Greeley goes all-in on metro districts

GREELEY — The city of Greeley is reviewing proposals for three master-planned communities involving some 5,500 acres, 1,600 new homes, close to 1.5 million square feet of commercial space, and ultimately north of $400 million in bonds — issued via the projects to fund infrastructure and amenities and repaid by future residents.

All three planned unit developments propose metropolitan districts, technically five to 10 individual ones per project, to construct roads and sewers and connect them to city systems, as well as the lakes and orchards and other niceties that have attracted homebuyers in neighboring cities such as Windsor.

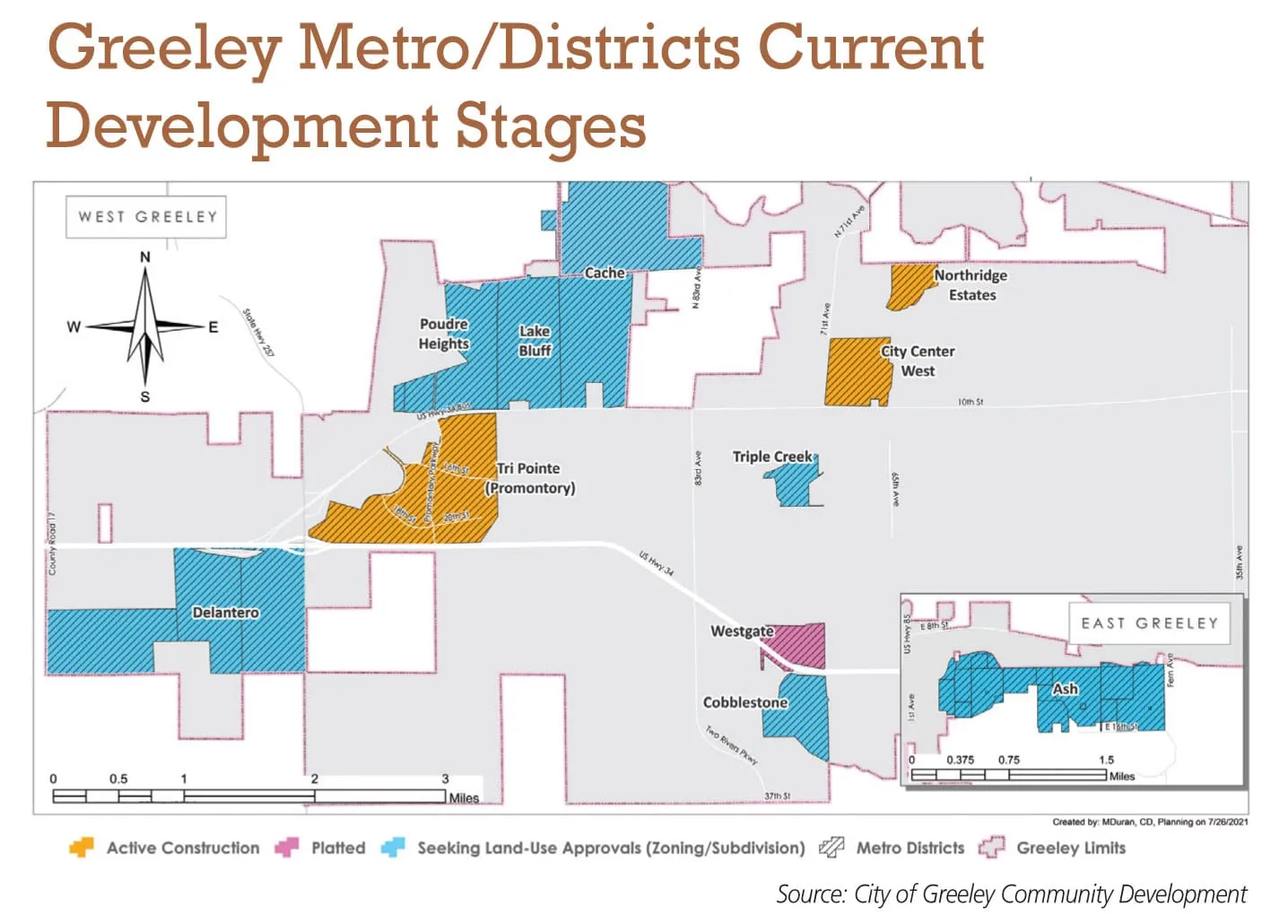

City staffers combing through developer visions for the three — Ash, Poudre Heights, and Delantero — emphasize the ephemeral aspect of current filings. None have gone to the City Council for approval, and late-in-session legislative action statewide is likely to affect the penciled-in numbers.

SPONSORED CONTENT

Still, Greeley since 2018, if not going “all-in” on metro districts, has at least begun to up the ante, and certainly compared with neighboring cities.

Hard Eight

There are more than 1,800 metro districts statewide; 1,500 have come over the past 20 years.

Greeley Planning Manager Mike Garrott said one driver in the last decade was the 2008 real estate recession, which tightened conventional lending; the city most recently approved five submitted in 2018; the three new ones are in-process.

Steve Southard of Advance HOA Management Inc., who runs metro districts in Windsor for Martin Lind’s developments, said rising land and water costs also turned developer attention to the vehicle.

“It’s almost the only way to develop in Colorado,” he said.

That may be true for bigger projects especially, others agreed, due to the complexity and now more-contested nature of metro districts. The Ash metro district in Greeley, located south of East Eighth Street in east Greeley, proposes 245 units and 263,000 square feet of commercial space on 461 acres. Poudre Heights’ 293 acres north of U.S. Highway 34 and the Promontory subdivision would hold 1,200 homes and 366,000 square feet of commercial, as well as 609,000 square feet of industrial. Finally, the 817-acre Delantero, also near Promontory but south of U.S. 34, hopes to draw up roughly 4,100 homes and 921,000 square feet of commercial space.

