Wells: Housing market moves into hyperdrive

Three dynamics are shifting the housing market into hyperdrive to start 2022.

No. 1: Interest rates — As rates nudge higher, many homebuyers are feeling the pressure of housing price growth — as well as inflationary pressures on other goods — and hastening to get in the market. This circumstance has stoked a more competitive marketplace, with many buyers trying to secure longer-term housing options and get out from under the burden of renting, causing their cost of living to increase substantially while bringing no return on that expense.

For example, we are seeing single-family rental rates increasing on lease renewals between 7% and 12%. Areas such as the 80528 ZIP Code in southeast Fort Collins and Windsor (Raindance) are seeing the highest growth in rental rates, a result of strong demand driven by amenities, proximity to Interstate 25, and public education.

SPONSORED CONTENT

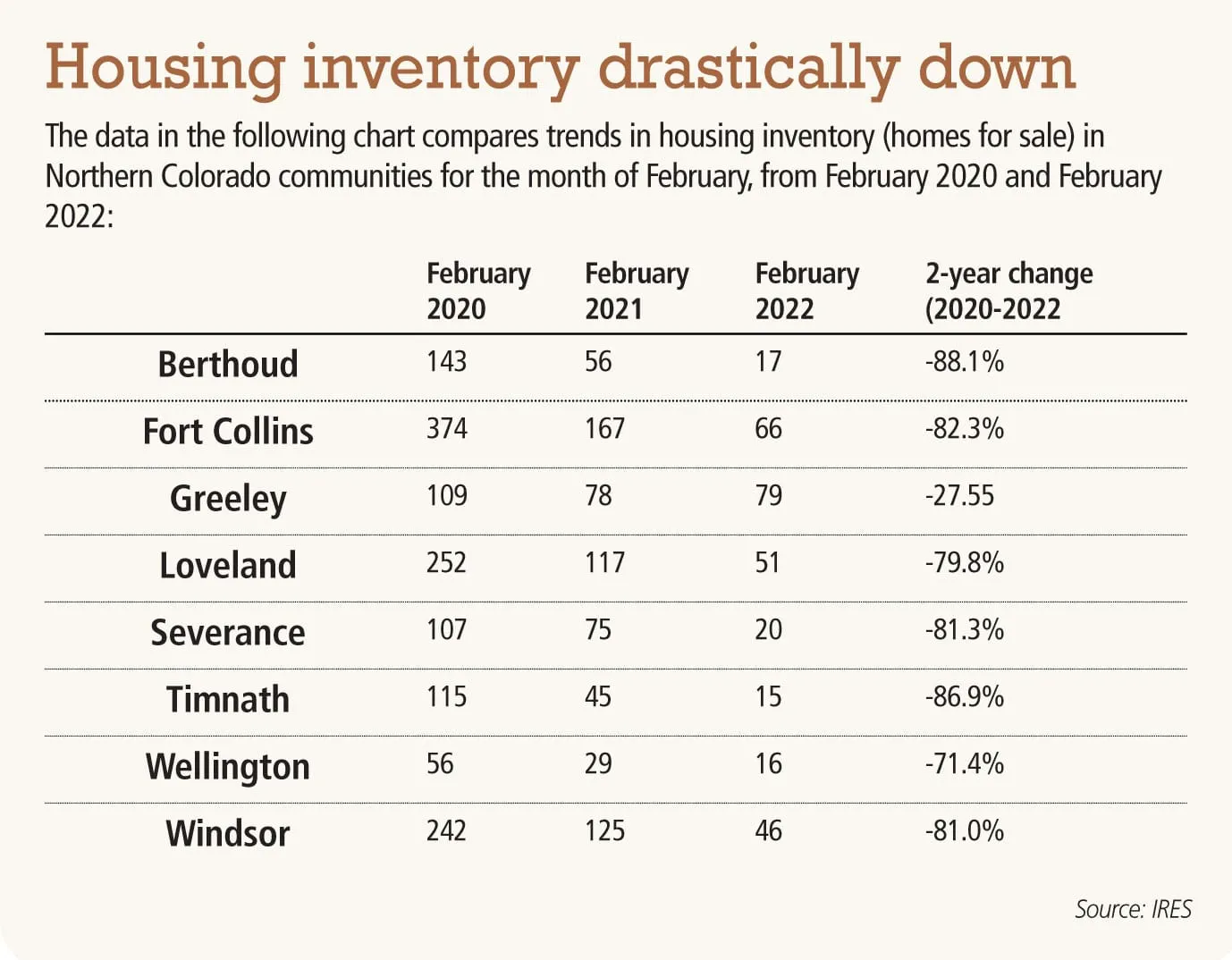

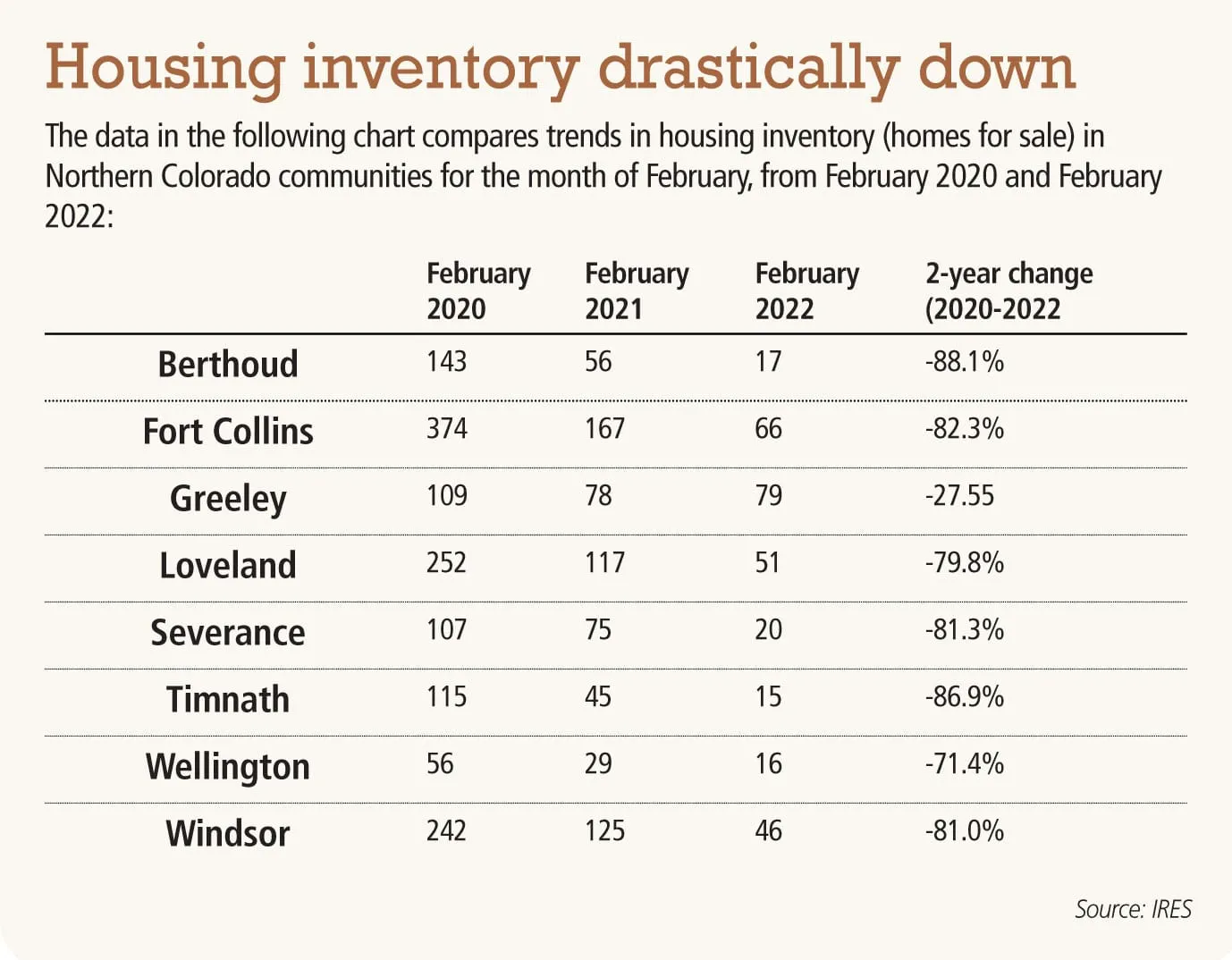

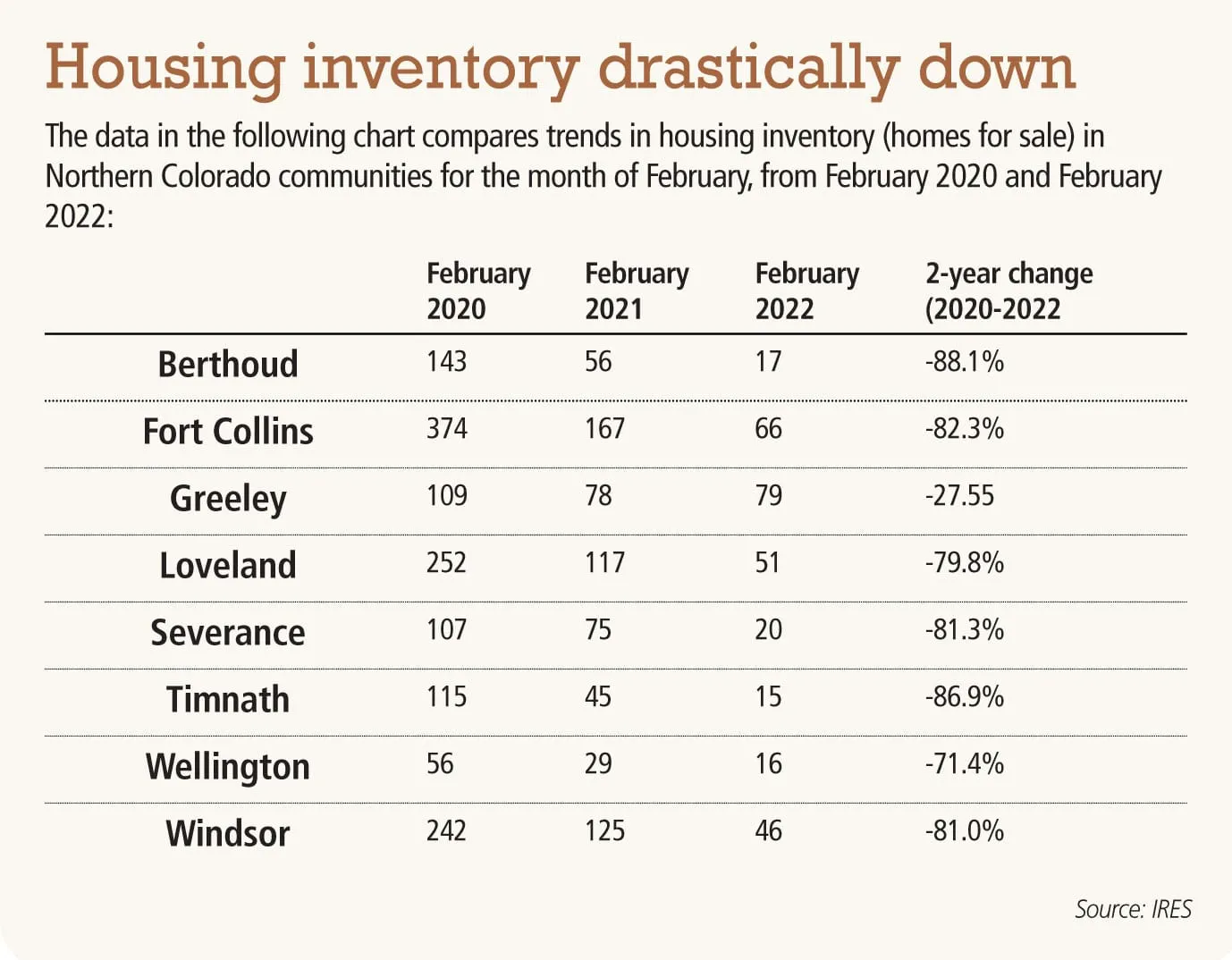

