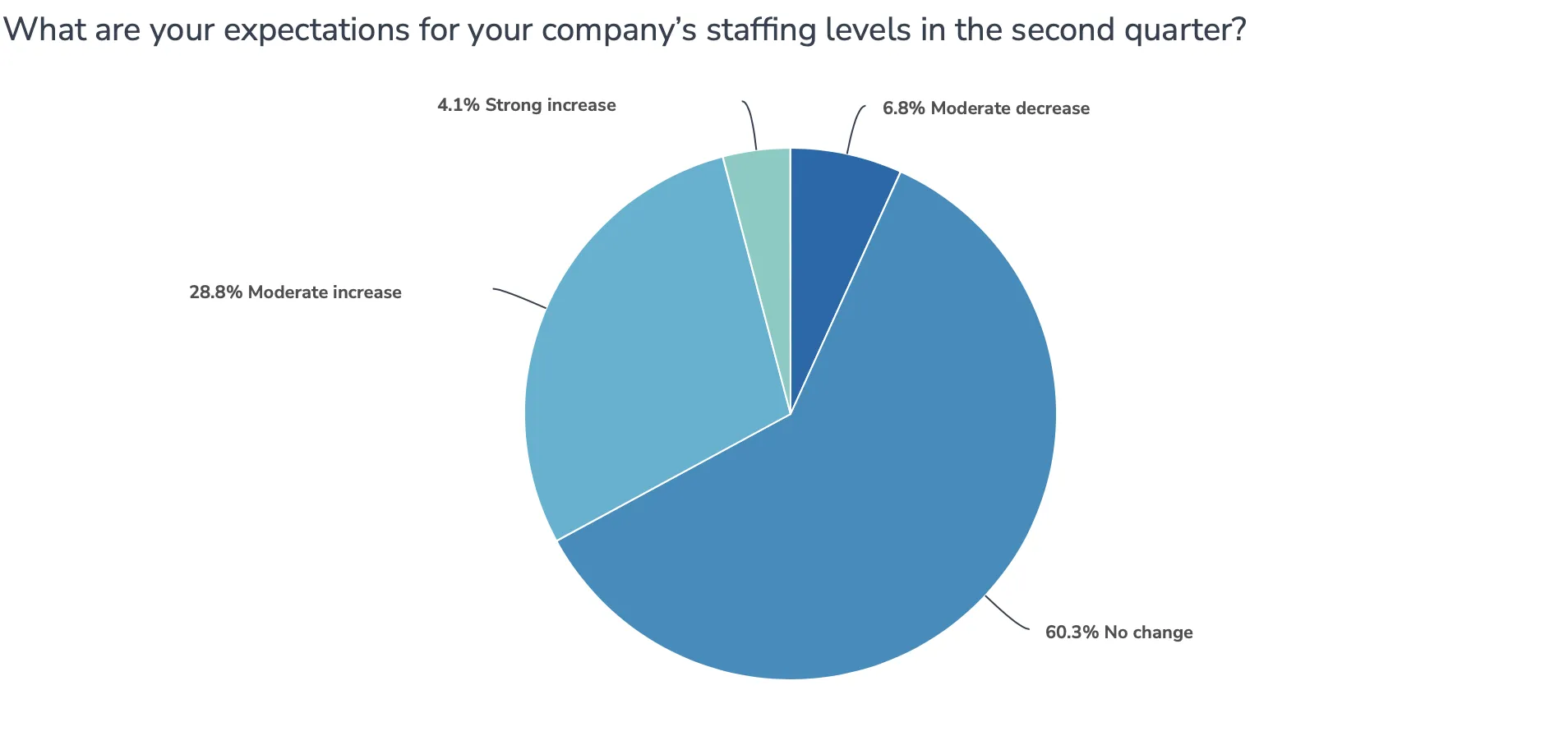

Region’s executives see stable employment in Q2

Regional executives expect no major changes to employment levels at their companies in the second quarter, with about a third anticipating increases in hiring.

That’s according to the inaugural CEO Roundtable Executive Survey, conducted by BizWest. The survey will be conducted quarterly, focusing on C-level executives in the Boulder Valley and Northern Colorado. BizWest conducts CEO Roundtables in both areas, with executives gathering to discuss trends, opportunities and challenges within their industries.

About 60% of respondents expect no change in employment in the second quarter, with 28.8% expecting a moderate increase in hiring, 4.1% expecting a strong increase and 6.8% expecting a moderate decrease.

SPONSORED CONTENT

Capital expenditures are expected to remain flat for a majority of respondents, with 56.2% anticipating no change, 16.1% expecting a moderate decrease, 1.4% a strong decrease, 24.7% expecting a moderate increase and 2.7% anticipating a strong increase.

Among other considerations for regional executives:

- Artificial intelligence: More than half of respondents — 56.2% — have begun to use some form of AI in their companies, with 5.5% integrating the technology through their business, 4.1% integrating AI in at least one business line, 27.4% employing AI on a limited basis and 19.2% experimenting with the technology. An additional 31.5% of respondents said they are evaluating how AI might apply to their company. Only 12.3% of respondents said the technology will have no effect on their business.

- Minimum wage: New minimum-wage requirements at the state, county or local levels are having no effect on 64.4% of respondents, with 24.7% describing it as having a somewhat negative effect, 6.8% very negative impact, 2.7% somewhat positive impact and 1.4 % very positive impact.

- Housing availability: Almost 70% of respondents said that housing availability was having a negative impact on their employees, with 53.4% describing it as somewhat negative and 16.4% viewing it as very negative. Respondents who viewed housing as having no effect on their employees totaled 30.1%.

- Construction of new facilities: About 20% of respondents said their companies might require construction of new facilities in 2024, with 5.5% having definite plans, 4.1% somewhat likely, 11% considering one or more projects and 79.5% not at all likely.

- Office-space requirements: More than half of respondents — 56.2% — anticipate no change in office-space requirements in 2024, with 2.7% expecting a strong increase, 9.6% a moderate decrease, 1.4% a strong decrease and 17.8% responding “Not applicable.”

- Transportation infrastructure: More than half of respondents rated the region’s transportation infrastructure as “Needs work” — 50.7% — or “Very poor” — 5.5%. Another 31.5% rated it as meeting their companies’ needs, with 5.5% rating it as “Very good.” Another 6.8% said it was irrelevant to their companies’ operations.

Factors affecting business strategy in 2024 include inflation, 73.6%; interest rates, 72.2%; labor supply, 59.7%; politics/growth limitations, 50%; the U.S. presidential election, 44.4%; supply chain, 34.7%; geopolitics, 27.8%; cybersecurity issues, 16.7%; and other issues, 11.1%.

Respondents hailed from a variety of industries, including agribusiness, banking and finance, brewing, business services, construction, government, health care, life sciences, manufacturing, natural products, nonprofits, outdoor industry, real estate, renewable energy, and technology.

BizWest’s CEO Roundtable program is sponsored by Plante Moran and Berg Hill Greenleaf Ruscitti LLP in the Boulder Valley and Northern Colorado. Bank of Colorado sponsors the program in the Boulder Valley, and Elevations Credit Union sponsors in Northern Colorado.

Regional executives expect no major changes to employment levels at their companies in the second quarter.