Albertsons calls off Kroger merger, sues over botched regulatory approval

The relationship between grocery giants Albertsons Cos. (NYSE: ACI) and Kroger Co. (NYSE: KR) appears to have passed its sell-by date.

Just hours after a pair of judges issued injunctions Tuesday afternoon blocking a planned merger between the companies, Albertsons threw in the towel, calling off the $24.6 billion deal and suing Kroger for failing to secure regulatory approval for the business combination.

Kroger, the parent company of Colorado-based grocery chain King Soopers, failed “to exercise ‘best efforts’ and to take ‘any and all actions’ to secure regulatory approval of the companies’ agreed merger transaction, as was required of Kroger under the terms of the merger agreement between the parties,” Albertsons said Wednesday morning.

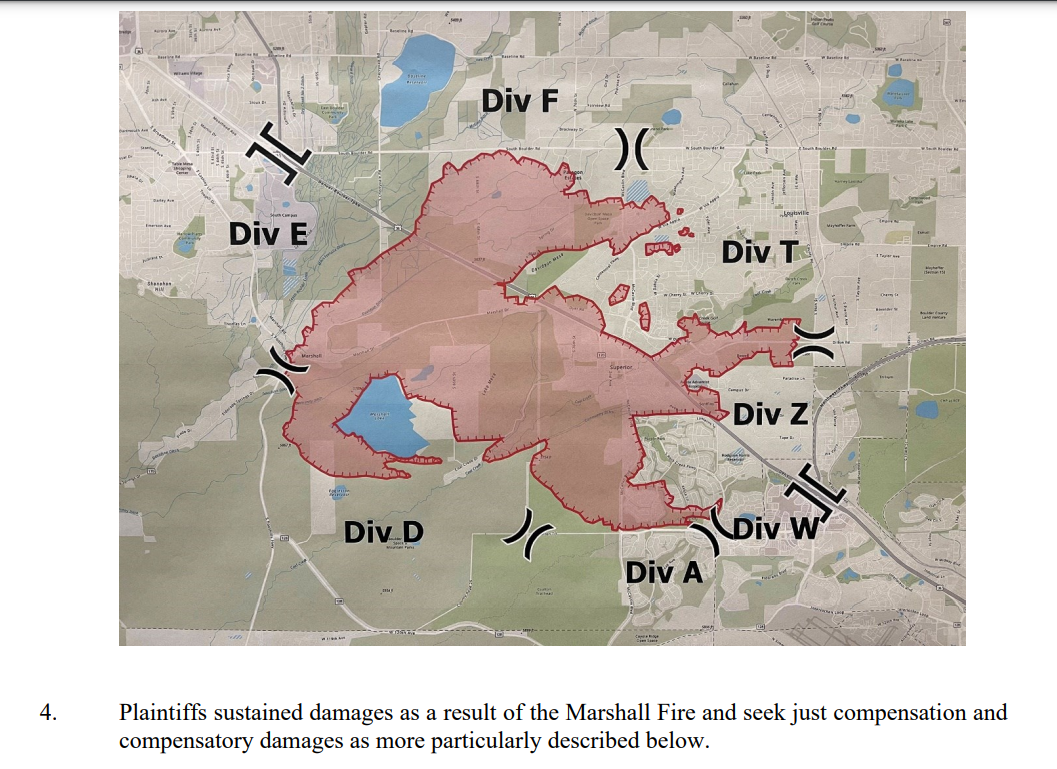

SPONSORED CONTENT

Cincinnati, Ohio-based Kroger breached its merger contract with Albertsons, which owns and operates Safeway grocery stores in Colorado, “by repeatedly refusing to divest assets necessary for antitrust approval, ignoring regulators’ feedback, rejecting stronger divestiture buyers and failing to cooperate with Albertsons,” Boise, Idaho-based Albertsons said.

Albertsons said it plans to ask the court to enforce a $600 million contract termination fee, and is “seeking billions of dollars in damages from Kroger to make Albertsons and its shareholders whole.”

