Wana exec: Cannabis preferences near inflection point

BOULDER — It’s been nearly a decade since adults in Colorado have been able to purchase recreational-use cannabis, and the market and its customers have evolved significantly since 2014.

With the 2023 dawning, Wana Brands chief marketing officer Joe Hodas told BizWest that leaders at the Boulder-based edibles giant “really believe this is going to be a year where the consumer blend begins to change.”

No longer will questions of “what’s the cost and how much THC is in it” drive decision-making for large swaths of the cannabis-consuming public, he said.

SPONSORED CONTENT

As pot companies such as Wana have grown “more sophisticated in product development,” their customers have begun to move “away from a sledgehammer approach, and toward products that fit their specific needs,” Hodas said.

Producers now routinely feature gummies, tinctures, beverages, patches and creams — Hodas calls them “use-case-specific products” — that provide tailored experiences for sleep, relaxation, fitness or energy.

Further specialization and specificity of effects is “a trend that we really think is going to explode in 2023” as “more and more people get educated” on the wide variety of effects cannabinoids can produce in the minds and bodies of users, Hodas said.

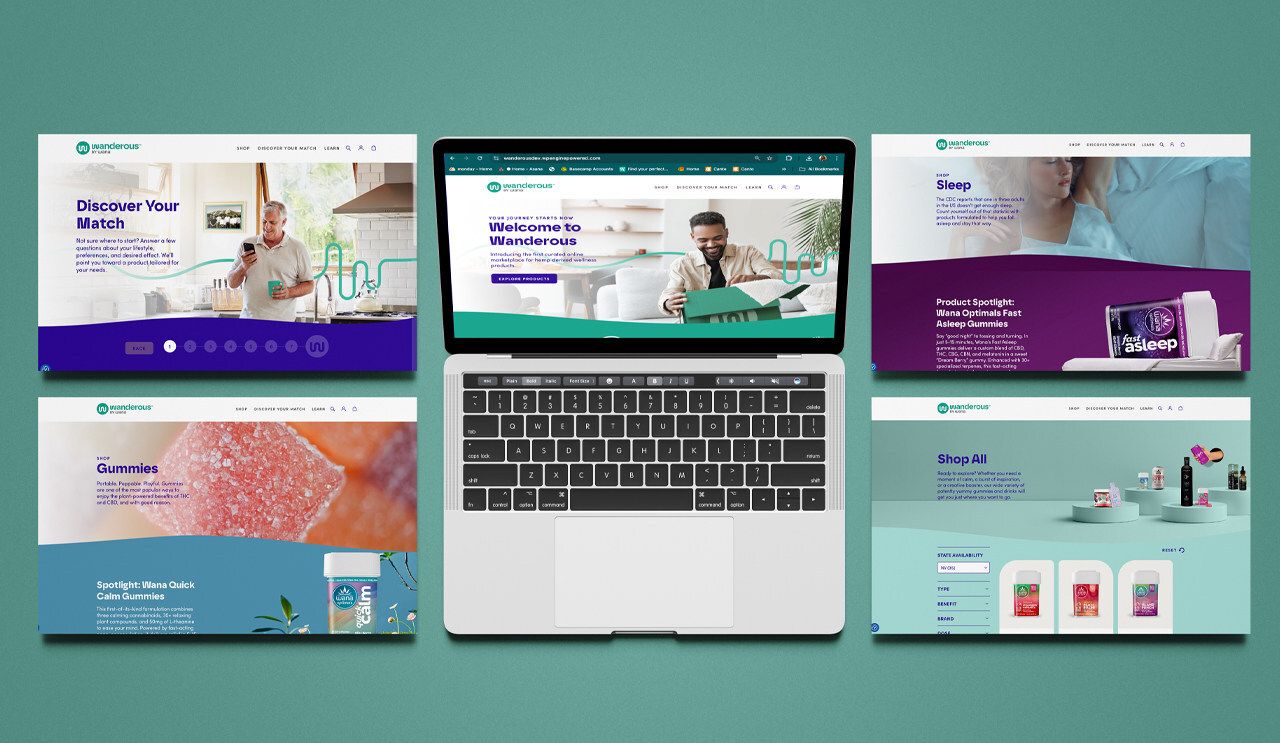

In an effort to get in front of this predicted trend, Wana has rolled out its Optimals line of specially-formulated gummies with prosecuted names such as Optimals Fit, Fast Asleep and Stay Asleep.

Wana plans to expand its Optimals line. As it does so, “reaching consumers through effective education will be critical to explaining the potential of cannabinoids beyond THC,” the company said.

Educated consumers are able to provide feedback, which is used to develop new products, Hoda said, citing Wana’s new Stay Asleep line as an example.

That line, which includes a higher dose of THC than Fast Asleep, was created to better address a wider “spectrum of sleep issues” that people turn to cannabis in an effort to alleviate, Hodas said. “Also, a lot of consumers are looking [both of Wana’s nighttime offerings] as a pair” that can be taken together to improve outcomes.

To develop new products, Hodas said, Wana partners with data-analysis firms that use “artificial intelligence to scan through thousands of consumer inputs on different strains” to identify varieties of cannabis that most match desired consumer outcomes.

“Consumers will increasingly recognize the value of cannabis brands that meet specific needs and enable specific experiences rather than evaluating products purely on which ones have the highest level of THC for the lowest cost,” Wana CEO Nancy Whiteman said in a prepared statement. “The quality of the experience will drive brand choice as consumers become more experienced and discerning when assessing their cannabis options. Ultimately, I think we will see consumers understanding that ‘value’ is about much more than low cost, high THC products.”

BOULDER — It’s been nearly a decade since adults in Colorado have been able to purchase recreational-use cannabis, and the market and its customers have evolved significantly since 2014.

With the 2023 dawning, Wana Brands chief marketing officer Joe Hodas told BizWest that leaders at the Boulder-based edibles giant “really believe this is going to be a year where the consumer blend begins to change.”

No longer will questions of “what’s the cost and how much THC is in it” drive decision-making for large swaths of the cannabis-consuming public, he said.

As pot companies such as Wana have grown “more sophisticated in product…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!