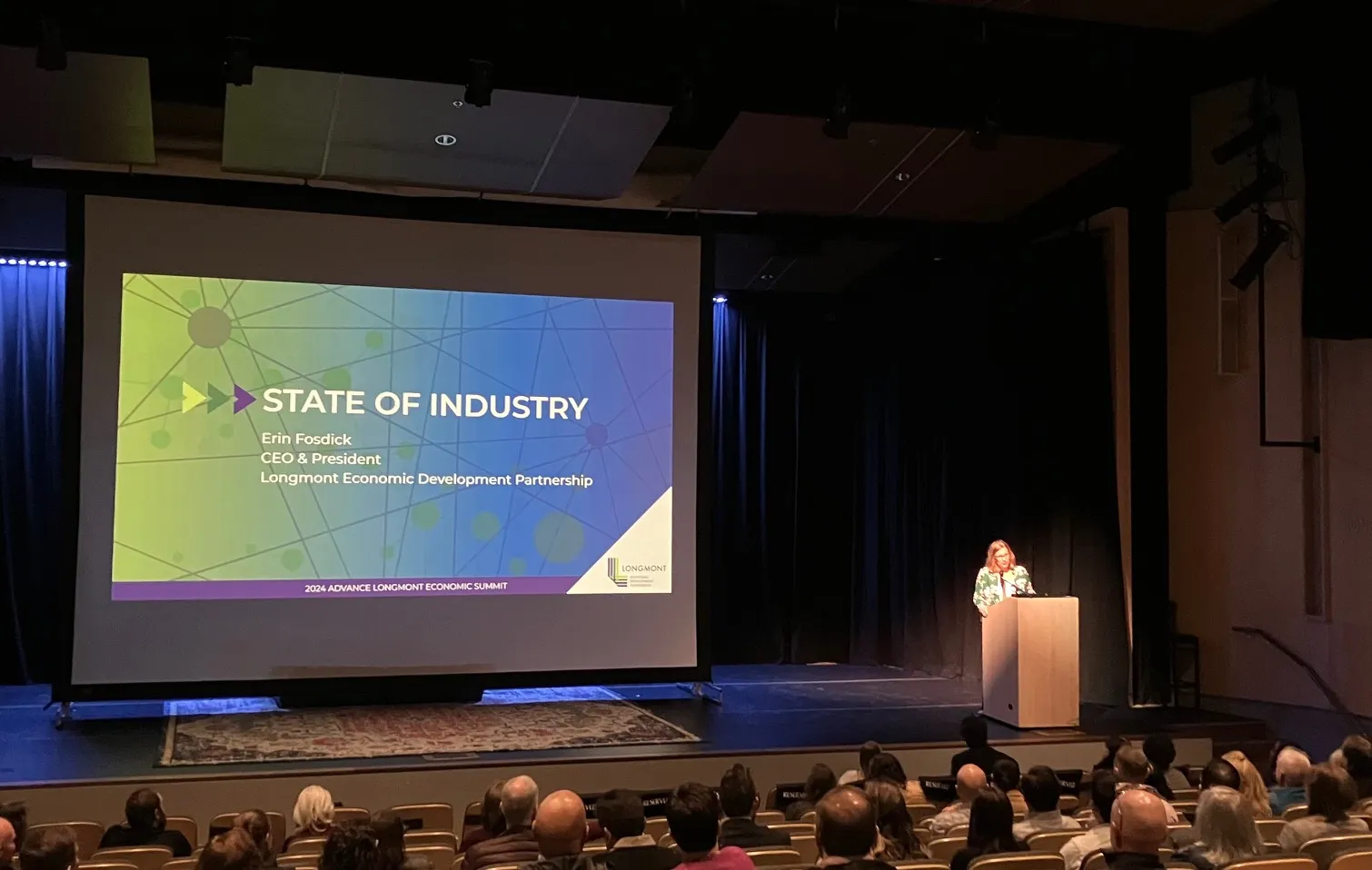

Advance Longmont Summit: Growth could slow as headwinds converge

Longmont expects its economic growth to continue but at a slower pace.

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!

Already have a paid subscription?