CU’s 2023 Colorado Business Economic Outlook projects slow growth in 2023

DENVER — The economy, both in Colorado and nationwide, has been on a rollercoaster ride since the outbreak of COVID-19 in early 2020. And while the biggest jerks and loops might be in the past, we’re not quite ready to step off the pandemic-coaster quite yet.

Even three years later, “I don’t think we’ve fully worked through it,” Brian Lewandowski, executive director of the Business Research Division at the University of Colorado Leeds School of Business, said of the pandemic economic impacts.

From the worker shortage to supply-chain disruptions to work-from-home productivity, there are still dynamics caused by COVID-19 that the economic system is still digesting.

SPONSORED CONTENT

“I don’t think that’s completely settled out yet,” Lewandowski said. “I don’t think we’re entirely in a new normal.”

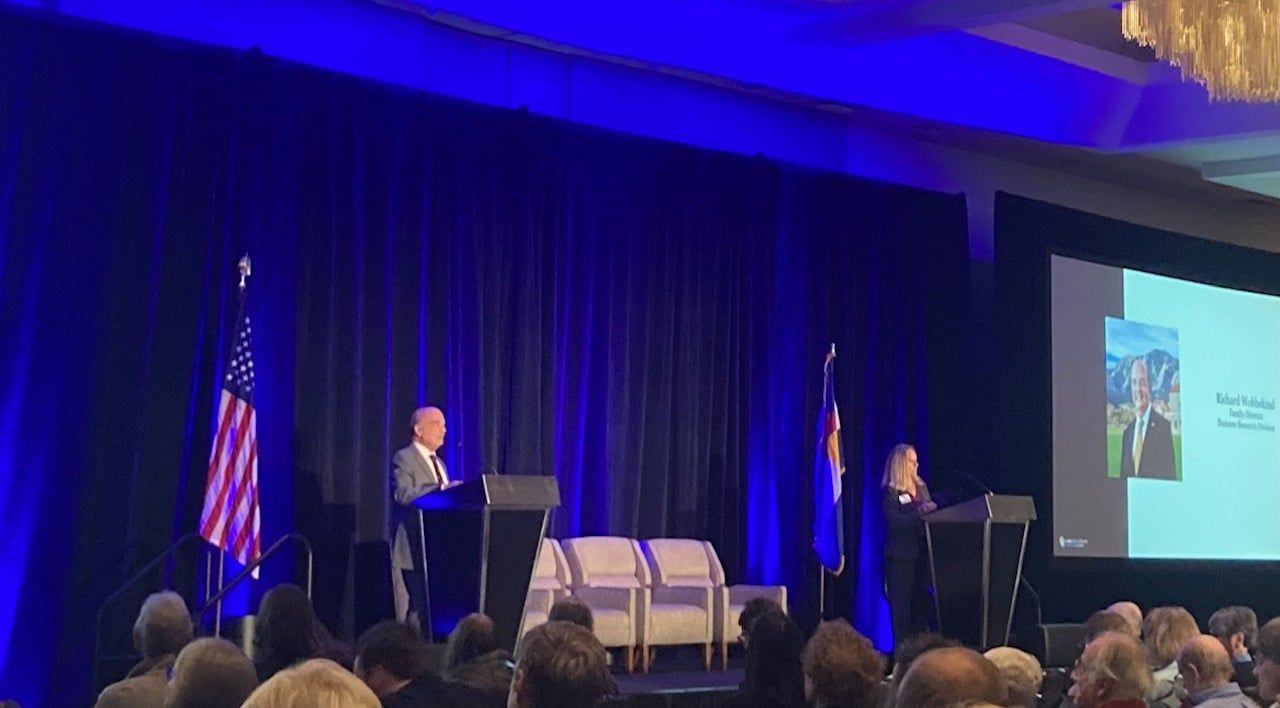

Lewandowski and Rich Wobbekind, faculty director and senior economist at the Business Research Division of the Leeds School of Business at the University of Colorado Boulder, have spent the past year writing CU’s 2023 Colorado Business Economic Outlook report. Wobbekind and Colorado State Demographer Elizabeth Gardner presented the report’s findings during an economic summit Monday in Denver.

The upshot, Wobbekind said, is that “employment growth at about half the pace of this year, so definitely a slower economy.”

According to the report, “While headwinds appear to be easing, the toll on 2023 will be measured in slow growth — just 0.2% based on Consensus Forecasts’ projections in November 2022. The Business Research Division is modestly more bullish, expecting 0.6% growth, with the U.S. economy teetering on a recession in the first half of the year followed by faster growth in the second half.”

It’s not one or two industry sectors that are expected to drag overall growth down, Wobbekind said during his presentation Monday afternoon. “Nearly every sector is expected to grow more slowly than in 2022.”

Colorado’s unemployment rate is expected to grow from 3.5% — a number indicative of an extremely tight labor market — this year to 4.1% next year.

Across a host of metrics, “Colorado’s economy outperformed much of the country in 2022,” the report said. “The state’s GDP increased 3% year-over-year in the second quarter, ranking the state seventh, compared to a national decline of 1.8% and the simple average growth of 1.3% for the 50 states.”

