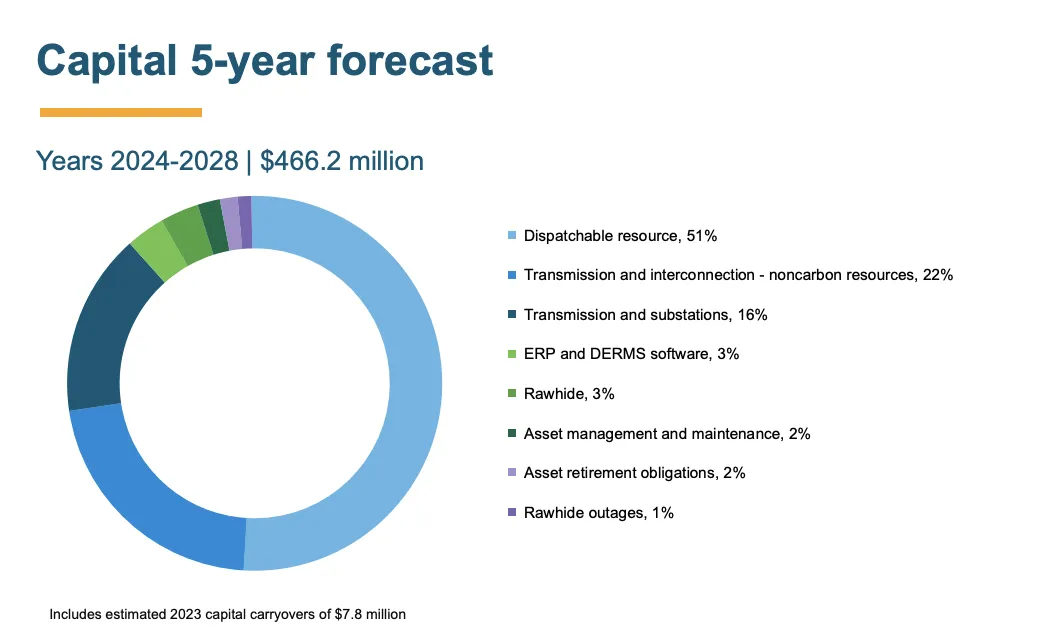

PRPA plans $466M capital spending over next five years

FORT COLLINS — Platte River Power Authority, if its board concurs, will spend upward of $466.2 million over the next five years to support capital projects, mostly in the area of conversion to non-carbon-generating sources.

The board heard a budget presentation Thursday morning from Jason Harris, controller of the wholesale utility that provides electrical power to Loveland, Longmont, Fort Collins and Estes Park.

Harris noted in his presentation that no new non-carbon resources are coming on line in 2024, but in 2025 and beyond, there will be non-carbon additions. Many of those, however, are not part of the capital budget because that…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!