Reserve has created much anticipation in all corners of the American economy by indicating it will cut interest rates this year. While the cuts have yet to occur, the Northern Colorado residential real estate market is still off to a positive start for 2024.

Here is a snapshot of statistics that show early momentum for the local housing sector:

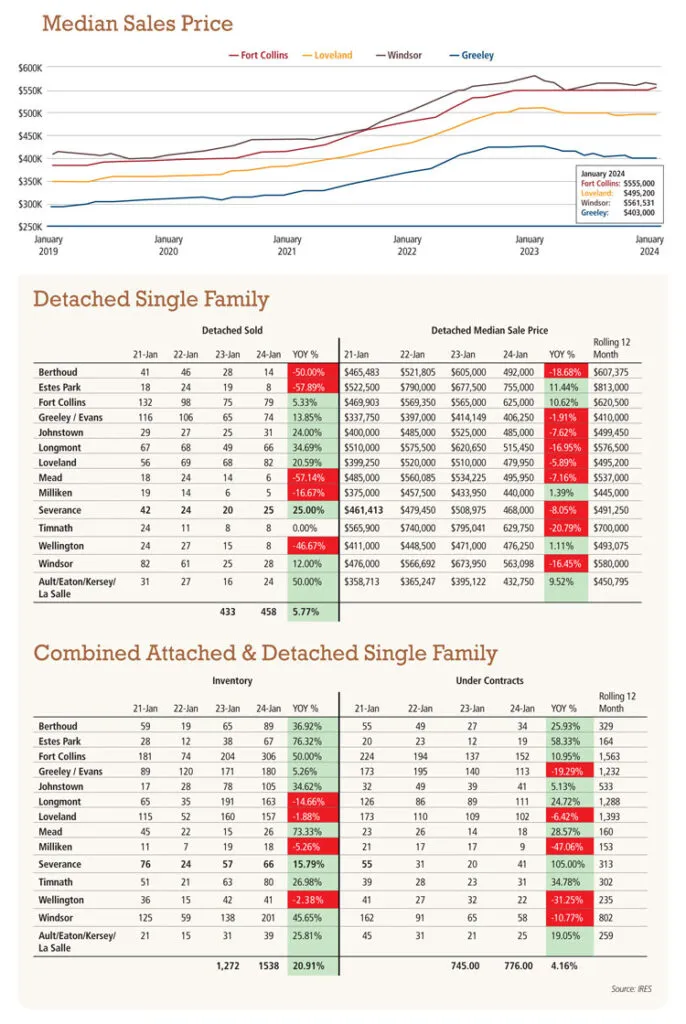

The number of closed home sales increased 5.7% year-over-year across Northern Colorado for January, increasing from 438 to 458 this year. The highest growth in closed sales was experienced by the collective Weld County towns of Ault/Eaton/Kersey/La Salle, which were up 50%; other notable increases include Longmont, up 34%, Severance, up 25%, and Johnstown, up 24%. Some areas did see a retraction in year-over-year home January sales include Berthoud, Estes Park, and Mead, which were down by at least 50% to start the year.

SPONSORED CONTENT

Northern Colorado has experienced inventory growth of 21% between January 2023 and January 2024. There is more competition, but demand continues to be strong. Communities with growing numbers of available single-family homes (both attached and detached) include: Estes Park, up 76% with 29 additional homes; Fort Collins, up 50% with 102 additional homes, and Windsor, up 46% with 63 additional homes.

