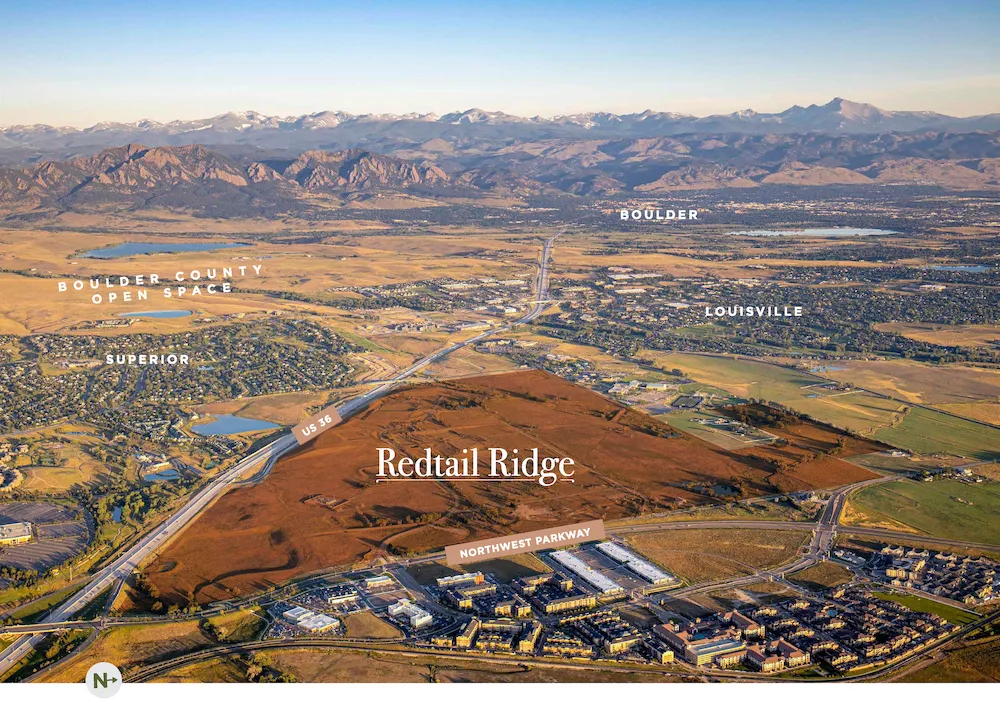

Redtail Ridge development partner puts skin in the game

LOUISVILLE — In an effort to make Redtail Ridge more attractive to potential biotechnology tenants, the Louisville project’s Denver-based developer brought on a pair of partners this year. One of those partners made the relationship official late last month with a nine-figure investment.

Chicago-based Sterling Bay LLC, as part of a real estate transaction conducted by a series of holding companies, paid Redtail Ridge developer Brue Baukol Capital Partners LLC just under $128 million, Boulder County warranty deeds show.

Brue Baukol officials, through a spokesman, declined to provide additional detail about the structure of this transaction or the overall investment in…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!