Longmont semiconductor sector boosted by CHIPS Zone approval

City joins Fort Collins as only cities in region to win designation

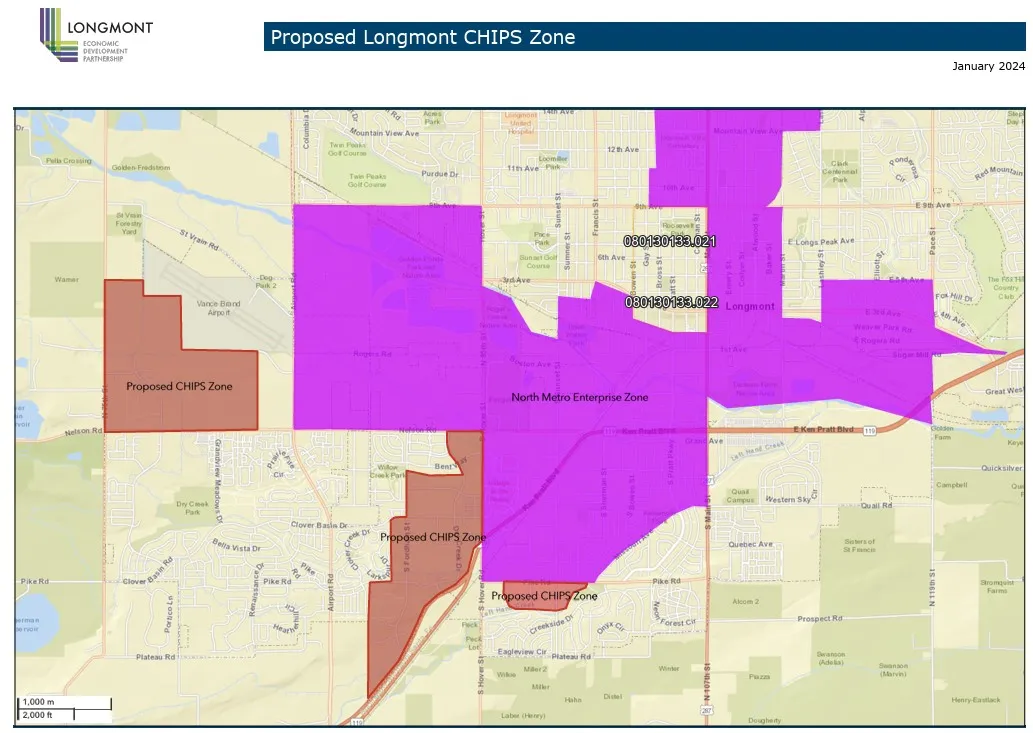

In what economic development leaders say is a win for Longmont’s burgeoning semiconductor industry, the city this week won designation for a CHIPS Zone, making qualifying companies in the sector eligible for special tax incentives.

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!

Already have a paid subscription?