No. 2: Seasonality — With society seeming to be returning to normal, so is the seasonal demand in the housing market — wherein the traditional surge for home buying and selling picks up as the public education calendar winds down. However, with the combination of buyer demand and severely reduced standing inventory, this return to seasonality has created stiff competition for homes hitting the market. Consequently, the market is experiencing completely new tiers for pricing in almost all neighborhoods across Northern Colorado. Expect the homebuying season to start to ramp up toward the end of March with the onset of daylight saving time. Thankfully, it should coincide with the addition of new inventory, as homebuilders take advantage of Spring weather to deliver much needed supply to the marketplace.

No. 3: Millennial homebuyers — The Millennial generation is coming of age and reaching homeowner relevance. And they want houses now.

The Millennial generation is the largest generation on record, and the five-year window between 2019 and 2023 is when this generation is reaching its peak homebuying age of 30. This influx of demand from a generation, coupled with the severe lack of standing inventory, has created white hot competition for available resale and new construction inventory. Builders have not been able to keep pace with demand as a result of supply chain issues delaying construction timelines longer than expected; the result is a slowing of the locomotive that is the real estate demand across the country and region. This new year is already shaping up as we expected with rapidly appreciating prices driven by continued consumer interest and a pressing need for housing.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at bwells@thegroupinc.com or 970-430-6463.

Three dynamics are shifting the housing market into hyperdrive to start 2022.

No. 1: Interest rates — As rates nudge higher, many homebuyers are feeling the pressure of housing price growth — as well as inflationary pressures on other goods — and hastening to get in the market. This circumstance has stoked a more competitive marketplace, with many buyers trying to secure longer-term housing options and get out from under the burden of renting, causing their cost of living to increase substantially while bringing no return on that expense.

For example, we are seeing single-family rental…