Wells: How’s the market? That depends on which market

We depend a great deal on statistics to illuminate the condition of a local real estate market. Are sales up or down? Are prices rising or flattening? Is inventory shrinking or expanding?

But the answers to these questions don’t always tell the whole story. In fact, real estate headlines that refer to statistical trends are often generalized — looking at regional or statewide data. More than ever, real estate conditions today are hyperlocal, meaning that factors such as sales prices, homebuyer demand, and inventory, can be specific to cities, zip codes, and even neighborhoods.

Here are a few things you need to know to help you understand some of the dynamics of the market:

SPONSORED CONTENT

Inventory is growing in almost all areas

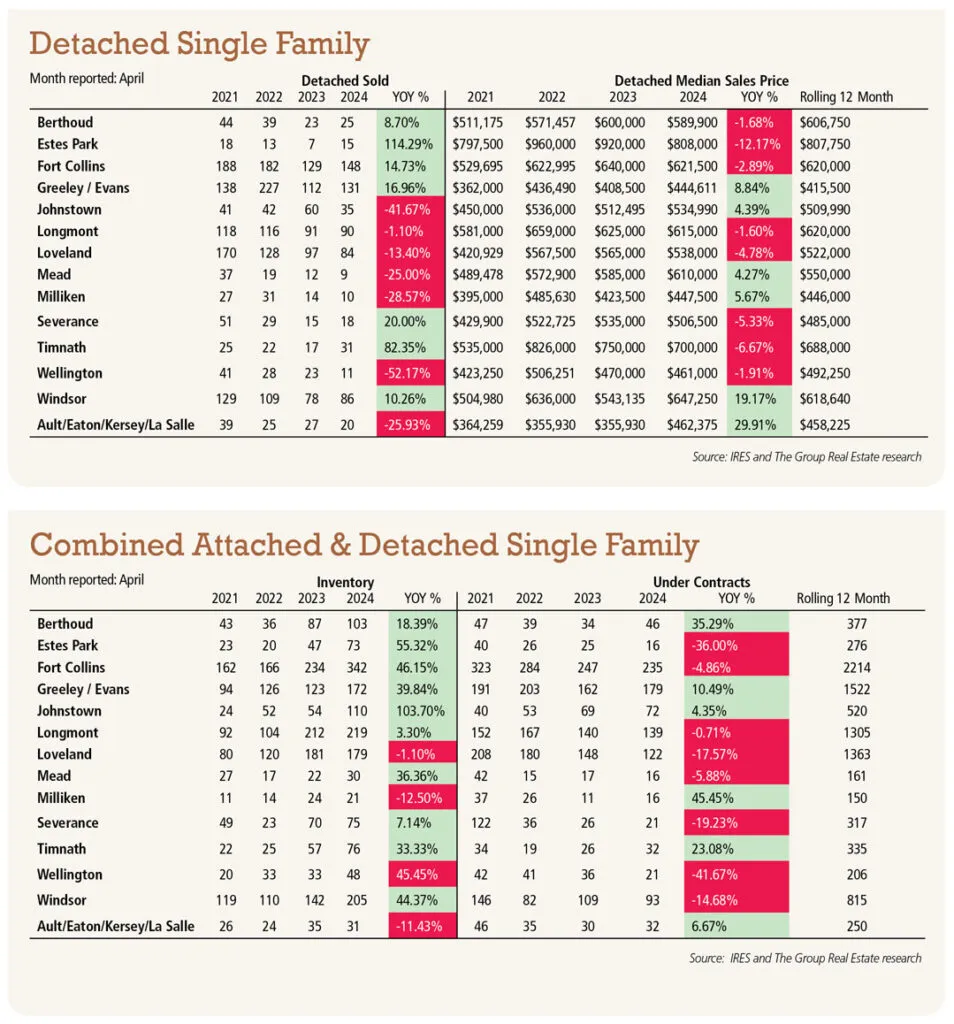

Across the entire IRES MLS area — which spans the Northern Colorado region, including Fort Collins, Greeley, Loveland, and Windsor — there were 8,625 single-family houses, condominiums, and townhomes available for sale as of April 2023. One year later, the region experienced an increase in inventory of 41.3%, with 12,184 single-family houses, condos, and townhomes available.

But a closer look shows that inventory in Fort Collins is up 46% over the 12-month period, while Loveland inventory is actually down by 1%. This disparity underlines what I mentioned above: While Fort Collins and Loveland are only a few short miles apart, the market dynamics are very different.

Closed sales on the upswing

Fort Collins has registered strong sales growth in both single-family houses as well as condos and townhomes. Single-family sales were up 21% year over year in April. Affordability challenges are certainly a factor in driving strong growth in condo and townhome sales, which are up 32.7%.

Loveland’s market has experienced strong results in condo and townhome sales, with closings up 18.1% in April 2024 compared to April 2023. However, April sales of single-family houses in Loveland declined 10.1% this year compared to April 2023.

Greeley, which does not have as much availability in the condo or townhome categories, recorded 22 sales in April, down from the previous April by 12%. At the same time, sales of single-family homes totaled 115 in April, an increase of 27.8% over April 2023.

Sales of higher price-point homes surge in some areas

In some Northern Colorado communities, sales of homes priced above $1 million are surging in early 2024. In Fort Collins, for example, sales or properties listed between $1 million and $1,999,999 increased 86% for the one-year period ending May 22, 2024, when compared to the same time period the year before. In Windsor, sales in this price range increased 53%.

For Loveland, meanwhile, sales in the $1 million-$1,999,999 range were essentially flat —down 8.3% — and Berthoud experienced a 23% decline. At the same time, Loveland’s sales in the $2 million-$2,999,999 range were up 200%. Timnath sales were flat in both of these two price ranges.

As we said at the outset, Northern Colorado’s real estate markets behave differently. We caution buyers and sellers against making assumptions based on the headlines. It’s better to ask questions about your local market, and your best source for answers is a trusted real estate professional.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at bwells@thegroupinc.com or 970-430-6463.

Brandon Wells, president of The Group Inc. Real Estate, provides things to know to help you understand the dynamics of the residential market.