Oh, Cann-a-bis! Colorado companies high on Canada’s cannabis market

When Brandy Keen called BizWest for an interview about what Canada’s upcoming October legalization of adult-use cannabis means for Colorado businesses, she did so on the way to the airport. In Toronto.

Keen, co-founder of Boulder-based Surna Inc., was one of several Colorado business leaders at the MJBizCon International in Toronto, an international convention for the cannabis industry hosted by Marijuana Business Daily. When she was asked if there’s market opportunity for Colorado cannabis companies in this new international market, the answer was a resounding “yes.”

“It’s already happening,” Keen said, adding that next to her at the convention were representatives from Colorado companies such as Kush Bottles, Urban-gro Inc. and Ceres Greenhouse Solutions Co.

SPONSORED CONTENT

While medical marijuana has been available in Canada, on Oct. 17 the nation is expected to implement legislation that will federally legalize recreational cannabis use. The move not only will allow for consumption, but also will open a world of new financing opportunities, public markets and wider acceptance of the cannabis industry.

While medical marijuana has been available in Canada, on Oct. 17 the nation is expected to implement legislation that will federally legalize recreational cannabis use. The move not only will allow for consumption, but also will open a world of new financing opportunities, public markets and wider acceptance of the cannabis industry.

The action might be happening north of the border, but Colorado companies are ready to take advantage of Canada’s new frontier. As some of the first companies to build cannabis startups in 2014, Colorado’s businesses have new opportunities in consulting, licensing, contracting, opening new locations and financing their operations.

To understand why Colorado companies might look toward business in Canada, it helps to understand what Canada is doing and the extent of the market opportunity.

Earlier this summer, Canadian Prime Minister Justin Trudeau announced that cannabis could be consumed recreationally without criminal penalties in Canada starting Oct. 17. The official start date is months later than what was initially expected. That’s because Canada is letting its provinces select their own legal framework for approaching adult-use — such as whether it would be sold in pharmacies, liquor stores or dispensaries, for example — and some requested more time to get the infrastructure in place. Other provinces already have retail storefronts ready to go.

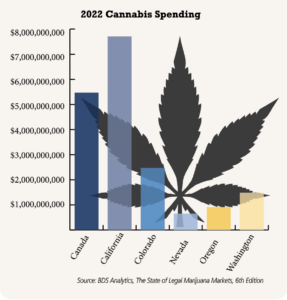

The market opportunity is a large one. By 2022, legal sales in Canada are expected to be about $5.5 billion, according to BDS Analytics, a cannabis industry analysis firm, in its new report, The State of the Legal Marijuana Market 6th Edition. It’s second only to California, which is expected to grow to $7.7 billion by 2022. In comparison, Colorado’s spending is expected to be about $2.5 billion by 2022.

There are currently 47 million adults able legally to purchase cannabis, a number that was 17 million prior to California’s legalization in January. The number of global users is expected to jump to 75 million when Canada’s recreational market comes online. Canada’s market is expected to be roughly the size of California’s. With the addition of Canada’s legal market, North American spending will represent about 90 percent of global spending on marijuana, growing from $9.1 billion in 2017 to $29 billion in 2022. Most of that likely will come from adult-use spending, not medical. By the end of the year, adult-use is expected to make up 58 percent of all spending. The rapid growth of adult use likely will be offset by new medical markets coming online in the future, and adult-use is expected to make up about 65 percent of spending by 2022.

When it comes to the fledgling business of recreational cannabis, companies from states such as Colorado and Washington — the first states to legalize adult-use in 2014 — are seen as experts.

“Colorado businesses have been in the space for so long and have so much experience,” said Shelly Peterson, vice president of sales for Lafayette-based Urban-gro, a company that supplies cultivation facilities with necessary equipment and design. “Even though it’s only been 10 years, it’s a baby industry. Companies here are really starting to stretch out. They’re sharing what they’ve learned, the pitfalls they’ve had and are stretching the industry forward.”

Colorado entrepreneurs carry a premium: They’ve been successful longer than pretty much anyone else. It’s an opportunity for them to outsource their knowledge to neighbors to the north.

“Colorado businesses couldn’t be in a better position than to go north across the border and offer consulting services,” said Jeremy Jacobs, CEO of Enlighten, a digital signage and advertising company for the cannabis industry. Enlighten is based in Bowling Green, Ky., but had its first customers in Colorado.

“Any kind of cannabis business in Colorado can look up north,” he said. “They’re going to need security systems, consulting to bring people into stores, advice on retaining customers. Who better to serve that than people in Colorado who have been doing this for five years come January. It’s a huge amount of opportunity. Colorado is the senior citizen on the block when it comes to cannabis.”

Keen had a similar sentiment.

“There’s an opportunity that comes from having expertise,” she told BizWest. Her company, Surna, builds climate-control systems for cannabis cultivation. “There’s a feeling of having been there, done that, that is important with scaling cultivation.”

Beyond consulting, there’s also opportunity to start business in Canada, either through landing contracts, as companies such as Surna and Urban-gro are doing, or licensing, a path Wana Brands is taking.

