Etkin Johnson places massive industrial portfolio on the market, eclipsing 2019 sale

LOUISVILLE — A year and eight months after closing the largest industrial portfolio sale in Colorado history, Denver-based Etkin Johnson Real Estate Partners is working on another deal that could be even bigger.

The company has listed 2.5 million square feet for sale, including its holdings in the Colorado Technological Center in Louisville. That compares with a 1.95-million-square-foot industrial portfolio that the company sold in January 2019 for $247.5 million, the largest sale by dollar volume in Colorado history.

In a statement emailed to BizWest, Etkin Johnson said the time is right for the company to sell the latest portfolio.

“As the industrial market in the Denver metro area continues a 41-quarter streak of positive net absorption, Etkin Johnson’s innovative product type remains highly sought-after by strong-credit tenants looking for growth opportunities,” the company said.

Commercial real estate brokerage CBRE will list the portfolio.

“CBRE is pleased to announce that it will be bringing Colorado’s Premier Industrial Portfolio to market the week of Sept. 14th,” according to a sales brochure obtained by BizWest. “The portfolio has never been marketed and consists of 23 Class A industrial buildings in the region’s most desirable and successful business parks.”

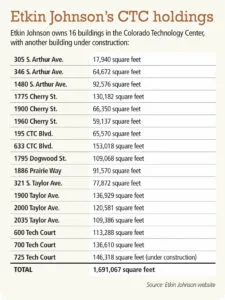

The bulk of the listing — 17 buildings encompassing almost 1.7 million square feet — is located in the Colorado Tech Center. Another 461,000 square feet are in Denver’s Enterprise Park fronting Interstate 70, and 355,000 square feet are under construction in southeast Denver and Northern Colorado.

“The primarily manufacturing and distribution portfolio has a diverse tenant mix of strong public and private companies, including credit tenants,” the brochure states. Tenants include companies such as Eli Lilly, Sierra Nevada Corp., FedEx, Medtronic, US Bank, Graphic Packaging International and Floor & Décor.

The portfolio is 100% leased with a 6.8-year weighted average lease term, according to the brochure.

“Rents on average are below existing market rates, and with the buildings in highly land-constrained locations, strong rent growth is expected.”

Interested buyers are being asked to sign confidentiality agreements to receive an offering memorandum.

CBRE brokers Jeremy Ballenger, Tyler Carner, Jim Bolt and Tim Richey have the listing on the portfolio. CBRE issued a statement to BizWest regarding the sale.

“Industrial real estate has never been more valuable, so competition is high for these assets — especially in a market like Colorado where opportunities of this scale are rare, and the economy is extremely well-positioned for economic and population growth,” according to the statement. “This portfolio has many advantages, led by the CTC where a buyer can step into an essentially supply-locked submarket amid growing demand from a high caliber of tenancy.”

CBRE said that demand for industrial/warehouse properties has been high, even during the COVID-19 pandemic.

“More consumers are using e-commerce platforms and adoption of online grocery shopping has skyrocketed — trends that are dramatically boosting warehouse and cold storage demand,” the company said. “Companies are further electing to increase ‘safety stock’ for their inventories to avoid incurring supply chain-related shortages that occurred this year, and therefore they are needing more space like these offerings.”

Etkin Johnson sold a 1.95 million-square-foot industrial portfolio in January 2019 to Berkeley Partners of San Francisco for $247.5 million, the largest such sale by dollar volume in state history. That sale included 19 properties in Arvada, Aurora, Boulder, Centennial, Colorado Springs, Denver, Englewood, Golden, Lakewood, Thornton, Westminster and Wheat Ridge.

Etkin Johnson was founded in 1989 by Bruce Etkin and David Johnson and has developed or acquired more than 90 properties totaling more than 9.2 million square feet, according to the company’s website. Its portfolio includes industrial/flex, hotel, office, multifamily and land.

The company has been one of the most prolific developers at the CTC, breaking ground in April on 725 Tech Court, the final phase in the almost 400,000-square-foot, three-building Louisville Corporate Campus at CTC. 725 Tech Court by itself will encompass 146,320 square feet and is scheduled for completion in the first quarter of 2021.

One of Etkin Johnson’s Northern Colorado projects is Axis 25, a two-building industrial development north of the Harley-Davison dealership near the interchange of Interstate 25 and Crossroads Boulevard in Loveland. The development — announced in March — will include two buildings, of 100,722 and 95,256 square feet.

© 2020 BizWest Media LLC

LOUISVILLE — A year and eight months after closing the largest industrial portfolio sale in Colorado history, Denver-based Etkin Johnson Real Estate Partners is working on another deal that could be even bigger.

The company has listed 2.5 million square feet for sale, including its holdings in the Colorado Technological Center in Louisville. That compares with a 1.95-million-square-foot industrial portfolio that the company sold in January 2019 for $247.5 million, the largest sale by dollar volume in Colorado history.

In a statement emailed to BizWest, Etkin Johnson said the time is right for the company to…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!