Kroger on Wednesday morning called Albertsons’ accusations “baseless and without merit.” Furthermore, Kroger blames Albertsons for “repeated intentional material breaches and interference throughout the merger process, which we will prove in court.”

The company “went to extraordinary lengths to uphold the merger agreement throughout the entirety of the regulatory process and the facts will make that abundantly clear,” Kroger said.

The Tuesday injunctions from U.S. District Court Judge Adrienne Nelson in Portland, Oregon, and King County (Washington) Superior Court Judge Marshall Ferguson appear to be a tipping point in this saga that began more than two years ago.

The merger proposal has drawn criticism from the Federal Trade Commission and from labor leaders, including United Food & Commercial Workers Local 7, the union that represents King Soopers grocery workers across the Front Range, including in Northern Colorado and the Boulder Valley. Critics argue that consolidation would increase prices and force down worker wages.

“It would be disastrous for shoppers who deserve competition that leads to better choices and lower prices,” UFCW Local 7 said in a statement Tuesday afternoon. “The merger would be detrimental to our communities, would harm farmers and suppliers who deserve a healthy balance to negotiate fair prices for their hard work. Instead, the proposed merger would create an out-of-balance system that drives up prices, drives out competition, and drives down wages and safety standards.”

Kroger and Albersons had argued that a merger was necessary to allow the combined organization to compete with the likes of Walmart Inc. (NYSE: WMT) and Amazon.com Inc. (Nasdaq: AMZN), both of which sell groceries.

To appease antitrust regulators, the would-be merger partners released a list of 579 Albertsons-owned stores in 19 states, including 91 in Colorado, that would be sold to C&S Wholesale Grocers Inc., a privately held New Hampshire company that owns several grocery-store brands such as Piggly Wiggly. The divestiture list includes nearly two dozen Boulder Valley and Northern Colorado Safeway stores.

Regulators were not appeased. Colorado Attorney General Phil Weiser filed a lawsuit similar to those lodged in Washington and Oregon, and a trial was held in Denver in October. The judge in that case has yet to issue a decision.

“A successful merger between Albertsons and Kroger would have delivered meaningful benefits for America’s consumers, Kroger’s and Albertsons’ associates, and communities across the country,” Albertsons chief policy officer and general counsel Tom Moriarty said in a prepared statement. “Rather than fulfill its contractual obligations to ensure that the merger succeeded, Kroger acted in its own financial self-interest, repeatedly providing insufficient divestiture proposals that ignored regulators’ concerns. Kroger’s self-serving conduct, taken at the expense of Albertsons and the agreed transaction, has harmed Albertsons’ shareholders, associates and consumers. We are disappointed that the opportunity to realize the significant benefits of the merger has been lost on account of Kroger’s willfully deficient approach to securing regulatory clearance.”

Weiser said that he expects Denver District Court Judge Andrew Luxen’s ruling in the Colorado lawsuit to be similar to those issued in Washington and Oregon, and said that he doesn’t think that Albertsons’ decision to step away from the merger will affect the case.

“Albertsons has made statements that suggest the merger is off and that Kroger has not handled the management of this divestiture defense well. Those points are out there, but we haven’t heard from Kroger or any other definitive evidence the merger is off,” he said. “So at this point, I would say it’s not certain what the parties are both thinking.”

Additionally, it’s important that Colorado prevail in the lawsuit, Weiser said, because the case is about more than whether the merger violates antitrust laws.

Beyond the merger, Colorado’s complaint against the grocery companies “involved a refusal to hire workers from the other stores” during a 2022 strike by King Soopers workers, Weiser said. “That type of lack of competition, that type of a commitment to undermine competition, hurts workers.”

Kroger and Albertsons “had a second illegal agreement not to solicit each other’s pharmacy customers during that strike — those are among the most prized customers — and not competing is a violation of antitrust laws,” he said. “We want to make sure we prevail and we get a decision on both those counts, as well as ensuring we permanently stop the merger.”

The relationship between grocery giants Albertsons and Kroger Co. appears to have passed its sell-by date.

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!