Wells: Generational housing gains ground in the U.S.

In many countries and cultures, home ownership has long been embraced as a family legacy — a treasure passed on from generation to generation. In the wake of the Great Recession (2008-2009), we are seeing similar characteristics of “generational” or “ancestral” housing gaining traction among American families.

In the United States, it’s common practice for parents to support their children financially throughout their schooling years. The goal is to provide children with a launching pad for success in their adult lives. It’s assumed that by investing in higher education, parents are paving the way for their children to get good jobs. From there, the children are then empowered to start saving their own funds to buy a home, start a family, and eventually provide for the next generation to follow the same path.

However, with the explosive growth of housing costs in the United States, coupled with constraints on housing inventory that have persisted for more than a decade, American parents are increasingly playing a vital role in securing housing for their children’s future.

According to a Redfin research report conducted in 2023, 38% of first-time homebuyers under age 30 received down payment funds through the means of a parental gift or inheritance. That statistic reflects the difficulty that first-time homebuyers now face when attempting to acquire a home. In its 2023 Profile of Home Buyers and Sellers, the National Association of Realtors reported that the median age for first-time homebuyers sits at 35 years old. While that’s down slightly from the highest point on record of 36 years old in 2022, it remains well above the median figure of 31 years old since 1990.

SPONSORED CONTENT

How market participation facilitates the region’s renewable energy use

Platte River Power Authority joined an organized energy market in 2023 and will join another in 2026. Read more about the how these efforts benefit the communities of Estes Park, Fort Collins, Longmont, and Loveland.

First-time buyers made up 32% of total homes purchased in 2023, up from the previous year’s 26%. This increase is still below the 38% average seen since 1981.

Another noteworthy trend is the increase in multiple generations living under one roof. The NAR reports that 14% of home sales in 2022 were to multi-generational buyers — near an all-time high, and up from 11% before the COVID-19 pandemic. According to respondents to the NAR Profile of Home Buyers and Sellers, reasons for multi-generational purchases varied from the need to care for aging parents to accommodating adult children living at home to the benefit of cost savings.

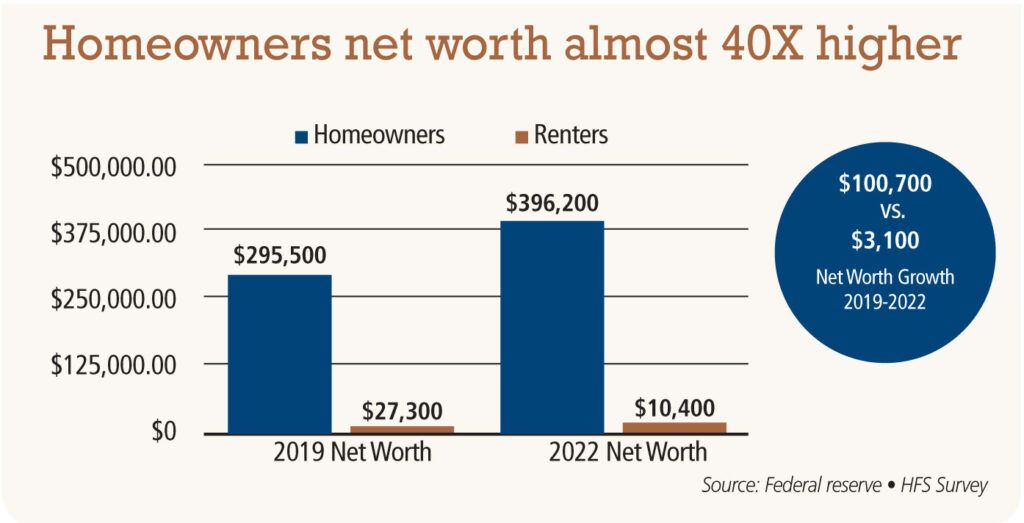

At The Group, we have always counseled our customers on the concept that investment real estate is a means to “give your kids a chance,” due to the significance of housing security and future wealth creation. According to the Federal Reserve’s latest Survey of Consumer Finances (SCF), there is a significant disparity in net worth between homeowners and renter households in the United States. According to the Federal Reserve HFS survey, since 2019, a homeowner’s net worth has increased by $100,700 from $295,500 while during that time period, the net worth of a renter has increased by only $3,100 when compared to 2022 data.

The average net worth of a homeowner household ($396,200) is approximately 40 times higher than that of a renter household ($10,400).

Parents should be weighing the dual benefits of being more involved in their children’s housing security strategy. First, consider that shelter constitutes one of the three primary human needs; second, recognize the financial benefits of long-term wealth creation. Leveraging home equity gains, drawing on real estate investments, or participating in multi-generational housing purchases, are all trends that we will continue to see grow in importance as parents look to set up the next generation for success.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at [email protected] or 970-430-6463.