Distribution boom

Developers flock to build industrial logistics, distribution facilities

LOVELAND — Earlier this year, when Amazon.com Inc. (Nasdaq: AMZN) signed a development agreement with the city of Loveland to build a massive new logistics center on Byrd Drive near the Northern Colorado Regional Airport, it was a sure sign of an unfolding trend.

As the population and economy of Northern Colorado continue to grow, companies and developers are flocking to build industrial logistics and distribution facilities to support the region’s needs. Even with the state’s population growth slowing, and inflation and supply-chain constrictions dragging on the economy, demand for these types of spaces in Northern Colorado remains at record levels.

“It’s no secret that all of these spec industrial buildings are coming,” said Kelly Jones, economic development director for Loveland. “What’s slightly surprising is the pace they’re coming at now. I can tell you just by looking at the permits and activity in our queue, it’s not slowing down.”

SPONSORED CONTENT

Mike Eyer, first vice president for the commercial brokerage CBRE, said a record 600,000 square feet of industrial space have been leased in Northern Colorado through the first two quarters of 2022. About 900,000 square feet more are in the pipeline to be delivered. Buildings are also being absorbed more quickly than normal, Eyer said. Usually, it takes about a year and a half to two years to fully lease out industrial projects of this scale. Now, most buildings are fully leased out within a year of completion.

“It’s still true on a number of fronts [that the industrial market remains hot],” Eyer said. “There is still a pretty strong appetite from developers looking to gain entry into the market.”

The market they’re trying to enter is one that has experienced robust growth over the past decade. Between 2010 and 2020, Weld and Larimer counties were the second-and-fifth-fastest-growing counties in the state — Weld grew 30 percent, Larimer 20 percent.

Some of the individual municipalities in the region have grown exponentially. Timnath grew 938 percent. Severance and Berthoud each experienced greater than 100% growth. Wellington, Windsor and Johnstown grew more than 75 percent. Lochbuie, Frederick, Firestone, Erie, Dacono, Milliken and Mead grew more than 40 percent. Jobs in Northern Colorado grew by 9.3 percent from 2015 to 2020.

Although statewide population growth slowed in 2021, the state is still expected to reach 6.5 million inhabitants by 2030.

“Assuming the population growth trajectory remains the same, you’ll continue to see a number of these companies come to the area,” Eyer said.

Clyde Wood, vice president of commercial development for McWhinney Real Estate Services Inc., said it’s no secret why the need for industrial distribution and logistics facilities has increased along with the population.

“I think the connection is pretty clear,” Wood said. “Over the years, as population growth and the new-home market have been robust for several years, those industries that support that growth need space. The connection is pretty clear why we’re seeing so many of those growing and needing space here.”

The list of major companies to move into these types of spaces in Northern Colorado over the past few years is impressive. McWhinney made the first big splash with Centerra Industrial, a 660,000-square-foot campus in Loveland. In 2016, it landed Safelite Group Inc. as one of the area’s first major Class A industrial tenants. Amazon and Home Depot also leased space in Centerra Industrial.

“That was fairly pioneering at the time,” Wood said. “I think that caught a lot of people’s attention.”

Hines Interests LP and U-Haul both also leased space in Loveland on Byrd Drive. Denver developer Etkin Johnson built Axis 25 in the city.

Further south along Interstate 25, Mead has also made itself a logistics hub. It landed a FedEx regional distribution terminal in 2020. Multiple other industrial distribution facilities are underway: Elevation25 by Silver Point Development and Access 25 by The Broe Group.

Access 25 will be the only dual highway-rail-access park in the region, and it has already landed Home Depot as a tenant.

FedEx also has a regional distribution facility in Johnstown in McWhinney’s Iron Horse industrial park.