Locally, the economies of the Boulder Valley and Northern Colorado are expected to be impacted by national trends and headwinds but should remain strong based upon the particulars of their regional industry mixes.

“A lot of the areas where the economy is doing well are areas [of the economy in which the Boulder Valley participates]: life sciences, aerospace, manufacturing,” Wobbekind said.

The energy sector, which has struggled in recent years, is expected to bounce back some in 2023, representing a boon for the oil-dependent Northern Colorado communities.

“With the COVID pandemic moving into the economy’s rearview mirror, Colorado, like other energy-rich states, will benefit from an increased demand for more energy and mineral resources,” the report said. The sector “is expected to continue adding jobs in 2023, thanks in part to the persistent higher oil and gas price environment nationally and globally.”

Additional industry highlights provided by the 2023 Colorado Business Economic Outlook report include:

Agriculture

The near-term success of Colorado’s agriculture sector depends quite a bit on operators’ abilities to control costs. This is especially true in Weld County, which is by far Colorado’s most dominant agricultural county.

Prices for crops are up, which is good for farmers, but “prices for feed, labor, and other inputs needed to raise livestock and grow crops will more than outweigh those gains,” the outlook report said. “Almost every input for farmers and ranchers costs more today than it did a year ago. Fuel, seed, pesticides, and especially fertilizer have increased.”

CU economists expect “overall net farm income … to drop by more than $1 billion to $852 million for 2022,” according to the report. “2023 is forecast to be even worse, as net farm income is projected to continue to fall to $772 million.”

Construction

A tale of two subsectors is emerging within the construction industry, with residential and commercial moving in different directions.

“Residential building — especially single-family — is quickly coming under high downward pressure while infrastructure (‘nonbuilding’) is growing into record volume,” the outlook reported. “‘Vertical; nonresidential building besides residential is holding its own. These trends will continue into 2023.”

Like many other industries, construction is expected to “continue to suffer from labor scarcity, delays in supplies of key components, and price increases in excess of average inflation.”

Colorado’s overall economic and labor strength has been and will continue to be a boon for commercial builders.

“Economic development agencies report continued strong prospects that should lead to corporate expansion in and relocation to the Denver metro area, driving more activity in the commercial and industrial subsectors,” the report said. “Another positive market force is robust bioscience and health care demand.”

Manufacturing

Colorado has outpaced its national competition as the manufacturing industry rebounds from the COVID-19 pandemic.

“As of September 2022, Colorado’s manufacturing sector was about 2.3% higher than pre-pandemic levels compared with 0.7% nationally,” CU’s report said. “…Over the next year, manufacturing employment is projected to grow by 0.3% as losses in computer and electronics and other durable goods categories weigh on gains sustained in several other subsectors.”

Financial activities

Financial institutions typically shun volatility, and the last three years have been nothing if not volatile.

“[A]t times when the environment is in turmoil, when society and/or economic fundamentals are in flux, volatility ensues,” the report said.

As such, the financial activities sector “underperformed other industries in 2022, growing at just 0.6%,” according to the outlook. “Growth is expected to falter in 2023, decreasing 2.2% or 4,000 jobs.”

Professional and Business Services

Standing in sharp relief to the struggling financial activities sector is professional and business services (PBS), which “emerged from the pandemic far stronger than other sectors and is poised to continue its long-standing tradition of robust growth,” the report said. “… PBS employers have generally kept trusted talent to serve clients and generate revenue, while purposely avoiding any layoffs because they have been acutely aware of the difficulty of recruiting and retention in this very tight market.”

The outlook projects that “PBS employment will grow another 7.3% to average 485,800 jobs in 2022. Despite any headwinds, growth will continue at a more moderate 4.2% in 2023, to total 506,100.”

Leisure and Hospitality

Few industries were altered as drastically as the hospitality sector during the early days of the pandemic. While the industry has bounced back, the depth of the hole it found itself in in 2020 has made that comeback a bigger challenge that other sectors have faced.

“Over the course of 2021, demand for leisure and hospitality services returned as vaccination rates increased and public health restrictions eased. The rapid return to demand for these services led to historic increases in job openings in 2021 and 2022 as employers attempted to hire workers in the industry,” the report found. “However, workplace conditions that were exacerbated by the pandemic have decreased the supply of labor that lags the elevated demand for employees.”

While the hospitality field has regained pre-pandemic employment levels, “it lags the respective growth witnessed in a majority of other industries in Colorado over the same time period,” according to CU economists.

Employment in the field is expected to grow by a modest 3.2% in 2023.

Editor’s note: This report was significantly updated Monday afternoon to include details on multiple industry sectors.

DENVER — The economy, both in Colorado and nationwide, has been on a rollercoaster ride since the outbreak of COVID-19 in early 2020. And while the biggest jerks and loops might be in the past, we’re not quite ready to step off the pandemic-coaster quite yet.

Even three years later, “I don’t think we’ve fully worked through it,” Brian Lewandowski, executive director of the Business Research Division at the University of Colorado Leeds School of Business, said of the pandemic economic impacts.

From the worker shortage to supply-chain disruptions to work-from-home productivity, there are still dynamics caused by COVID-19 that the economic…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!