Surna already has contracts with Canadian cultivators to help build their facilities. As of June 30, Surna had six new commercial-scale projects in Canada, for a total $2.1 million, according to the company’s most recent quarterly report.

Its expertise in the field was a major reason why it was hired, Keen said.

“There’s not a cultivator I know in Canada that can touch the best facilities in Colorado when it comes to economy of scale, yield and quality of production,” she said, adding that companies like hers already learned from common mistakes six or seven years ago.

“These guys can hire a mechanical engineer who has done 50 hospitals, but they don’t know the nuances of cannabis and how to build a cultivation facility properly.”

Peterson, of Urban-gro, said the projects her company is doing in Canada started about a year-and-a-half ago, directly tied to the nation’s upcoming adult-use legalization.

While companies such as Surna and Urban-gro are working on new construction, other area brands are entering the market in different ways.

Boulder-based Wana Brands, for example, is speaking with potential Canadian licensing partners. Although edibles won’t come online in Canada until 2019, co-founder Nancy Whiteman said her company is already in discussions. In fact, her company was at the same Toronto expo Surna and Urban-gro attended.

“We’re licensing our intellectual property, our brand and our standard operating procedures,” Whiteman said, adding that partnerships is how Wana Brands is in other states outside of Colorado and that licensing is its preferred way of expanding the business.

“There’s a capital efficiency in licensing,” she said. The partner secures the license and buys the equipment and gains the benefit of the name recognition a well-known edibles company such as Wana Brands carries. Wana, meanwhile, gets speed to market and saves on capital expenditures. However, Whiteman added that selecting the best possible partner is critical, as quality control and consistency leaves her hands when she licenses.

“They’re doing business in our name the way we want it done,” she said. “We have to choose the partner super carefully, someone who is going to be a good steward for our brand.”

Other companies are following suit.

Kush Bottles Inc., a California company with Colorado operations, recently launched a Toronto subsidiary, Kush Supply Co. The subsidiary will serve licensed producers of its cannabis-centric containers and products, as well as work with licensed processors and retailers.

Another Colorado company, the dispensary Native Roots, has launched a Manitoba retail operation, Garden Variety.

While many companies in the state are looking at launching operations or business in Canada, the upcoming legalization provides another opportunity.

With the cannabis industry federally legal in Canada, companies can now list on public markets such as the Toronto Stock Exchange. The significance is a serious influx of capital and financing now available to all cannabis companies. Some companies, such as Ontario-based Canopy Growth Corp., a medical marijuana company, has already taken advantage in big ways. The company, the first to be listed in Canada under the ticker symbol WEED, is currently valued around $5.7 billion, bolstered by a $3.8 billion investment by American alcohol producer Constellation Brands. Other American companies are also getting in on the action. Stanley Brothers Holdings, the Boulder-based parent company of popular CBD company Charlotte’s Web, filed plans to pursue a public offering on the Canadian Securities Exchange.

“Capital is going to come into the U.S.,” said Jonathan Vaught, CEO of Lafayette-based cannabis biotech company Front Range Biosciences Inc. “We’ve seen that pretty significantly. The Canadian markets are raising a huge amount of capital, public or private.”

Patrick Rea, director of the Boulder-based cannabis accelerator Canopy (no relation to Canopy Growth Corp.), said that as more money becomes available in Canada, investors will look at global investments.

“There are good reasons to make investments in the U.S.,” Rea said. “We will be the largest market.”

In fact, Rea said he takes what is happening in Canada as a sign of what is yet to come.

“It’s a great preview for what will happen in the U.S.,” Rea said. “When we move forward with federal legalization, the opportunity will be so much larger here.”

There are still other benefits Canada’s legalization can bring. Peterson said that a new element that comes with Canada is the ability to export.

“A big piece is exporting,” she said. “All across Europe, Canada is tying up deals with countries to be their exporter. Canadians are looking at the global business, while the U.S. is still sorting out state to state. Canada is looking to gobble up the global market.”

Nancy Whitehead said that Wana Brands might consider exporting through Canada.

Another benefit is status.

“Globally Canada really sets a tone,” Jacobs said. “Canada is a country no one hates, and it’s taking the stance that cannabis should be legal. It’s getting the same process going in every other government’s mind. Canada is a lot like Switzerland, and it’s a neutral nation taking a stance on something while the whole world is looking.”

Canada’s fall legalization will bring changes to the global market and opportunities for Colorado businesses, but it isn’t their only opportunities. Companies such as Wana Brands are still looking at many opportunities in the United States, such as launching in Illinois, Florida and Michigan.

Peterson added that, given the size of the U.S. market — California alone is the size of Canada’s market opportunity — it’s important to not lose focus on U.S. potential.

“The U.S. is still a tremendous market for cannabis,” she said. “Canada is hot right now because things are being built out. But this industry shifts from market to market. Right now, it’s Canada. And Colorado businesses — growers and cultivators and dispensary owners — are benefitting from it because of the experience they’ve had in Colorado.”

When Brandy Keen called BizWest for an interview about what Canada’s upcoming October legalization of adult-use cannabis means for Colorado businesses, she did so on the way to the airport. In Toronto.

Keen, co-founder of…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!