Lightning eMotors asset sale set to close; work to go on

LOVELAND — Sale of the assets of collapsed electric-vehicle company Lightning eMotors Inc. likely will close next week after court actions Thursday and Friday, but some operations will continue in part of Lightning’s space on the Forge Campus in Loveland.

Marcie Willard, acting economic-development director for the city of Loveland, confirmed Friday that Livermore, California-based Gillig LLC has leased 55,000 square feet on the south side of Forge’s 140,000-square-foot Building A at 815 14th St. SW in Loveland.

“They still have some equipment on both sides, but they’ll be moving it into the south side,” Willard said.

SPONSORED CONTENT

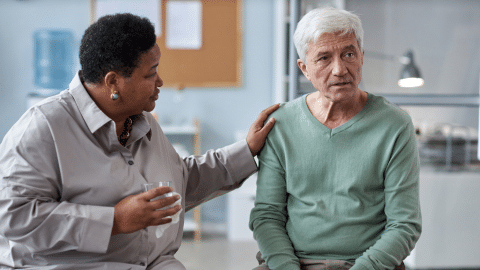

Prioritizing mental health in hospice care

Prioritizing mental health support alongside physical comfort, Pathways hospice care aims to enhance the quality of life for patients and their families during one of life's most challenging transitions.

Willard and Mike Staheli, managing director at the Denver office of court-appointed receiver Cordes & Co., said 40 to 50 employees would continue developing the electronic drive trains there that Lightning eMotors had been working on.

“That’s good news,” Willard said, adding that Lightning already had moved its operations out of the 105,000-square-foot Building B and that “there has been quite a bit of interest in Building B from other entities.”

According to an 8-K report filed with the Securities and Exchange Commission, as well as a filing made last month in Larimer County District Court, receiver Cordes & Co. entered into an agreement with Gerco LLC, a Delaware corporation, to sell all Lightning’s assets for $12.6 million in cash.

The sale was approved Thursday by Larimer County District Judge Laurie Dean, but Staheli said his company is “working on a slightly revised court order.” He said he expected that revision to be signed Friday and that “closing will occur next week.”

Gerco was created in Delaware in January, likely as a single-transaction entity to represent Gillig. Sources told BizWest on Friday that the Loveland operation will be branded as Gillig, A private company founded in 1890 that manufactures buses, Gillig had already been making offers of full-time jobs to some Lightning eMotors engineers early this month.

“This was an incredibly rushed effort,” Staheli told BizWest. “We had a very short window to find a buyer for the assets, and we were fortunate to find one who is going to continue some element of Lightning’s work.”

He said his company is still working to resolve issues with some of Lightning’s unsecured creditors.

Lighting eMotors on Dec. 14 told the SEC that its assets would be sold, with proceeds going to creditors. That filing came a day after Greenwood Village-based private-equity firm Cupola Infrastructure Income Fund LLLP, which in October 2019 had provided Lightning with a $3 million working-capital line of credit as well as a $3 million term loan, sued in Larimer County District Court seeking appointment of a receiver to sell the company’s assets. Lightning said in its SEC filing that it “stipulated and agreed to the motion and proposed order to appoint Cordes and Co. as the receiver.”

According to court documents, proceeds from the sale of assets of the company, a provider of zero-emission medium-duty commercial vehicles and electric-vehicle technology for fleets, would be distributed by Cordes & Co. to the creditors of Lightning eMotors (OTC: ZEVY) and its subsidiary, Lightning Systems Inc., “pursuant to their applicable priorities and as ordered by the court.”

According to a news release issued Jan. 25 by Lightning eMotors, “the company’s shareholders will not receive any distributions in the receivership or as a result of the transaction.”

Lightning’s 15-year journey was marked by rapid growth, pioneering innovations, major contracts, global acclaim and emergence into public trading using an alternative business tactic. In the final miles, however, its underpinnings were damaged by supply-chain challenges, the failure of a pair of battery makers, massive losses and a bevy of lawsuits that all led to the collapse of its share prices and delisting by the New York Stock Exchange.

Calls to Gillig for comment were not returned by BizWest’s afternoon deadline.

Sale of the assets of collapsed electric-vehicle company Lightning eMotors Inc. likely will close next week after court actions Thursday and Friday, but some operations will continue in part of Lightning’s space on the Forge Campus in Loveland.

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!