Flatiron Park’s next phase

New owners aim to make Flatiron Park epicenter of Boulder’s biotech boom

BOULDER — So, it’s early 2022, COVID-19 is wreaking havoc on the market for office space, and you’ve just made the single-largest real estate deal in Colorado history, spending $625 million to acquire hundreds of thousands of square feet of offices. Now what do you do?

If you’re BioMed Realty LLC, a California-based Blackstone portfolio company, you lean on your strengths: developing and operating life-sciences-centric corporate campuses.

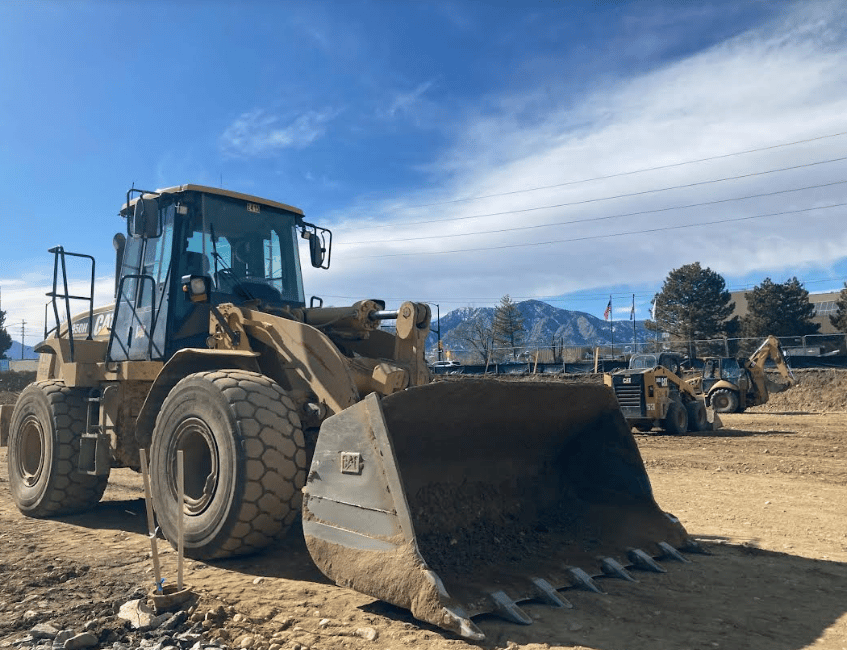

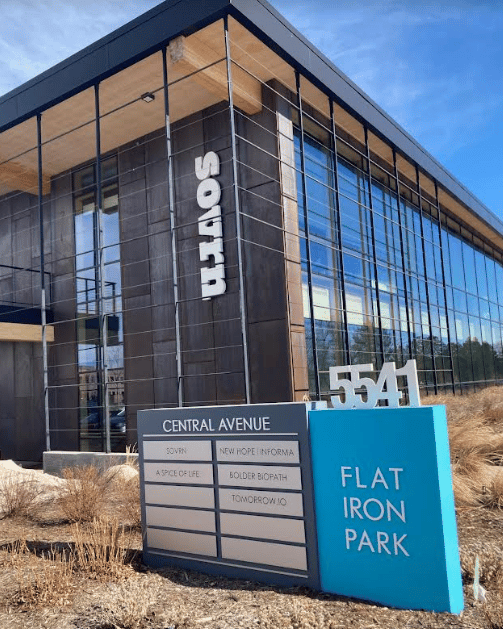

As Boulder’s biotechnology sector booms, BioMed is redeveloping significant portions of traditional office space within east Boulder’s Flatiron Park business district into lab-office-flex buildings that will cater to life-sciences tenants.

SPONSORED CONTENT

Federal District Court Rules Corporate Transparency Act Unconstitutional . . . But Most Small Businesses Must Still Comply

Lyons Gaddis Real Estate and Business Attorney Cameron Grant shares important details of the Corporate Transparency Act (CTA).

“We’re trying to activate an area that’s always been vibrant, even though it’s kind of hard to see it right now because the office market still hasn’t quite yet returned,” Jon Bergschneider, president of West Coast markets at BioMed Realty, told BizWest last week, gesturing out a window toward a swath of parking lots that sat underutilized because many employees of tenant firms remain working from home.

“It’s evolving,” he said of American workers’ relationship with their offices. “What we thought was going to be the case coming out of COVID hasn’t exactly been the case. What we’re hearing from clients is changing … and people are still digesting what it would mean for the office environment to come back.”

While you might be able to write computer code (or business news stories) from home, you’d probably have a tough time developing a cancer drug in your bathtub. That’s part of the reason why Boulder area developers can’t seem to build flex-lab spaces fast enough.

“Lab never really slowed down,” Bergschneider said, in relation to other commercial real estate segments.

Last year, when BioMed bought 24 buildings in Flatiron Park that total roughly 1 million square feet, about 15% of the space housed life-sciences users. The company aims to bump that percentage up to around 50 over the next few years.

“Most of it was creative office,” BioMed vice president Mike Ruhl said of the square footage in Flatiron Park when the company took over from Crescent Real Estate LLC in March 2022. “We’re in the process of changing that.”

BioMed’s speculative approach to building life-science spaces in Flatiron Park is part of a broader industry trend. When companies, especially startups, have a promising product and access to capital, they often need space in a hurry and can’t wait around for the several years it takes to build new labs.

