Colorado biz leaders remain pessimistic as job growth slows

BOULDER — As Colorado’s job growth slows to a level that one University of Colorado Boulder economist calls “confounding,” state business leaders continue to express widespread pessimism about the economic landscape.

CU’s Leeds Business Confidence Index dipped slightly heading into the fourth quarter of 2023, with respondents citing interest rates, inflation and national politics as leading sources of heartburn.

The LBCI fell half a point to 43.6 in the third quarter. An LBCI score — which is based on impressions of the state economy, national economy, industry sales, industry profits, industry hiring and capital expenditures — of 50 is neutral. Heading into the fourth quarter, all six components of the LBCI were on the pessimistic side of the ledger.

SPONSORED CONTENT

That pessimism from the 222 business leaders who responded to the survey between Sept. 1 and Sept. 20 belies the fact that many metrics still indicate a relatively healthy Colorado economy.

“I do think a lot of people were anticipating … a recession this year,” said Rich Wobbekind, faculty director and senior economist at the University of Colorado Boulder Leeds School business research division, or BRD. But that recession has either yet to materialize or is very mild.

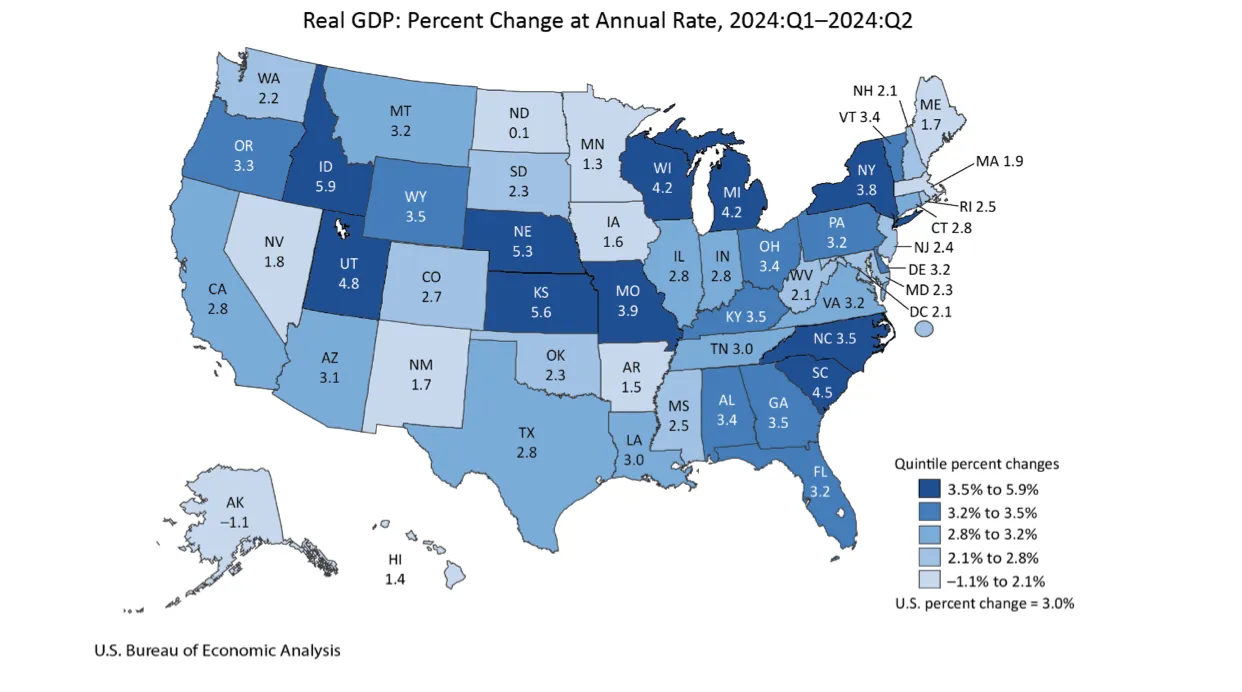

“So while GDP, consumption, employment and income continue to provide a positive narrative about the national economy, there are a number of headwinds that pose challenges that we’re watching very closely,” BRD executive director Brian Lewandowski said. Those headwinds include “high interest rates, commercial real estate, energy prices, inflation, worker shortages and now a possible government shutdown.”

For much of the COVID-19 recovery period, Colorado has one of the national leaders in employment growth. That may no longer be the case. Employment in the Centennial State grew 1.5% year-over-year in August, putting it in the lower half of state growth rates.

“The last three months were notably the slowest three months of job growth since December 2020,” Lewandowski said. “We are seeing a slower labor market, a slower job growth number, but it’s still a phenomenal number of jobs that continue to be added month after month. I would not describe that as slow job growth, just slower job growth than what we’ve been seeing.”

For economists, “this job growth number in Colorado has been a little bit confounding because the economic conditions in the state don’t feel like we’re lagging the nation. We’ve been explaining this as perhaps it’s a labor-shortage issue versus a lack of firms seeking workers or a lack of demand for workers,” Lewandowski said, adding that revisions could be coming to the state employment figures that will result in Colorado regaining its position among the nation’s fastest growers.

BOULDER — As Colorado’s job growth slows to a level that one University of Colorado Boulder economist calls “confounding,” state business leaders continue to express widespread pessimism about the economic landscape.

CU’s Leeds Business Confidence Index dipped slightly heading into the fourth quarter of 2023, with respondents citing interest rates, inflation and national politics as leading sources of heartburn.

The LBCI fell half a point to 43.6 in the third quarter. An LBCI score — which is based on impressions of the state economy, national economy, industry sales, industry profits, industry hiring and capital expenditures — of 50 is neutral. Heading into…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!