Ben Snow, director of economic health and housing for the community, said metro districts are essential to the city’s economic development.

“I believe for Greeley to remain competitive — for attracting new development that will attract new residents — metro districts are part of that. I like coming into a new development with nice amenities, and I don’t mind paying for it,” he said.

He said Centerra in east Loveland is “a great example: nice, high-quality sense of place. People like to be associated with those kinds of places …” Often, “people don’t know where the metro districts are and where they’re not, but a lot of the stuff that’s built out has more curb appeal [because there’s] more investment in landscaping and monument signage.”

Snow’s first work with metro districts came 15 years ago, he said, with “communities in south metro Denver, particularly Arapahoe and Douglas counties.” Districts proliferated “to spur growth and development, and I see the same trends now here in NoCo. It’s a very effective tool when used responsibly.”

But other cities don’t concur with Greeley’s approach or don’t covet bigger projects.

Longmont and Fort Collins last year imposed moratoria on metro districts. Homeowner woes in a Johnstown metro district drew statewide attention as a result of newspaper reporting. Loveland has approved some districts but not others.

Long Range

Real estate professionals with some gray in their beards say Greeley’s faster track is the right one.

“One reason they’re starting to approve them is they’re watching Windsor get phenomenal” communities, said Lind, the developer who’s delivered 4,000 homes in 27 years — all in that city, all in metro districts.

He quickly ticks off several more bullets for the “pros” column:

“A very ordinary house [gets] extraordinary services … paid for over 30 years” by monies tax-deductible to individual homeowners, who can be elected to the boards that oversee the district. On the developer side, he added, “insurance is cheaper” for the district which, as a quasi-municipal body, operates with fewer liabilities.

Residential broker Dennis Schick said that amenities to drive sales “get in there first” and that in a real estate downturn, “a metro district can’t go into foreclosure.”

Schick co-owns Re/Max Alliance: 26 offices, a thousand agents statewide, and “$4.8 billion in real estate on 10,000 transactions” last year.

“We’re shifting a lot of our attention to Greeley and Weld.”

See Clearly

Amenities and benefits are there or, developers say, will be. “We have areas we’re going to turn into working farms,” Windsor’s Southard said, including corn and fruit orchards, and “people love to get married in a winery or barn.”

It’s the cost side of the analysis that is getting greater scrutiny.

Heightened hesitation on metro districts contributed this year to a state law intended to increase transparency of the process, requiring, for instance, more disclosure of how much homeowners pay for the pumpkin patch, the electoral specifics of residents running for and serving on boards, and annual reports by the metro district.

“It gets people aware sooner,” said Elizabeth Peetz, vice president of government affairs with the Colorado Association of Realtors. A study of Northern Colorado metro districts under the group’s auspices showed a greater interaction among developers, cities and residents and “mixed results” on affordability. Homeowners pay less to get into a property and more over time than they otherwise might, the study said.

Projected debt — the bonds — on the three new Greeley proposals are $110 million for Poudre Heights and $157 million for Delantero. Filings for Ash don’t show a number yet — Garrott said developers left it out and have been asked to provide it in the next round of submittals — but a midpoint number relative to the others would bring the total to more than $400 million.

A second bill related to metro districts that was signed into law will boost costs for developers when the land for the metro district includes oil and gas activities, as Delantero and Ash do, Peetz said.

Peetz said increased costs get “passed onto consumers” but how the new bill plays out “will most likely be made in the rule-making.”

“The tax burden is a concern,” Garrott said. The 30- and 40-year bonds typically issued are “long-term debts” cities have to consider.

Greeley is doing its part on interaction: Project review comments from planners reflect numerous requests for more information, greater alignment with city standards, and requests to remove some elements of proposals.

Garrott said the city’s comprehensive plan completed in 2018 and a strategic housing plan offered up in 2019 guide the decision-making, including 13 specific criteria for approval that in one way or another “have to be addressed” for developers to seal a deal.

The city’s municipal code, section 2, chapter 9, is specifically entitled ‘Metro District Standards.’

Three proposals this year for new metropolitan districts in Greeley continue the city’s general amenability to this approach to development. With new state regulations related to transparency and oil and gas production taxes, they might also test the limits of — and set new boundaries for — what has grown into a go-to model for developers of large master planned communities.

Metro Districts let cities add infrastructure — roads and sewers, for example — and developers add amenities — lakes and beaches, parks and orchards — for flocking residents seeking new local digs. The necessities and benefits are paid for by bonds issued by the districts with homeowners repaying them over time by tax assessment.

Lenders have tightened traditional financing types over the last decade, narrowing the road to a completed community. Developers say they’d otherwise have to pay for infrastructure and amenities upfront, passing costs through on home prices — or not build at all. Brokers enjoy being able to showcase tree-lined streets ambling toward swaths of amenities. Homebuyers have sought and their legislative representatives in June delivered on increased transparency in the process.

Metro districts started with the Boomers’ generation but 80% of Colorado’s metro districts have formed in the past 20 years. They are increasingly popular in general with both builders and buyers of new homes in growing cities.

GREELEY — The city of Greeley is reviewing proposals for three master-planned communities involving some 5,500 acres, 1,600 new homes, close to 1.5 million square feet of commercial space, and ultimately north of $400 million in bonds — issued via the projects to fund infrastructure and amenities and repaid by future residents.

All three planned unit developments propose metropolitan districts, technically five to 10 individual ones per project, to construct roads and sewers and connect them to city systems, as well as the lakes and orchards and other niceties that have attracted homebuyers in neighboring cities such as Windsor.

City staffers combing through…