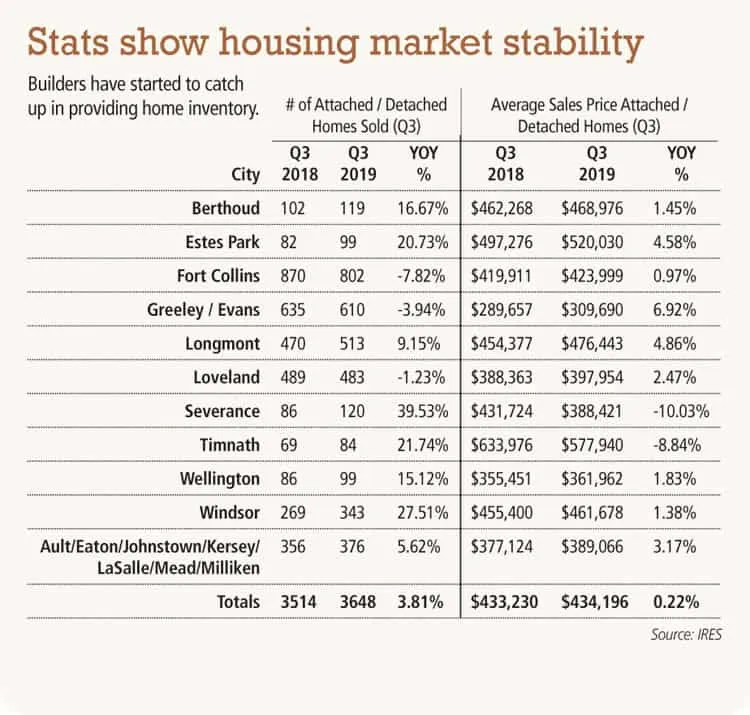

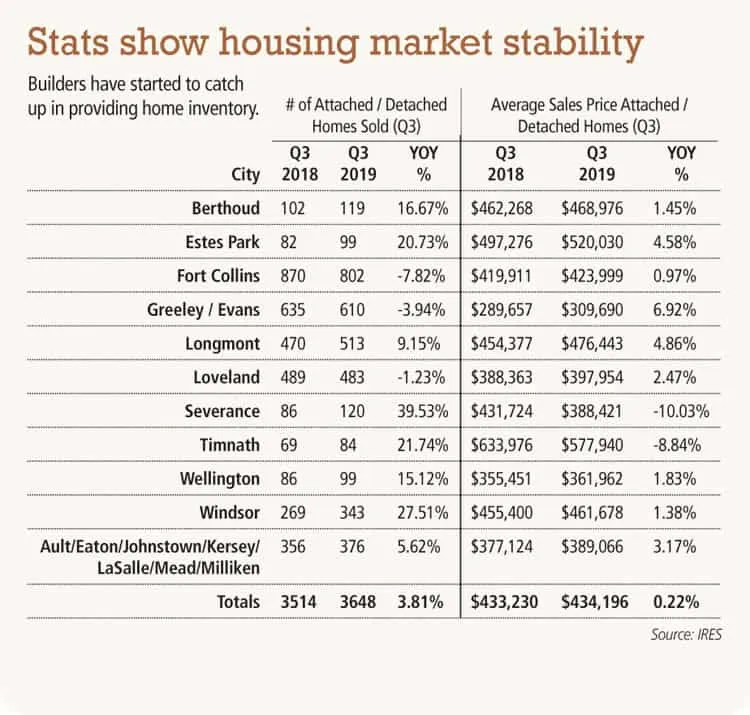

Wells: Stats show housing market stability

For those of us who make it a practice of monitoring the health of the Northern Colorado real estate market, the close of the third quarter provides us with a new round of data from which we can evaluate the patient.

