Redtail Ridge brings on development partners as plan pivots to biotech space

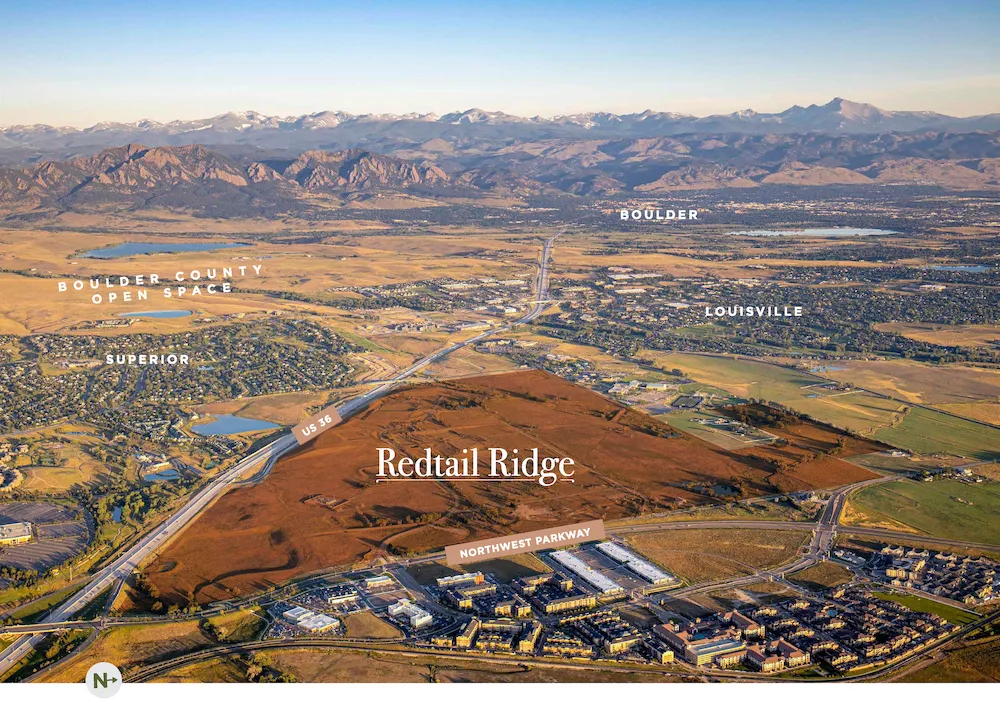

LOUISVILLE — Two months ago, Louisville voters sent a resounding message to Denver-based developer Brue Baukol Capital Partners LLC: The several iterations of plans put forward over the past several years to develop the Redtail Ridge mixed-use project on the roughly 400-acre, long-vacant, former Phillips 66 (NYSE: PSX) site weren’t going to cut it.

As a result of the special election, previously approved plans for Redtail Ridge were rolled back, and the zoning of the parcel reverted to a set of land uses, known as the ConocoPhillips Campus General Development Plan 1st Amendment, that was approved by city leaders a dozen years ago.

Since then, Brue Baukol has signed on the services of out-of-town real estate developers Sterling Bay LLC and Harrison Street LLC to help pivot Redtail to a 2.6 million-square-foot, commercial-only development with a focus on biotechnology facilities.

SPONSORED CONTENT

Brue Baukol senior vice president Jay Hardy told BizWest that Brue Baukol estimates that there is a 1.5 million-square-foot deficit of life-science facilities in the region.

“We felt like that was a really unique opportunity,” he said.

While the demand might exist, Brue Baukol’s experience in the biotech space is limited.

“The Colorado life sciences market is driving global health innovations and the products and services that save lives,” Brue Baukol president Geoff Baukol said in a prepared statement. “Our partnership with Sterling Bay and Harrison Street brings a significant level of expertise in life sciences that will enable Redtail Ridge to provide these companies with the state-of-the-art facilities their customers demand and that their workforce expects.”

According to Rodney Richerson, managing principal at Sterling Bay, Brue Baukol’s new development partners “have [developed or purchased] close to 7 million square feet of lifescience product across the country,” including the 292,000-square-foot Lafayette Corporate Campus portfolio, which it purchased last September for Etkin Johnson Real Estate Partners.

While no tenants have signed on for space in Redtail Ridge yet, “we’ve had some pretty high-level discussions with a number of life sciences companies” that could eventually call the development home, Richerson said.

One of the major highlights of Redtail Ridge’s previous plans was a new home for Centura Health’s Avista Adventist Hospital.

“The city has made a zoning determination that [a hospital] is an allowable use, so that kept it on the table regardless of what happened with the referendum,” Hardy said.

The two sides are still negotiating, but should Brue Baukol win approval of its new subdivision plat, Avista will likely move ahead with the purchase of land within Redtail, he said.

With its new partners in place, Brue Baukol expects horizontal work at the site to begin in late 2022 and vertical construction to begin in mid-2023.

While the COVID-19 pandemic has forced developers and commercial real estate landlords to reconsider their office-space holdings strategies, the biotech industry has remained incredibly strong in the Boulder Valley region, and developers are taking advantage of opportunities.

Maryland-based St. John Properties Inc. is building the 14-building Simms Technology Park on a roughly 80-acre parcel in Broomfield near the Rocky Mountain Metropolitan Airport that is expected to cater to biotech tenants.

Dallas developer Lincoln Property Co. and investor Federal Capital Partners are developing CoRE — Colorado Research Exchange in the Interlocken business park. The project will include 450,000 square feet in four buildings, with the aim of attracting life-sciences tenants.

California office and industrial real estate investor SteelWave LLC, which bought the Medtronic Inc. campus in Boulder’s Gunbarrel neighborhood in early 2022, dipped its toe into the Boulder biotechnology property scene again this month with the purchase of a three-building Wilderness Place campus that’s home to disease-diagnostics firm Biodesix Inc. (Nasdaq: BDSX).

Representing the single largest single-asset transaction in Colorado’s history, BioMed Realty LLC in April bought the roughly 1,000,000-square-foot, 22-building Flatiron Park campus from Crescent Real Estate LLC for $625 million with the goal of attracting more biotech tenants.

“I envision us climbing to a top five leading life sciences hub,” Colorado Bioscience Association CEO Elyse Blazevich said of the Front Range during a BizWest CEO roundtable with biotech industry leaders held in April.

LOUISVILLE — Two months ago, Louisville voters sent a resounding message to Denver-based developer Brue Baukol Capital Partners LLC: The several iterations of plans put forward over the past several years to develop the Redtail Ridge mixed-use project on the roughly 400-acre, long-vacant, former Phillips 66 (NYSE: PSX) site weren’t going to cut it.

As a result of the special election, previously approved plans for Redtail Ridge were rolled back, and the zoning of the parcel reverted to a set of land uses, known as the ConocoPhillips Campus General Development Plan 1st Amendment, that was approved by city leaders a dozen…