A wild ride: Bank mergers, branch openings, closings expected to continue

Banking in the Boulder Valley and Northern Colorado in 2019 seems set to continue the wild ride of recent years, with mergers and acquisitions, new entries into the market, and a steady stream of branch openings and closings.

Regional players such as Tulsa, Okla.-based BOK Financial Corp. (Nasdaq: BOKF) and McKinney, Texas-based Independent Bank Group Inc. (Nasdaq: IBTX) recently completed their acquisitions of CoBiz Bank and Guaranty Bank and Trust Co., respectively, leaving branch closures in their wake.

But that comes as national banks display contrary approaches to the market, with Bank of America and JPMorgan Chase adding locations, and U.S. Bank and Wells Fargo closing branches.

SPONSORED CONTENT

Regional banks are establishing branches as needed to flesh out their geographic footprint, and, in some cases, closing branches that aren’t performing.

Meanwhile, credit unions are aggressively adding locations as they expand their geographic reach.

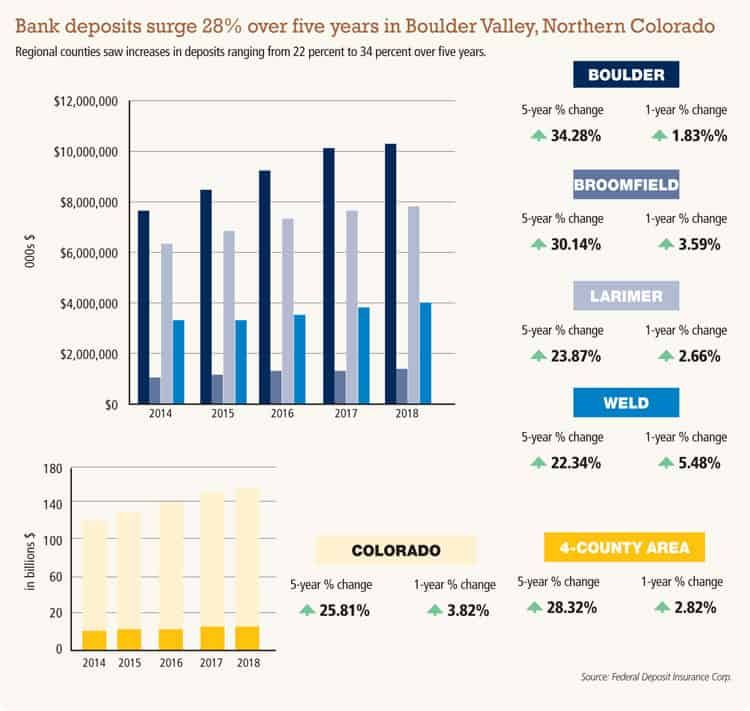

This all comes as deposits surge in the Boulder Valley and Northern Colorado, reaching $23.51 billion as of June 30, 2018, according to the Federal Deposit Insurance Corp. That’s up 28 percent in five years; deposits totaled $18.33 billion as of June 30, 2014.

This all comes as deposits surge in the Boulder Valley and Northern Colorado, reaching $23.51 billion as of June 30, 2018, according to the Federal Deposit Insurance Corp. That’s up 28 percent in five years; deposits totaled $18.33 billion as of June 30, 2014.

Boulder County posted the largest percentage increase in deposits in that time frame, gaining 34.28 percent, to $10.28 billion, with Broomfield at $1.4 billion, Larimer at $7.8 billion and Weld at $4 billion.

“I think the demographics in the northern part of the state are just strong,” said Chris Maughan, regional president for Alpine Bank, which recently expanded to the Boulder market. “All those metro areas are experiencing very strong population growth and income growth.”

That growth drives deposits, Maughan said, making the area attractive for mergers and acquisitions, as well as expansion by banks that had not served the area before.

And as Colorado-based banks are absorbed through acquisition, it creates opportunity for community banks based in the state to reach in to fill the void, he said.

