Wells: Improving interest rates, stable prices bring opportunities

As we finish the first chapter of 2023, we’re getting our first glimpse of what 2023 has in store for residential real estate.

To start the year we’re keeping a close watch on the economy and the overall trend and trajectory for inflation and interest rates. The Federal Reserve recently announced another 0.25% increase to the Fed Funds rate in January — which was expected — signaling that while inflation is still higher, the Fed is beginning to ease up on its approach to monetary policy. Economists expect that we will continue to see the Fed raise short term rates throughout 2023 as it works to lower baseline inflation closer to its target of 2%.

There seems to be a bit of a divergence between labor market statistics and what is actually occurring on the street, as national headlines suggest many companies have begun cutting workforce. As January employment data rolls in, government statistics reflect a hot jobs market both regionally and nationally. The unemployment rate has dipped to 3.4%, the lowest on record since 1969; and nationally, 517,00 jobs were added in January. But it takes a few months for the activity on the street to make its way into the statistical data. All of this means that we are still very much in a transition period for the national economy.

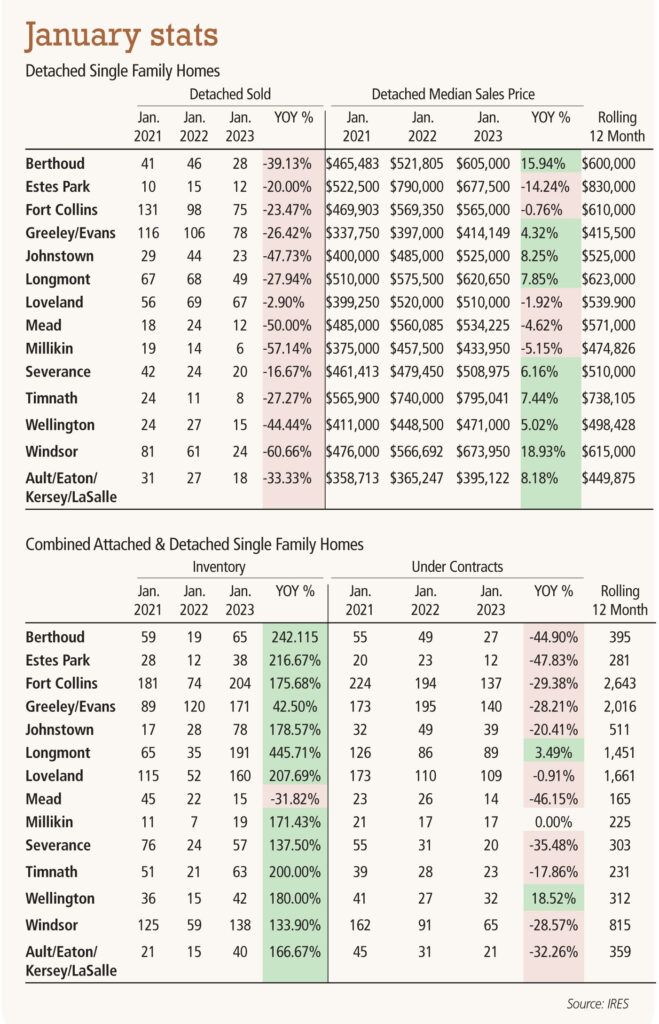

As predicted, we will continue to see a slower start to the 2023 housing market compared to the past several anomaly years. The number of detached single-family homes sold is down 34% year over year in January across the region, but compared to 2018 and 2019, it’s down just 10% to 15%. The market is showing signs of stability with housing prices, as median prices for the Northern Colorado region are up just 3.96% year over year in January. The number of homes under contract, a key measure of what is to come in the next 30-60 days, shows a marked improvement from December of 2022, with pending home sales up 51% month over month. Year over year, under contracts are still down 24% compared to January of 2022, and down 7.9% compared to 2019.

What does this tell us about housing to start the year?

We saw higher interest rates erode affordability late last year, and those rates are still making an impact on the market. It is expected that 2023 will start slowly and sellers will need to price their properties competitively against the active inventory — looking into the past for comparable sales and pricing guidance is less effective in today’s dynamic market. We expect prices to remain relatively flat on a year-over-year basis. Buyers in today’s market may have a unique opportunity to benefit from an increasing supply of available homes and improvement in the interest rates available for long-term financing; at the same time, housing prices are not escalating as in years past. Be advised that attempting to time a market is a fool’s game. If someone is looking to move, there is a window of opportunity in which the market is behaving as a neutral market and not overly favoring buyers or sellers.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at bwells@thegroupinc.com or 970-430-6463.

As we finish the first chapter of 2023, we’re getting our first glimpse of what 2023 has in store for residential real estate.

To start the year we’re keeping a close watch on the economy and the overall trend and trajectory for inflation and interest rates. The Federal Reserve recently announced another 0.25% increase to the Fed Funds rate in January — which was expected — signaling that while inflation is still higher, the Fed is beginning to ease up on its approach to monetary policy. Economists expect that we will continue to see the Fed raise short term rates throughout…