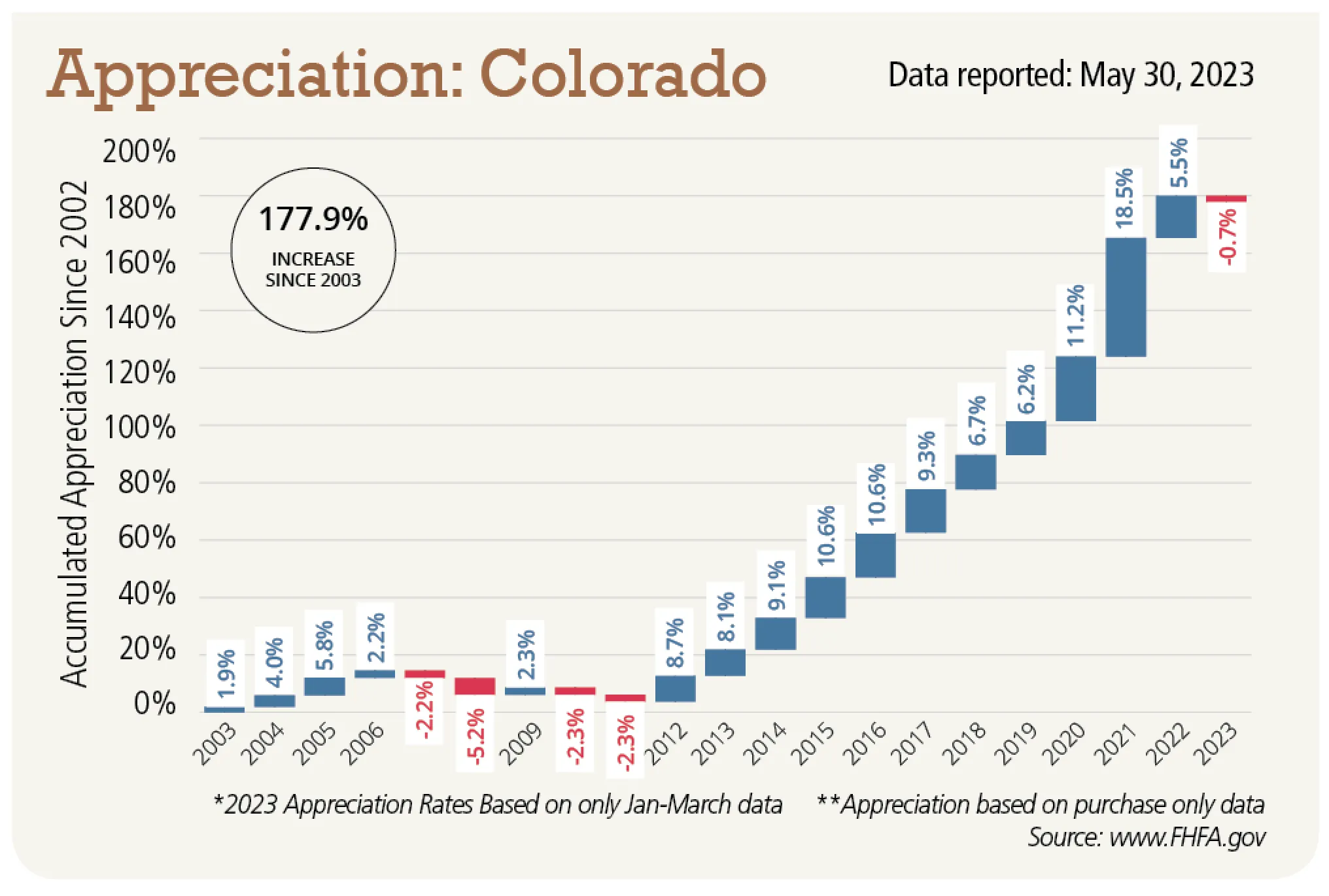

Median prices don’t tell the whole story about housing values

To better understand the dynamics of a local real estate market, it’s important to analyze the difference between median price fluctuations and home price appreciation.

If you’re following the business press, you’re most likely to read or hear about the changes in median sale prices. These figures would indicate that homeowners are experiencing much heavier price swings than is actually the case.

So, let’s take a closer look to see the factors at play with median price changes:

The allocation or distribution of sales across price ranges has a major impact on pricing trends. For example, if a market has seen a shift…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!