Xceligent’s exit creates void for brokers

The unexpected Chapter 7 bankruptcy of Xceligent, a listing service for the commercial real estate market, has turned that industry upside down and sent Realtors scrambling to find a reasonably priced alternative.

Nathan Klein, partner and commercial brokerage manager for LC Real Estate Group LLC in Loveland, said that the big problem with the demise of Xceligent is that it was universally adopted by brokers in Northern Colorado and many independent brokerages in Denver and had the best and most current local data available. Most of that data, at least in Northern Colorado, was provided by the brokers themselves.

Unfortunately, in its bid to expand quickly into larger markets like New York, Xceligent began to cut corners. One of those was by padding its own information database with information it stole from the CoStar database. CoStar, a national and more expensive commercial real estate listing service, sued and essentially put Xceligent out of business.

SPONSORED CONTENT

How Platte River Power Authority is accelerating its energy transition

Platte River Power Authority, the community-owned wholesale electricity provider for Northern Colorado, has a history of bold initiatives.

As part of its lawsuit, it sent cease and desist letters to all Realtor associations that had adopted Xceligent as their listing service saying they would “sue their pants off” if they continued using comparison data from the Xceligent system, said Klein. Because Xceligent had acquired Commercial Search, a 100 percent broker load system, most of the data in the Xceligent system for NoCo was owned by the brokerages themselves which caused major consternation in the industry.

Jim Neufeld, commercial broker with Re/MAX Commercial Alliance in Greeley, said that Xceligent’s demise was a very big deal for Northern Colorado brokers. He said he got an email from Xceligent in the middle of December saying it was filing for bankruptcy and going out of business.

“So Xceligent has all the listings for the Northern Colorado and Denver areas. It was in 30-some states. It was a huge service and this was a big deal. Now our listings are gone. What the heck are we going to do? There is no backup. CoStar is a backup but it is so expensive that many brokers don’t use them,” Neufeld said.

Re/MAX Commercial Alliance, Greeley, Colo.

He pointed out that Xceligent used to cost his company less than $100 a month but CoStar costs a few hundred dollars a month.

“We all relied on it. If we wanted to show properties to an oil company in Greeley, we would go to Xceligent, pull up a list of properties and, boom, we were on our way. All of a sudden that’s gone,” he said.

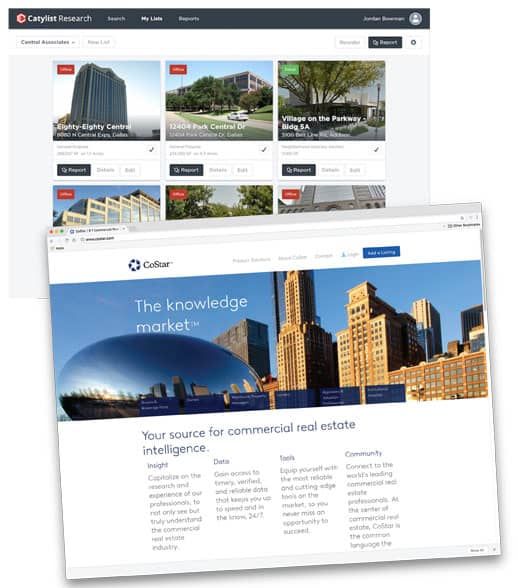

A new search service called Catylist Commercial Property Database has jumped into the hole left by Xceligent, but “it is not as big or well organized as Xceligent was,” Neufeld said. That company has had to start from scratch by re-entering all commercial properties for the Northern Colorado and Denver markets. For Northern Colorado alone that is estimated to be several thousand properties. In Denver, it is between 40,000 and 50,000 properties.

It could take months or years for Catylist to catch up to where Xceligent was, Neufeld said. That company is trying to expand into the same states Xceligent was serving. In the meantime, CoStar is trying very hard to get Xceligent’s former customers to sign up with them.

Because of the vacuum left by Xceligent’s departure, there are holes in the data and brokers now have to do property searches the old-fashioned way, by combing through county websites, exporting the data into Excel and creating graphs from there.

“It is time consuming,” Neufeld said.

“It’s been kind of a chore. If you take CBRE or Cushman or JLL, they have their own databases and their own research departments. We don’t have that. This is particularly bad for small brokers,” he said.

RE/MAX has 15 commercial brokers in NoCo and Denver.

Neufeld adds that he doesn’t believe he has recovered yet from Xceligent’s bankruptcy.

“I can’t find good analytics or a good replacement. It has been kind of a big deal. I want to say it has been devastating. Too strong a word? It has had a significant impact to Northern Colorado brokers.”

The comps are the greatest loss to the market because brokers used to be able to go back and search Xceligent to see what industrial properties sold for in the prior year, even break it down by price per square foot. Now they have to dig through the data to find that information themselves.

CoStar also bought LoopNet a few years ago, one of the largest national online commercial property search databases, that many Colorado brokers subscribed to as part of their portfolio of databases. The price of that service used to be about $150 per month to list LC Real Estate Group’s entire portfolio. Now, because CoStar has a monopoly, it is costing $40 to $50 per listing per month.

Klein said that would cost him over $1,800 a month if he continued his subscription.

“It’s a shame because it definitely penalizes our clients because it is one less listing for public search. I see LoopNet being less valuable by the day. I talk to many colleagues who feel the same way. They also have dropped their LoopNet subscriptions. It might make sense if you are a national investment broker, listing $2 million deals. Those listings tend to be short term in nature and bigger so they have more dollars to pay for advertising,” Klein said.

LC Real Estate Group, in contrast, has an office building that has 18, 2,000-square-foot suites. The building is a permanent listing because there is always an office turning over. That listing alone would cost the company hundreds of dollars on LoopNet.

Klein said that LoopNet offers five- or 10-listing packages, saying that brokers could use the package to market their biggest clients. He refuses to do that because all of his clients are important to him. He doesn’t want to be the one to have to tell his smaller clients they aren’t important enough to merit a listing on LoopNet.

“That is not how I want to run my business,” he said.

The unexpected Chapter 7 bankruptcy of Xceligent, a listing service for the commercial real estate market, has turned that industry upside down and sent Realtors scrambling to find a reasonably priced alternative.

Nathan Klein, partner and commercial brokerage manager for LC Real Estate Group LLC in Loveland, said that the big problem with the demise of Xceligent is that it was universally adopted by brokers in Northern Colorado and many independent brokerages…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!