“Time to market is always such a big thing for life-science users. Now that we actually have product that’s completed or close to being completed, [the region] will continue to open the door for companies considering their options for relocation and growth,” Becky Gamble, CEO of the brokerage Dean Callan & Co., told BizWest this week.

Modular lab and office technology “has become much more mobile,” Ruhl said, allowing for tenants to better customize space within spec buildings to suit their specific needs. “They can reconfigure depending on what kind of science they’re doing.”

BioMed’s redevelopment efforts — which, upon completion of the company’s existing plans, are expected to result in it owning about 1.3 million square within Flatiron Park — are currently centered around a cluster of spec buildings on Central Avenue that are expected to be delivered in late 2023 and mid-2024

“We’re seeing really strong demand for move-in ready product” BioMed leasing director Jennifer Chavez said.

If developers build turn-key flex spaces that are easily customizable, tenants “can focus on their research,” BioMed development director Kelsey Hunter said.

BioMed officials said the company is already in contact with potential tenants who could potentially move in as soon as buildings are finished.

In addition to life-sciences tenants, Flatiron Park is home to quite a few technology companies, including Apple Inc. (Nasdaq: AAPL), which is suspected to occupy as much as 240,000 square feet of space in the east Boulder park.

“You’re starting to see [life-sciences and technology users] collide in parks like this” in markets across the country, Ruhl said.

BioMed officials said they don’t plan to boot office users to make room for life-sciences tenants, but will take on new redevelopment projects as leases expire.

“Our intention is not to push out all office and technology uses and make it 100% life-sciences,” Bergschneider said. “We want to continue to nurture that cohabitation of the two sectors.”

The goal is to create “clusters within a cluster” such that certain portions of the park have higher concentrations of life-science companies and others are mostly home to traditional office users, with amenities occupying their own corner.

The conversion process of offices to lab-flex spaces “is mostly around infrastructure,” Ruhl said. Biotech users typically have different needs when it comes to power, mechanical systems, back-up generators, loading docks, hazardous-materials transport and ventilation.

Redevelopment also offers the opportunity to modernize aging offices.

“We’re trying to make our buildings as efficient as possible,” Ruhl said.

BioMed, of course, isn’t the only developer looking to cash in on the demand for biotech-centric real estate in the Boulder Valley region.

On Boulder’s Walnut Street, Conscience Bay Co. LLC is developing West Meadows, a 112,423-square-foot building that the company said represents a “significant opportunity for a cutting edge, two-story, science and technology development.”

Dallas-based investor and developer Mohr Capital LLC is dipping its first toe in the market with plans to build a four-building speculative campus on a vacant parcel next to the Oracle Corp. operation in Broomfield’s Interlocken business park.

Nearby, another Dallas developer, Lincoln Property Co., is developing a large new office, research and development, and light-manufacturing campus in Interlocken with an eye toward biotech tenants.

The project, known as CoRE – Colorado Research Exchange, will be built at 235 Interlocken Blvd. and is planned to total about 450,000 square feet spread across four buildings that will range from about 16,000 square feet for the development’s amenities center to nearly 200,000 square feet for the largest office building.

In Louisville, Redtail Ridge represents a major question mark for the city’s life-sciences future.

The project, which for years has proved difficult to push across the regulatory finish line, could eventually house a 2.6 million-square-foot, commercial-only development with a focus on biotechnology facilities on the roughly 400-acre, long-vacant, former Phillips 66 (NYSE: PSX) site off U.S. 36.

However, residents and Louisville officials have been thus far unwilling to grant the approvals necessary for Denver-based developer Brue Baukol Capital Partners LLC and partner Sterling Bay LLC to break ground.

In Lafayette, Sterling Bay is transforming a Lafayette Corporate Campus office building formerly leased to Ball Corp. (NYSE: BALL) into a speculative flex space geared toward biotechnology tenants.

The company, which bought the Campus Drive property as part of a $74.5 million portfolio acquisition deal in 2021 with developer Etkin Johnson Real Estate Partners, intends a roughly 50-50 split between office and laboratory uses for the roughly 52,000-square-foot space.

The lab space will be geared toward research and development uses rather than light manufacturing such as pharmaceutical or medical-device production.

Just next door to the Lafayette Corporate Campus, Medtronic Inc. is putting the finishing touches on its medical-device research and development hub.

The company will soon consolidate its local business into 400,000 square feet of new office and laboratory space spread across two, five-story buildings. Of that, 60,000 square feet will be dedicated to research and development, a 10,000-square-foot increase over Medtronic’s current R&D footprint in the region.

California-based life-sciences company Agilent Technologies Inc. expects to break ground this month on its Frederick manufacturing facility expansion that will add nearly 200,000 square feet to its existing operations.

The Weld Count plant, for which the company will receive state and local subsidies for a $725 million expansion effort, is developing therapeutic nucleic acids, known as therapeutic oligonucleotides or oligos. Shipments of pharmaceutical ingredients from Agilent’s new production lines are expected by 2026.

BOULDER — So, it’s early 2022, COVID-19 is wreaking havoc on the market for office space, and you’ve just made the single-largest real estate deal in Colorado history, spending $625 million to acquire hundreds of thousands of square feet of offices. Now what do you do?

If you’re BioMed Realty LLC, a California-based Blackstone portfolio company, you lean on your strengths: developing and operating life-sciences-centric corporate campuses.

As Boulder’s biotechnology sector booms, BioMed is redeveloping significant portions of traditional office space within east Boulder’s Flatiron Park business district into lab-office-flex buildings that will cater to life-sciences tenants.

“We’re trying to activate an…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!