Wells: In recessions, local real estate prices often run against the grain

In recessions, local real estate prices often run against the grain

Economic cycles happen. And as our current economic expansion moves forward (reaching a record 122 months as of August), it’s hardly surprising to hear from economists and media pundits who want to weigh in with their opinions on when it might come to an end.

SPONSORED CONTENT

While such speculation is likely to continue — and not all experts agree that a recession is imminent — I’d like to offer some perspective about how Northern Colorado’s housing market has weathered recessions in the past, and the position that local real estate is in today.

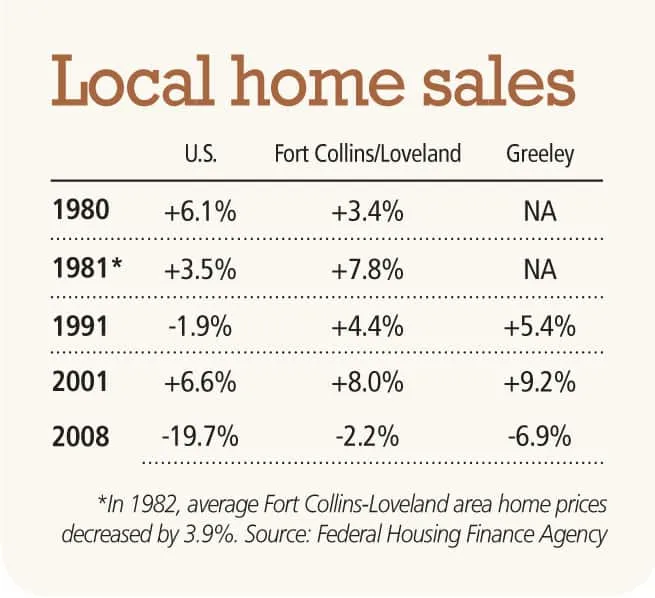

First of all, let’s look back on our last five U.S. recessions and their impact on home prices. It’s probably not what you’d think. During three of those five recessions, average home prices across the country still increased. And in the Fort Collins-Loveland area, home prices increased in four of the five recessions. We don’t have Greeley-area data for the 1980 and 1981 recessions, but Greeley-area prices did increase in two of the last three recessions.

For a snapshot of what I’m talking about, take a look at this table:

There are two conclusions we ought to draw from this recent history:

There are two conclusions we ought to draw from this recent history:

1. First, a recession does not equal a housing crisis. More specifically, the market conditions today are much different than we witnessed in 2008. In fact, Javier Vivas, director of economic research at Realtor.com, recently observed that “Over-construction is largely what got us into trouble last recession, and we’ve experienced just the opposite since then.” And Zillow economist Jeff Tucker goes further to say “Rather than risky borrowers taking on adjustable-rate mortgages, we have buyers with sterling credit scores taking out predictable 30-year fixed-rate mortgages.

2. Second, we can see that home values across Northern Colorado have been more resistant to negative price trends than the country as a whole.

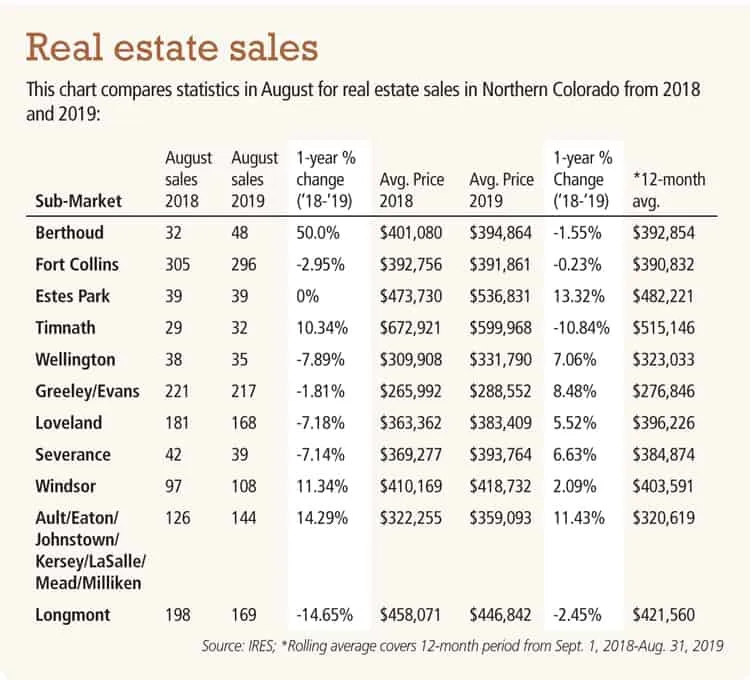

Which leads me to another important consideration amidst all the concern for a slowdown. The Northern Colorado housing market is healthier now than it’s been at any point in the last five years. In fact, a recent survey found that Fort Collins ranks No. 4 among the country’s best housing markets for home price growth and stability. That’s also true up and down the Front Range, with Boulder, Denver, and Cheyenne, Wyoming, all among the top 10.

Bottom line, I see nothing in our data analysis to show our economy in Northern Colorado weakening. Low mortgage rates are providing homeowners with the opportunity to refinance while also allowing buyers to purchase homes at favorable terms. Furthermore, housing inventory — which was tight for several years earlier in this decade — has increased, easing the stress on home prices and giving potential buyers more time to consider where they want to invest.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado.

In recessions, local real estate prices often run against the grain

Economic cycles happen. And as our current economic expansion moves forward (reaching a record 122 months as of August), it’s hardly surprising to hear from economists and media pundits who want to weigh in with their opinions on when it might come to an end.

While such speculation is likely to continue — and not all experts agree that a recession is imminent — I’d like to offer some perspective about how Northern…