Pessimism abounds among Colorado business leaders

BOULDER — Heading into the second quarter of 2023, Colorado business leaders continue to feel mostly pessimistic about the state’s and nation’s economic footing.

More than half (56.9%) of the Colorado business leaders surveyed as part of the University of Colorado Boulder’s first-quarter 2023 Leeds Business Confidence Index think a recession is on the horizon this year.

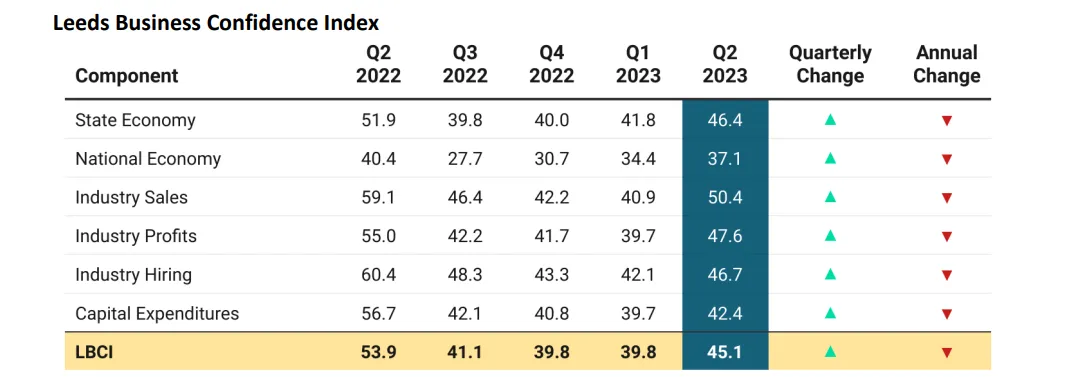

The LBCI was 45.1 for the second quarter, up from a dismal 39.8 in the first quarter.

An LBCI score — which is based on impressions of the state economy, national economy, industry sales, industry profits, industry hiring and capital expenditures — of 50 is neutral,…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!