Wells: A look at how presidential elections impact real estate markets

Every four years in the United States, the presidential election seems to cast a shadow over the real estate market. The prospect of change creates a wary public, which causes economists and voters (i.e., homebuyers and sellers) to ask familiar questions:

- What will happen to housing prices?

- Will interest rates go up or down?

- Should I wait to buy or sell?

Indeed, conventional wisdom tells us that elections ought to trigger uncertainty, which should have a chilling effect on real estate. However, an analysis of recent election-year and post-election-year home sales data appears to paint a different picture, both locally and nationally.

Looking at recent presidential election years, the pace of home sales nationally tends to slow slightly in November of election years. Otherwise, the data surrounding home sales does not support the notion that real estate goes into retreat due to elections.

SPONSORED CONTENT

Here’s a snapshot of what we’ve learned from sources such as the U.S. Department of Housing and Urban Development, the National Association of Realtors, and the Federal Home Loan Mortgage Corp. (Freddie Mac):

- In nine of the past 11 elections, HUD and NAR statistics show that home sales increased the year after the election. The two post-election downturns occurred after the 1980 and 1988 cycles.

Notably, in 1980, the country was experiencing 14.6% inflation, and the Fed Funds rate was 19.39%. And in 1988, the Fed Funds rate jumped from 6.5% to 9.8%, and a recent change in tax law had altered how homeowners could depreciate property, which cooled off the recent upward trend in real estate valuations.

- In eight of the past 11 presidential elections, Freddie Mac shows that 30-year mortgage rates decreased during the four-plus months (July-November) leading up to the election. The exceptions were 1980, 1992 and 2016.

Thus far in 2024, mortgage rates have inched downward from a high of 7.22% to 6.77% in mid-July. With inflation readings improving and employment markets beginning to cool, there are signs that rates will continue to decrease before the November 2024 election.

- In seven of the past eight elections, NAR reports that median home prices increased after the election.

And how has Northern Colorado responded to election impacts?

