Redtail Ridge development partner puts skin in the game

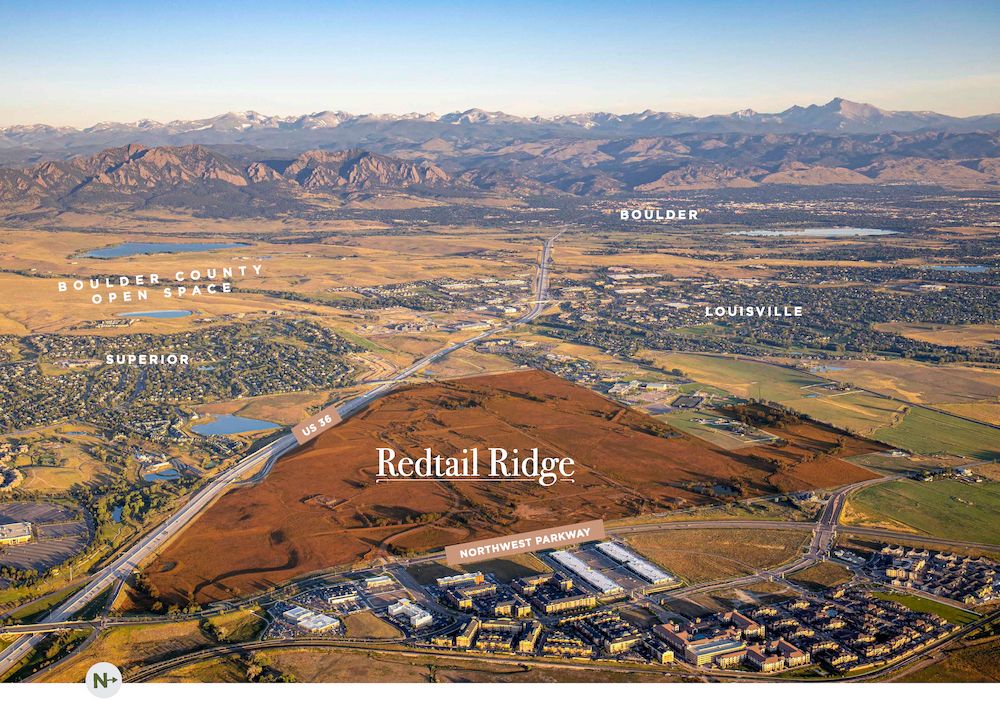

LOUISVILLE — In an effort to make Redtail Ridge more attractive to potential biotechnology tenants, the Louisville project’s Denver-based developer brought on a pair of partners this year. One of those partners made the relationship official late last month with a nine-figure investment.

Chicago-based Sterling Bay LLC, as part of a real estate transaction conducted by a series of holding companies, paid Redtail Ridge developer Brue Baukol Capital Partners LLC just under $128 million, Boulder County warranty deeds show.

Brue Baukol officials, through a spokesman, declined to provide additional detail about the structure of this transaction or the overall investment in Redtail Ridge by Sterling Bay.

SPONSORED CONTENT

Select your Republic Services residential cart now!

In preparation for Republic Services becoming the primary provider of residential recycling, yard trimmings, and trash, residents should now select the best cart size and service schedule for their household needs.

However, the spokesman indicated that the deal represents initial funding by Sterling Bay for vertical development at the roughly 400-acre, long-vacant, former Phillips 66 (NYSE: PSX) site. Overall investment could eventually top $1 billion, and Brue Baukol will remain a central player in the project.

Brue Baukol bought the site in 2020 for $34.93 million.

After a special election in April that went against Brue Baukol and rolled back previously approved development plans for Redtail Ridge, Sterling Bay and Harrison Street LLC were brought on to help pivot Redtail to a 2.6-million-square-foot, commercial-only development with a focus on biotechnology facilities.

Brue Baukol senior vice president Jay Hardy told BizWest last month that Brue Baukol estimates that there is a 1.5-million-square-foot deficit of life-science facilities in the region.

According to Rodney Richerson, managing principal at Sterling Bay, Brue Baukol’s new development partners “have [developed or purchased] close to 7 million square feet of lifescience product across the country,” including the 292,000-square-foot Lafayette Corporate Campus portfolio, which it purchased last September from Etkin Johnson Real Estate Partners.

With its new partners in place, Brue Baukol expects horizontal work at the site to begin in late 2022 and vertical construction to begin in mid-2023.

While the COVID-19 pandemic has forced developers and commercial real estate landlords to reconsider their office-space holdings strategies, the biotech industry has remained incredibly strong in the Boulder Valley region, and developers are taking advantage of opportunities.

Maryland-based St. John Properties Inc. is building the 14-building Simms Technology Park on a roughly 80-acre parcel in Broomfield near the Rocky Mountain Metropolitan Airport that is expected to cater to biotech tenants.

Dallas developer Lincoln Property Co. and investor Federal Capital Partners are developing CoRE — Colorado Research Exchange in the Interlocken business park. The project will include 450,000 square feet in four buildings, with the aim of attracting life-sciences tenants.

California office and industrial real estate investor SteelWave LLC, which bought the Medtronic Inc. campus in Boulder’s Gunbarrel neighborhood in early 2022, dipped its toe into the Boulder biotechnology property scene again this month with the purchase of a three-building Wilderness Place campus that’s home to disease-diagnostics firm Biodesix Inc. (Nasdaq: BDSX).

Representing the single-largest single-asset transaction in Colorado’s history, BioMed Realty LLC in April bought a roughly 1,000,000-square-foot, 22-building portfolio in Flatiron Park from Crescent Real Estate LLC for $625 million, with the goal of attracting more biotech tenants.

LOUISVILLE — In an effort to make Redtail Ridge more attractive to potential biotechnology tenants, the Louisville project’s Denver-based developer brought on a pair of partners this year. One of those partners made the relationship official late last month with a nine-figure investment.

Chicago-based Sterling Bay LLC, as part of a real estate transaction conducted by a series of holding companies, paid Redtail Ridge developer Brue Baukol Capital Partners LLC just under $128 million, Boulder County warranty deeds show.

Brue Baukol officials, through a spokesman, declined to provide additional detail about the structure of this transaction or the overall investment in…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!