Wells: Analyzing the trends shaping residential real

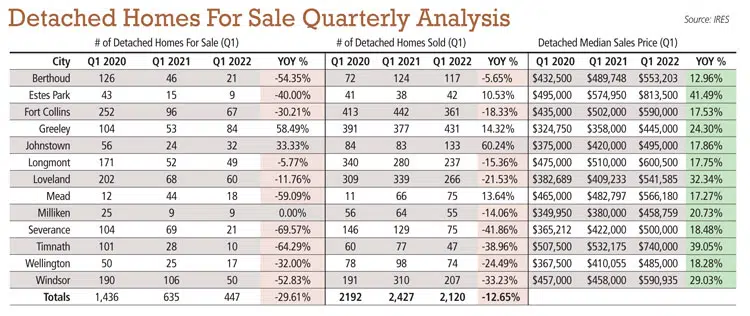

While American consumers are embracing freedom from post-COVID restriction, there are mounting concerns that inflation might take the wind out of the sails of consumer spending in 2022. What’s the impact on residential real estate?

Here is a closer look at what we see happening in the housing market:

Inflation

Rents have become a primary source of inflationary pressure, as evidenced by the Consumer Price Index (CPI). According to a recent CNBC article, rents are up 10.2%, accounting for about one-third of the latest CPI report. And these pressures will likely persist into 2023, as rent hikes have still not taken effect for…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!