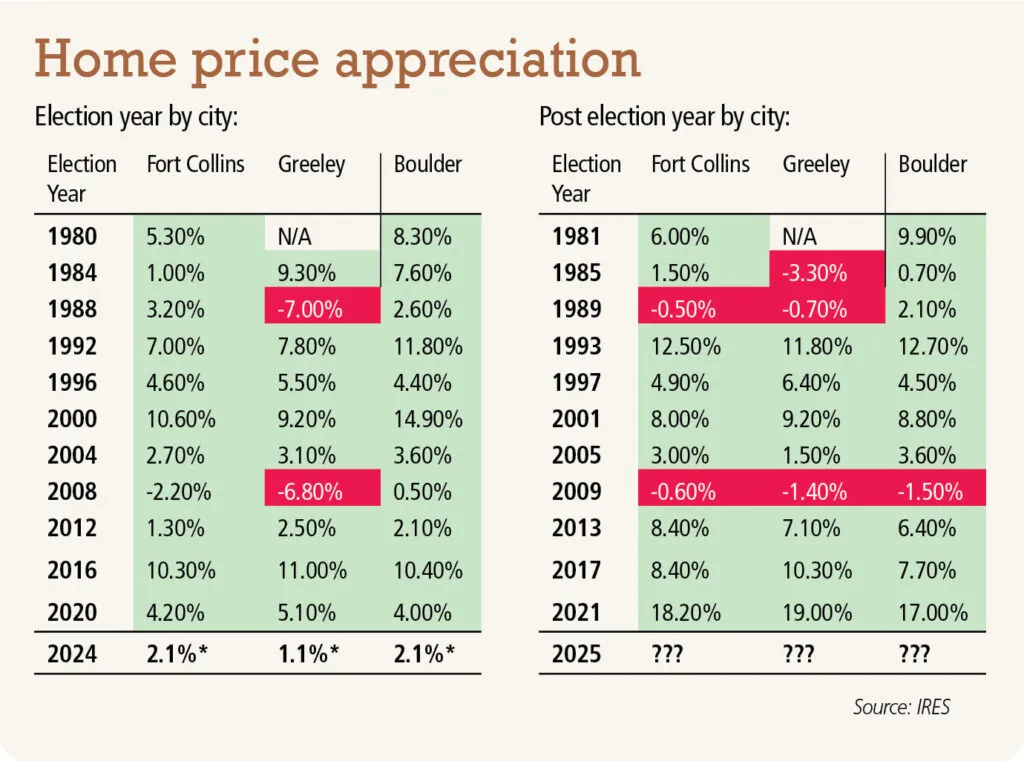

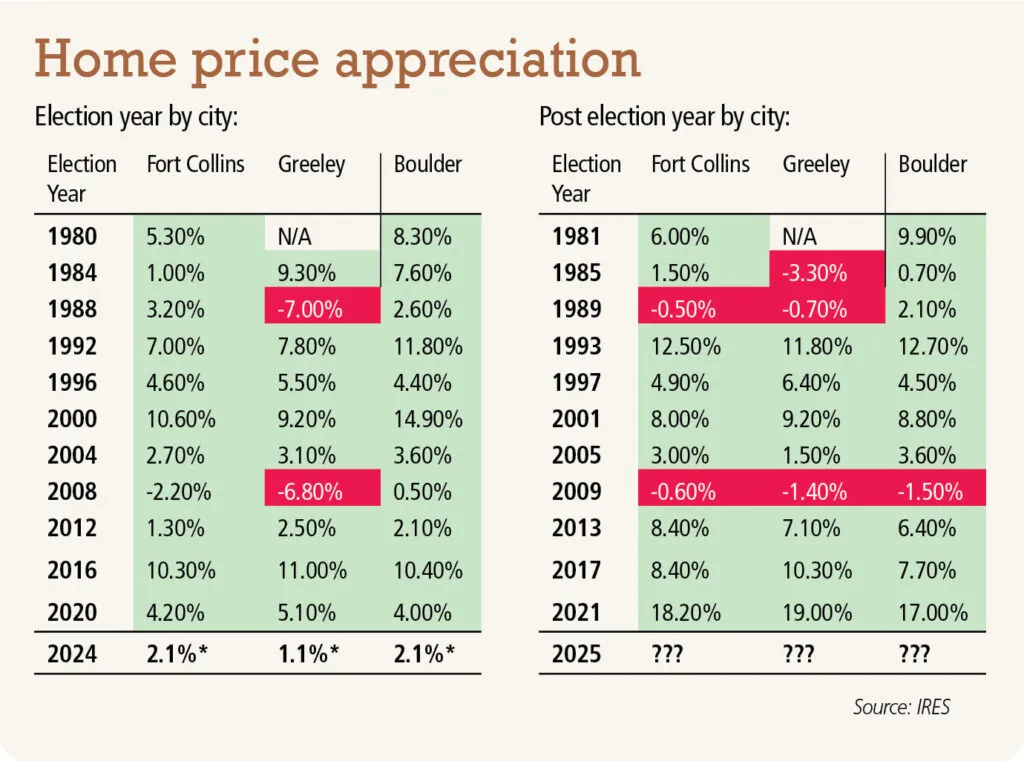

When it comes to home prices, local markets have tended to shrug off election uncertainty. In Fort Collins, prices appreciated in 10 of the past 11 election years; Greeley experienced appreciation in eight of 10 elections (1980 data was not available), and Boulder experienced a clean sweep — 11 out of 11.

In the year after elections, Fort Collins prices appreciated after nine out of the past 11 elections; Greeley prices appreciated seven out of 10 (1980 data was not available), and Boulder prices appreciated 10 out of 11 times.

The safe conclusion: Elections have had minimal — if any — impact on residential real estate activity. For the most part, housing markets across the country have responded favorably, with lower interest rates usually positively impacting sales in post-election years.

Brandon Wells is president of The Group Inc. He can be reached at bwells@thegroupinc.com or 970-430-6463

Every four years in the United States, the presidential election seems to cast a shadow over the real estate market. The prospect of change creates a wary public, which causes economists and voters (i.e., homebuyers and sellers) to ask familiar questions:

- What will happen to housing prices?

- Will interest rates go up or down?

- Should I wait to buy or sell?

Indeed, conventional wisdom tells us that elections ought to trigger uncertainty, which should have a chilling effect on real estate. However, an analysis of recent election-year and post-election-year home sales data appears to paint a different picture,…