Wells: Trend spotting – Watch for home prices to stay hot in 2021

As we look ahead to what’s in store for residential real estate in 2021, it’s important to examine recent industry trends to see what they might tell us about how the new year will unfold. In particular, it’s potentially illuminating to see how the Northern Colorado housing market responded to the last significant economic upheaval — the Great Recession of 2008-2010 — and look for any similarities or differences between then and now.

During the Great Recession, home prices declined slightly across our region, but still held up much better than in most parts of the country. Then beginning in 2011, prices started to appreciate — slowly at first, and then at a high rate of speed. By 2013, average annual appreciation was up 8.7% in the Fort Collins-Loveland area, surging to an 11.7% growth rate by 2015 (see chart).

SPONSORED CONTENT

Average annual appreciation rates for the Fort Collins-Loveland MSA, 2010-2020:

|

2011 – 1.2% |

2016 – 10.2% |

|

2012 – 1.2% |

2017 – 9.0% |

|

2013 – 8.7 % |

2018 – 6.6% |

|

2014 – 7.7% |

2019 – 4.2% |

|

2015 – 11.7% |

2020 – 2.6% (through Q3) |

As these figures show us, the market started to stabilize after the peak appreciation years of 2015-2016, trending back toward the long-term, 42-year average of 5.4 % annual appreciation. Slowing rates of appreciation even prompted some pundits to hint openly that a housing “bubble” was taking shape. But now there’s reason to believe that a new growth trend is about to emerge out of the COVID-19 pandemic, which some are calling the “Great Reshuffle.”

Indeed, after a shock to the market in the early months of the pandemic (March-May), the upward pressure on prices has been gradually increasing. As evidence, look to the fact that sales prices in the third quarter increased nationally by 7.8%, according to the Federal Housing Finance Agency’s latest House Price Index (HPI) purchase-only report. In fact, that data represents “the strongest quarterly gain in the history of the FHFA HPI purchase-only series,” said Lynn Fisher, deputy director of the FHFA’s Division of Research and Statistics. Notably, prices in the month of September were up 9.1% from September 2019, indicating more price pressure heading into the fourth quarter.

What we’re feeling locally, and in many communities around the country, is the impact of supply-and-demand economics on housing prices. Demand for housing — much of it driven by the desire for more space and amenities to accommodate working and schooling at home — is exceeding the supply of available housing. And with record-low interest rates adding to the buying power of many potential homebuyers, the competition for available housing is furious, even in the cold-weather months when homebuying typically tails off.

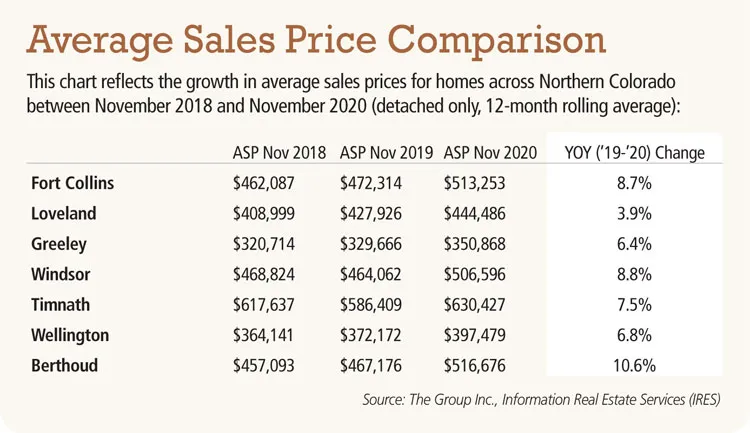

Local sales price trends for November (see chart) reinforce that thinking. If the market cooled off in these parts, it’s not noticeable from these numbers. Average prices year-over-year are up across the board from November 2019, even hitting double-digit growth in Berthoud. And with so-called “suburban flight” – people moving out of larger cities to smaller communities like those in Northern Colorado — we see no signs of demand slowing in the immediate future.

While the circumstances are different between the aftermath of the Great Recession and the emergence of the Great Reshuffle, the resulting impacts on home price appreciation could be similar.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado

As we look ahead to what’s in store for residential real estate in 2021, it’s important to examine recent industry trends to see what they might tell us about how the new year will unfold. In particular, it’s potentially illuminating to see how the Northern Colorado housing market responded to the last significant economic upheaval — the Great Recession of 2008-2010 — and look for any similarities or differences between then and now.

During the Great Recession, home prices declined slightly across our region, but still…