The number of homes under contract, a great leading indicator for closings in the months to come, were up across the region by 4.16%. Severance leads the way with an increase of 105%, or 21 homes. Longmont registered 22 additional homes under contract, up 25%, while Fort Collins — the largest community in Northern Colorado — had 15 additional homes under contract. The Fort Collins number reflects an 11% increase. Most of the feedback I’m hearing from buyers is that they are tired of waiting and want to solidify their housing future in a market without rapidly escalating prices

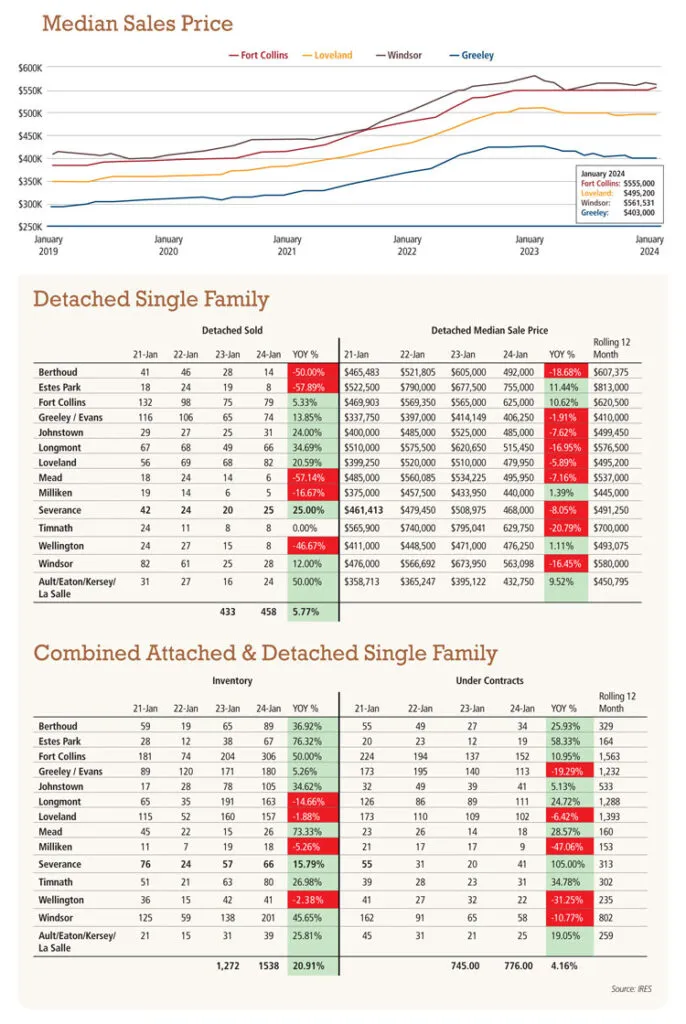

Prices have remained relatively flat when looking at a 12-month rolling median price for single-family homes and condos/townhomes. The combination of flattened prices and improving interest rates compared to 2023 has created an excellent opportunity for prospective purchasers.

As I mentioned at the outset, many eyes are on the Federal Reserve and its suggested cuts in the Fed Funds Rate this year. The looming question is when will those cuts come, and by how much. Fed Chairman Jerome Powell has signaled to the market that the Fed is happy with the inflation trajectory, but not completely satisfied; that’s because employment and wage growth have been stronger than expected, slowing the approach to the Fed’s targeted 2% baseline for the nation’s inflation.

While not directly correlated, the real estate industry is anxiously awaiting downward pressure on 30-year mortgage rates to help ease affordability for many Americans. Nevertheless, we have seen that housing appears more robust than expected at the beginning of the year, even without the Fed’s influence.

We still expect the back half of 2024 to be stronger than the first half of the year, but so far, through the first month, we are seeing positive signs for both buyers and sellers. These signs include increasing opportunities due to growing inventory, strengthened demand, homes under contract, and flattened price points.

I firmly believe the market is in an opportunity zone for both buyers and sellers.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at bwells@thegroupinc.com or 970-430-6463.

Housing does not appear to be waiting for the Fed. The Federal Reserve has created much anticipation in all corners of the American economy by indicating it will cut interest rates this year. While the cuts have yet to occur, the Northern Colorado residential real estate market is still off to a positive start for 2024.

Here is a snapshot of statistics that show early momentum for the local housing sector:

The number of closed home sales increased 5.7% year-over-year across Northern Colorado for January, increasing from 438 to 458 this year. The highest growth in…