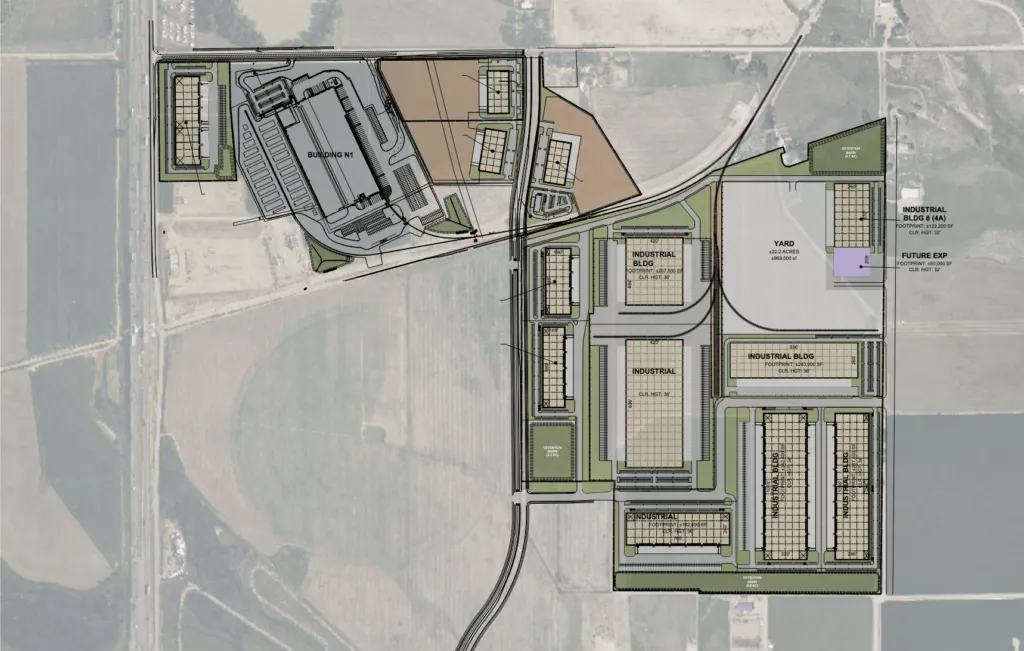

Then there’s the crown jewel: the 3.87-million-square-foot logistics center Amazon is building in east Loveland. That facility, which is slated to open in 2024, could have 62 loading docks and employ more than 1,000 people.

Many of these companies previously had a presence in the state, but not in Northern Colorado,

“A lot of them have been in Denver and are looking to plant a flag up here,” Eyer said. “Prior to two or three years ago, the region didn’t have the population to support that.”

This means that municipalities that developers and large companies previously wouldn’t have considered are now on the map for potentially massive developments.

“Cities like Loveland and Johnstown, we’re all getting the looks we wouldn’t get 10 years ago,” Jones said. “The speed at which the consumer is wanting products is forcing companies to put their distribution facilities in locations closer to population centers.”

Getting the Amazon logistics center was a multi-year journey for Loveland, one the city hopes will not stop with this facility.

“It’s difficult to land these,” Jones said. “The process we went through was not easy. There is prestige in getting that. It was very competitive. It points other developers toward us … It was a huge coup to earn this from one of the world’s largest companies. Eventually, we would like to keep building this relationship as they get familiar with us. There’s momentum beyond just that facility.”

For other projects in the region, ones that aren’t purpose-built for a company such as Amazon, competition for tenants will be fierce, Eyer said.

“These projects are all very similar,” Eyer said. “The buildings are similar. For the most part the locations are close. It’s a very competitive market. Developers that started construction a year ago have a significant advantage over those starting now because they have a lower cost basis. These buildings are almost like commodities where whoever can offer the most competitive lease rate is going to win.”

How long this trend can continue is dependent on how the region’s population and economy continue to grow. The need for more industrial logistics and distribution facilities should scale along with the area’s growth. At what point — if any — the industrial market could become oversaturated is unknown, but it’s a factor weighing on the mind of experts.

“I would say absolutely,” Wood said. “In Northern Colorado, it’s something we are very focused on. For several years we were the only game in town. We proved the concept that there is demand for Class A industrial space up here. That got the interest of outside developers. They want a piece of the pie, but that pie is not nearly as large as metro Denver. Even though demand is steady, it’s not that deep … We are very cautious about oversupply, but we are still bullish on the market in general.”

Even so, Eyer said, that hasn’t happened yet.

“I think we haven’t reached that saturation point,” Eyer said. “I think we have the demand to handle what is currently being built. It’s impossible to tell how much demand there will be. We’re just not there yet. We’re seeing record leasing activity. I have no doubt we’ll absorb the current construction.”

LOVELAND — Earlier this year, when Amazon.com Inc. (Nasdaq: AMZN) signed a development agreement with the city of Loveland to build a massive new logistics center on Byrd Drive near the Northern Colorado Regional Airport, it was a sure sign of an unfolding trend.

As the population and economy of Northern Colorado continue to grow, companies and developers are flocking to build industrial logistics and distribution facilities to support the region’s needs. Even with the state’s population growth slowing, and inflation and supply-chain constrictions dragging on the economy, demand for these types of spaces in Northern Colorado remains at record levels.

“It’s…