“There’s been a lot of consolidation in the industry,” Maughan said, referring to the CoBiz and Guaranty Bank acquisitions, as well as that of Citywide Bank, which was acquired by Iowa-based Heartland Financial USA Inc. in 2017.

“We’ve seen that the last year here in Boulder,” Maughan said. “All those banks were effectively Colorado-owned and operated and independent banks.”

Alpine Bank, based in Glenwood Springs, is employee-owned, Maughan noted, giving it “value alignment” with potential customers who prefer local decision-making.

“That’s really the opportunity we saw here,” he said.

Two big acquisitions

Two big acquisitions

The two biggest and most-recent acquisitions involved Guaranty Bank and CoBiz Bank.

BOK Financial completed its almost $1 billion acquisition of CoBiz Bank in October 2018, leading to a closure of branches in Boulder, Fort Collins and Louisville. Branches to be closed include 224 Canyon Ave. in Fort Collins and 400 Centennial Parkway in Louisville. Additionally, a Colorado State Bank and Trust branch at 1505 Pearl St. will be consolidated into a nearby CoBiz branch, which will reopen as BOK.

Independent Bank wrapped up its own $1 billion purchase of Guaranty Bank and Trust Co. in January, leading to four branch closures in Fort Collins, Greeley and Loveland. Locations to be shut down include one at 3277 S. Timberline Road in Fort Collins; 6222 W. Ninth St. in Greeley; and 1050 Eagle Drive and 1355 E. Eisenhower Blvd. in Loveland. The branches are expected to be open through the end of May.

Both the Independent Bank/Guaranty deal and the BOK/CoBiz deal reflect the latest in a string of bank mergers and acquisitions going back years.

Banking-industry executives at a February CEO Roundtable organized by BizWest said more M&A activity involving Colorado banks is possible in 2019.

Branch comings & goings

M&A activity has driven some bank-branch closures in the region, but openings are occurring as well. A BizWest analysis of branch opening and closing data from the Office of the Comptroller of the Currency and the Colorado Division of Banking — along with news reports — identified more than two dozen bank or credit-union branch openings that were announced or completed since January 2018.

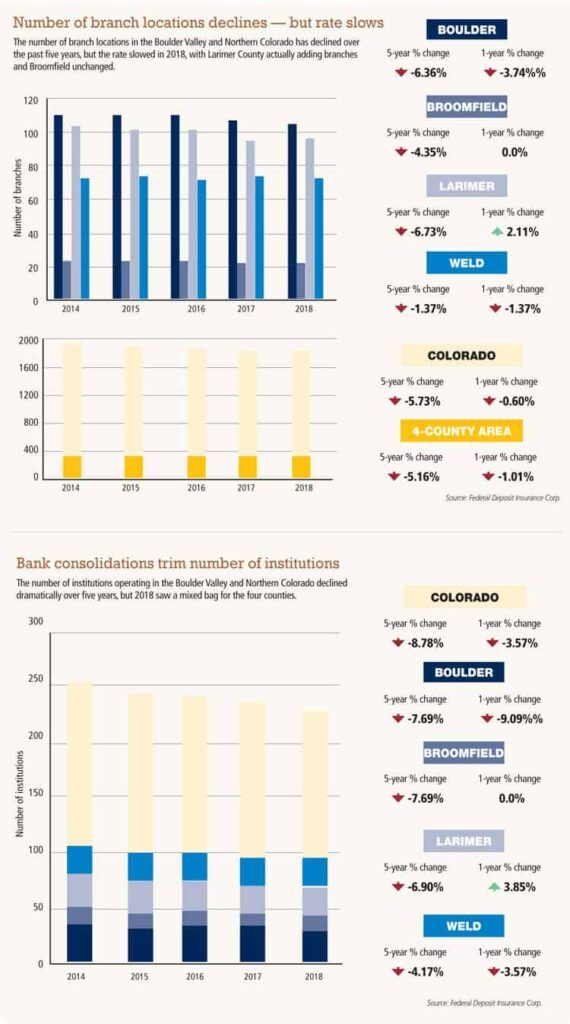

Overall, branches have declined in number for years. Over the past five years, branch locations for banks have dropped from 310 to 294 in the Boulder Valley and Northern Colorado, a five-year decrease of 5.16 percent (or an annualized rate of 1 percent). But the rate of decline slowed in 2018, which saw a 0.6 percent decrease.

