Loveland CFO: Food tax elimination will result in $13.2M reduction

LOVELAND — City of Loveland financial staffers are confident that the city will see $13.2 million less in sales tax collections in 2024 as a result of the elimination of the tax on food for home consumption.

Voters approved the discontinuation of the food tax in November. Budget writers have been working since that time to project what the loss will be, and how that will impact city spending.

City chief financial officer Brian Waldes told the council at its annual retreat last weekend and again Tuesday night that the food tax loss would be $13.2 million, despite the fact that overall city tax collections recorded for January were above what was forecast.

SPONSORED CONTENT

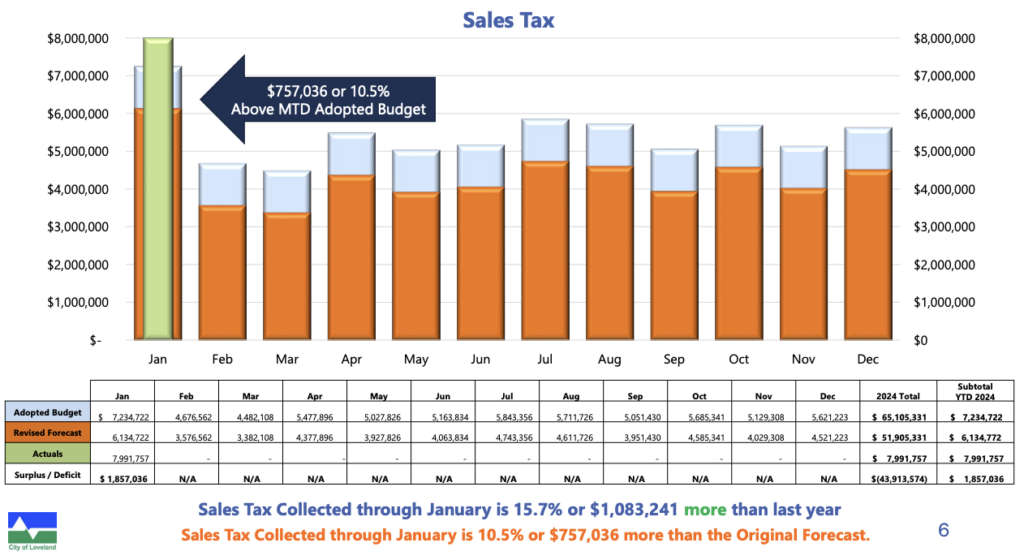

Financial charts shared with the council showed that $7.99 million was collected in January, compared with $7.23 million originally budgeted for the month. The budgeted number had been revised down to $6.13 million after the food tax vote in November.

Waldes told the council that January numbers will change once 2023 is closed out — some of the revenue recorded for January was actually December revenue. But the biggest piece of the variance, he said, came from sales taxes collected on two large machinery purchases, purchases unrelated to the food tax elimination that won’t be repeated.

Waldes said that staff is working on three requests that council members made during the retreat.

The first is to show what one-time or temporary measures can be taken to reduce spending. This could include delays in capital spending or use of cash reserves to cover this year’s reductions in revenue.

The second is to prepare “an austerity budget” that would reflect a permanent reduction of $13.2 million in spending.

And the third is to look at new revenue, whether new fees or new tax streams, that could replace the lost food tax revenue.

“We’ll bring a range of variations,” he told the council, explaining that they might see the effect on spending if various percentages of reserves are used to cover the shortfall.

City of Loveland tax collections are projected to be down $13.2 million as a result of the elimination of the food tax.

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!