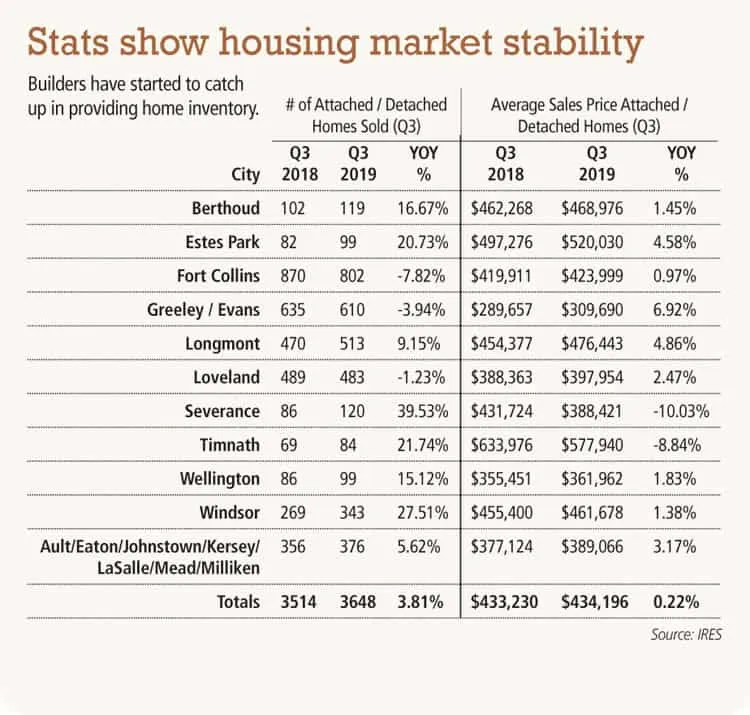

What we can diagnose from Q3 (July-September) is that the market is making progress overall — home sales are up, and average sales prices are stable — while we can also see some readings that warrant some further assessment.

SPONSORED CONTENT

Here’s a closer look at some of the trends and statistical curiosities that caught our attention over the past three months:

Small towns make big strides in home sales. Overall, home sales across the region increased by 3.8 percent. But there is a distinct difference between the region’s small and large communities.

We track 11 different sub-markets within the larger Northern Colorado market. Of those, eight registered an increase in home sales over the third quarter of 2018. Most robust in this category were the towns of Severance (up 39.53 percent) and Windsor (up 27.51 percent). Timnath, Estes Park, Berthoud and Wellington all recorded double-digit sales growth.

The three sub-markets that didn’t show growth were also three of the biggest. Fort Collins experienced a 7.82 percent decline, while Greeley-Evans sales slipped 3.94 percent and Loveland backtracked by 1.23 percent.

Growth in average sales prices stabilizes. One year ago, the average sales price for a Northern Colorado home had increased nearly 5.3 percent between the third quarter of 2017 and the third quarter of 2018. Average price growth was essentially flat between the third quarter of 2018 and the third quarter of 2019, at 0.22 percent. This does not mean that appreciation has not occurred. Much of this is due to builders being able to bring inventory to the market at a lower average sales price and in greater quantities than resale homes in some areas, which has weighted the average sales price down.

We consider this to be much-needed relief after several years of accelerated average price increases earlier in the decade. Couple the slower price growth with the prospects for wage gains going forward, and the result could be that we’ll be gaining some ground in housing affordability.

Housing inventory in a state of flux. A shortage of homes for sale continues to be a primary factor in the rising cost of housing in many communities around the country. Tight supply can also be a factor in limiting the growth in home sales. Consequently, our local housing inventory bears watching as an indicator of how the market will perform in the months ahead. As we move into the fourth quarter, we see some noteworthy trends taking shape in our different sub-markets.

In communities where inventory was up during the third quarter, so were the number of homes under contract compared to the third quarter of 2018. In Severance, for instance, inventory was up 7.5 percent and contracts nearly doubled from the year before — up 94 percent. An exception was Greeley-Evans, where inventory was up 12.8 percent while contracts declined by 6.2 percent.

But what about the sub-markets where inventory was down? Fort Collins experienced a 4.1 percent drop an inventory and an 11 percent decline in contracts. At the same time, Windsor’s inventory fell 12.3 percent and contracts shot up 19.4 percent. Similarly, Longmont saw inventory slip 10.2 percent and contracts rise 10.9 percent.

From this data, it’s fair to conclude that overall housing demand around Northern Colorado continues to be healthy as we approach the end of the year.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado

For those of us who make it a practice of monitoring the health of the Northern Colorado real estate market, the close of the third quarter provides us with a new round of data from which we can evaluate the patient.

What we can diagnose from Q3 (July-September) is that the market is making progress overall — home sales are up, and average sales prices are stable — while we can also see some readings that warrant some further assessment.

Here’s a closer look at some…