Wells: Inventory, interest rates continue to shape real estate

As we get closer to wrapping up the year, questions are starting to mount about what might be in store in 2024 for regional real estate.

But in the interest of not skipping ahead too far, too quickly, I believe it is important to take a look at what trends and data have shaped the marketplace in 2023.

The two primary factors influencing local real estate in 2023 are limited inventory and higher-than-expected interest rates. Consequently, the market has been subdued, given the number of rate-locked owners who are resistant to selling and many would-be buyers who are sitting in wait for some relief from interest rates.

SPONSORED CONTENT

Here’s the fact of the matter: There is still incredibly strong demand for real estate across Northern Colorado, but some simple factors are holding the market back a bit.

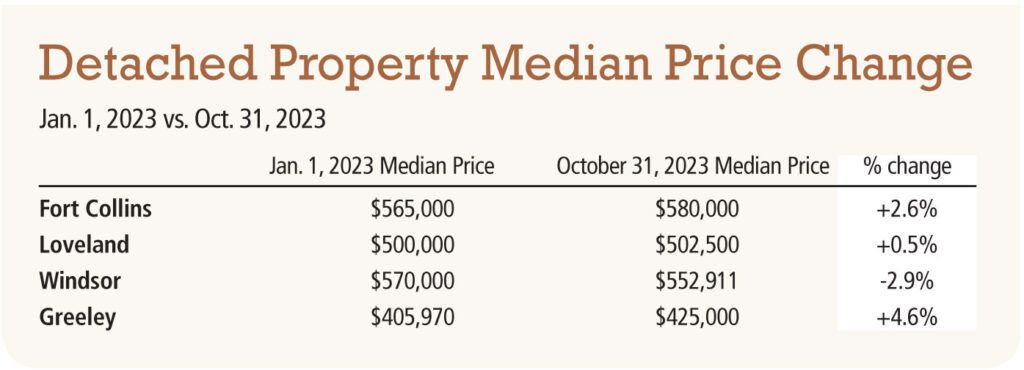

Taking a look at median prices around the area, we can reflect back on much of the doom-and-gloom outlook that many media outlets forecasted about real estate values at the start of the year, and say they were proven false. As we had predicted, much of the region’s pricing has held steady. That’s reinforced by the comparison of median prices at the start of the year to prices at the end of October 2023.

I should note that Windsor’s apparent reduction in prices is driven by a dip in the construction of new, higher-end units that would have been sold at higher prices in 2023. In fact, like most of the region, the Windsor market is still very strong with pricing remaining stable. Windsor continues to see appreciation in home values, albeit at a rate slower than historical averages.

Now, let’s compare the market landscape to the start of the year by taking a look at overall inventory of Detached Residential listings.

Inventory has certainly increased across the board, which is helping to satisfy a continued strong demand. The Fort Collins and Greeley areas — the markets with the highest median price increases — have also seen the largest percentage growth in homes for sale, indicating that there are more opportunities for buyers in the market.

In 2023, many would-be buyers have been moved to the sidelines due to higher interest rates. This trend has caused the supply of available homes for sale (measured in months of supply) to increase across the board. This metric looks at the inventory and the pace of properties going under contract, and reflects how long it would take to absorb all the existing inventory, if nothing was newly listed.

This data also points to whether we are experiencing a buyer’s or seller’s market — and Northern Colorado has certainly become a more buyer-centric market as 2023 unfolded. Buyers now have much greater choice and negotiating power to search for concessions, interest rate buydowns, and other incentives that sellers are using to attract buyers to their properties. A home in great condition at a competitive price certainly still has plenty of opportunity to attract a buyer quickly in this market. However, sellers must recognize the dynamic shifts that have occurred in the market, favoring the buyers over the past 12 months.

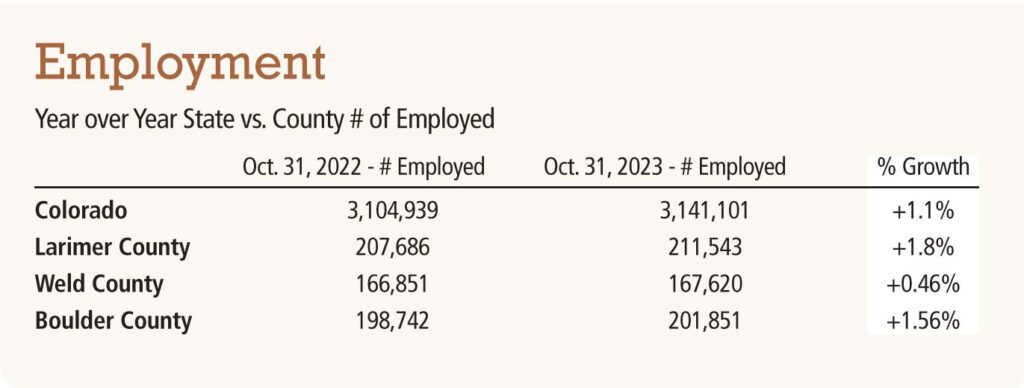

We can also use employment data to analyze where the real estate market might be headed. It’s safe to say that we should expect more of the same as we move through the fourth quarter of 2023.

Employment growth has slowed as a result of more challenging economic conditions. With annual growth in employment below 2%, contraction has occurred after more than a decade of employment growth around the 3% to 4% range. This is part of the normal economic cycle and should be used to understand real estate markets regionally. Markets will continue to move, but it will take longer to sell a property than most sellers might be accustomed to. Buyers are more firmly in a position of control in negotiations than in years past. It’s certainly more of a normal real estate market than we have experienced in some time.

Interest rates and their movement will be a prime indicator of market reactions. As rates lower, you will see the timed release of demand on the marketplace. And more buyers competing for the same inventory will lead to more upward price pressure. Meanwhile, the market is presenting a unique opportunity for buyers, who hold leverage in negotiating and are not being met with rapidly increasing prices.

Brandon Wells is president of The Group Inc. Real Estate, founded in Fort Collins in 1976 with six locations in Northern Colorado. He can be reached at [email protected] or 970-430-6463.