And branches in Larimer County actually increased by 2 percent last year, with Weld County remaining unchanged.

Here are some of the highlights of branch expansions:

- One of the biggest names to expand locally is Bank of America, which opened its first local branch in Boulder at 1965 28th St. in 2016. But that branch soon will be followed by branches in Broomfield and Longmont, according to development-review documents filed with the two cities. Other locations remain a possibility for the bank, which recorded $2 billion in Colorado deposits as of June 30, 2018.

- ANB Bank, based in Denver, has added two new locations as it expands into Longmont and Loveland.

- Elevations Credit Union, which opened its second Fort Collins branch on South College Avenue in early 2018, plans a third branch, at 221 E. Mountain Ave. in Old Town.

- Ent Credit Union, based in Colorado Springs, late last year secured approval to expand its geographic territory to additional counties, including Adams, Boulder, Broomfield, Larimer and Weld. That expansion apparently will begin in Fort Collins, with the credit union filing a development-review application with the city for a location at 243 N. College Ave.

But while some banks extend their geographic reach, others are pulling back — and not just BOK and Independent Bank.

BizWest has identified five U.S. Bank branch locations slated to close in the Boulder Valley and Northern Colorado, including three branches located within Safeway stores.

Evan Lapiska, vice president of public affairs and corporate communications for U.S. Bank, in a prepared statement, said, “U.S. Bank takes the closure of a branch very seriously. We take many factors into consideration when making the decision, including how the branch is used and the location of other branches. In these instances, the demand for services at the respective branches necessitated a change in our approach. We hope to continue serving the community through our other locations throughout the region.”

Lapiska did not disclose whether other U.S. Bank locations could be eliminated, but a recent report by S&P Global identified U.S. Bank as having the most in-store branch locations in the nation, with 708, with 150 of them in Safeway stores.

But U.S. Bank has recorded net closings of 29 locations of in-store branches since June 30, 2017, S&P Global reports. The report noted that in-store branch locations for all banks are being closed at a faster pace than stand-alone locations nationwide.

Numerous other banks have closed random locations in the region.

Loan-production offices

One common strategy for banks looking to secure a foothold in the market is to establish loan-production offices, which often grow into full-scale branches. Two out-of-state banks have filed applications to open loan-production offices in Broomfield and Longmont. FirsTier Bank of Kimball, Neb., filed to open a loan-production office in the Arista development in Broomfield, while the Bank of England, based in England, Ark., filed to open a facility in Longmont.

What’s next?

No one expects that the slow reduction in branch locations will reverse itself. Consumer habits have shifted toward online banking, making brick-and-mortar locations less necessary.

But as some large banks reduce their physical footprint, others — including national players new to a market or regional or local players expanding into a market — will add new branches back into the mix.

But even that will be on a measured, methodical basis.

“The way people are banking is changing,” Alpine Bank’s Maughan said.

And although the bank might open additional branches, he said there are “no firm plans” to do so.

“We’re just trying to be very intentional and smart about where we put our locations,” he said.

That sentiment would undoubtedly hold true for other banks in the region.

See related story, Branch closures, yes, but openings, too.

Banking in the Boulder Valley and Northern Colorado in 2019 seems set to continue the wild ride of recent years, with mergers and acquisitions, new entries into the market, and a steady stream of branch openings and closings.

Regional players such as Tulsa, Okla.-based BOK Financial Corp. (Nasdaq: BOKF) and McKinney, Texas-based Independent Bank Group Inc. (Nasdaq: IBTX) recently completed their acquisitions of CoBiz Bank and Guaranty Bank and Trust Co., respectively, leaving branch closures in their wake.

But that comes as national banks display contrary approaches to the market, with Bank of America and JPMorgan…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!