Increases predicted for premiums: Small-business groups expected to fare better for 2018 plan year

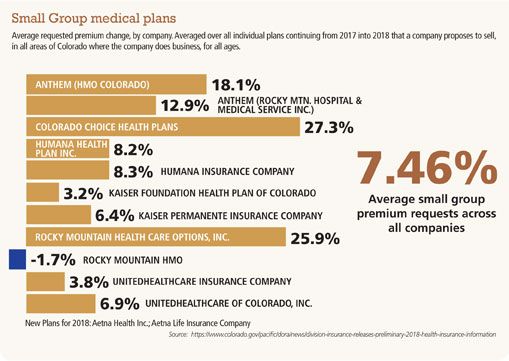

Uncertainty about the fate of the Patient Protection and Affordable Care Act in Washington, D.C., and higher medical and prescription costs are fueling some double-digit percentage premium increases in the individual plan market for the 2018 plan year. The small business group market is seeing an average of 7.46 percent increases.

Uncertainty about the fate of the Patient Protection and Affordable Care Act in Washington, D.C., and higher medical and prescription costs are fueling some double-digit percentage premium increases in the individual plan market for the 2018 plan year. The small business group market is seeing an average of 7.46 percent increases.

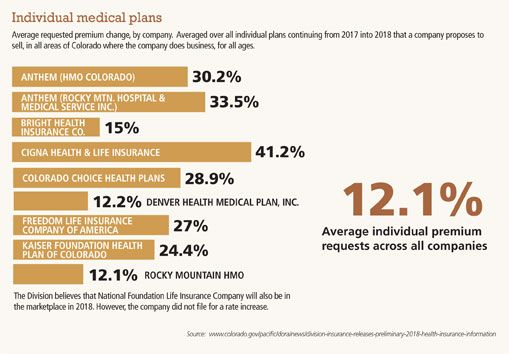

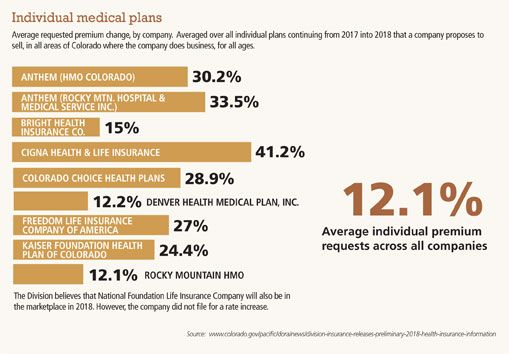

And while finalized rates aren’t out yet — the Colorado Division of Insurance won’t release those until September — insurance carriers in the state’s individual market have asked for between a 12.1 percent increase and a 41.2 percent increase in rates, averaging out to a nearly 27 percent individual premium increase across all companies.

For the small group market, insurance carriers asked for increases ranging from 3.2 percent to 27.3 percent. One carrier, Rocky Mountain HMO, showed a decrease in premium costs for small group medical plans. The average increase across all carriers is 7.46 percent.

SPONSORED CONTENT

How dispatchable resources enable the clean energy transition

Platte River must prepare for the retirement of 431 megawatts (MW) of dispatchable, coal-fired generation by the end of the decade and address more frequent extreme weather events that can bring dark calms (periods when there is no sun or wind).

The good news is that every county in Colorado will have at least one insurance carrier offering policies in the individual market, said Joe Hanel, manager of public policy outreach for the Colorado Health Institute.

If the 27 percent increase in premiums is actually realized across most of the state, “you have to wonder how much more, how much longer people will be able to afford this or whether people will be able to afford it this year. It seemed like last year we were at the breaking point,” Hanel said. “Add a 27 percent increase, and that is starting to be a large chunk of people’s income if they don’t qualify for tax credits. If you do qualify for tax credits, it is not as big a deal because the amount of tax credit grows as your premium price grows.”

Last year’s average increase in premiums was 20 percent, he added.

The Division of Insurance goes through the carrier requests for increases to make sure they are justified from an actuarial standpoint, Hanel said. Most years, what is requested and what is approved doesn’t change dramatically.

“A lot of analysts were thinking that this would be the year these dramatic price increases would slow down and stabilize. That has not been the case,” Hanel said.

The reason for that is because the cost of medical care, especially prescription drugs, continues to increase, and hospital care in rural areas is quite expensive, he said. Political instability is another factor.

There is too much uncertainty about what is going to happen with the Affordable Care Act and whether the individual mandate will be enforced.

Michael Conway, deputy commissioner of insurance at the Colorado Division of Insurance, said individuals shouldn’t look at those high percentages and just assume that their individual premiums will go up by that much.

“We always touch on that every year. We try and get out there as much as we possibly can that the rate increase, while it is big, might not be as impactful depending on the premium tax credit they get,” Conway said.

It is really important for individuals searching for health insurance on Connect for Health Colorado to shop the state insurance exchange to see what kind of plan they want and what it will cost.

In recent report, the Henry J. Kaiser Family Foundation found that for a 40-year-old living in Denver and earning $30,000 a year, their premium for the ACA Silver Plan was $313 per month without a tax credit in 2017. With the tax credit, they paid $207 per month.

Based on expected 2018 insurance rates, that same individual would pay $352 for the full premium and $201 per month with the tax credit, which is actually a decrease from what they paid in 2017.

Vincent Plymell, communications manager for the Division of Insurance, said that there is a lot of concern and angst when people talk about the individual health market, “but here in Colorado that accounts for 7 percent to 8 percent of the population, or 450,000 to 500,000 people. The majority of people, 51 percent to 52 percent, still get coverage through their employer. The rest of the market is people who get coverage through Medicare, Medicaid or veterans through the VA, so the individual market is important and it does cause a lot of concern, but it is important to know that it is a small slice of the market.”

The Medicaid expansion in Colorado added 448,915 people to the program in the 2016-17 budget year, says Marc Williams, public information officer for the Colorado Department of Health Care Policy and Financing.

Ninety-five percent of the Medicaid expansion in the state is paid for through federal dollars, and 5 percent comes out of a hospital provider fee that hospitals in the state pay based on the number of patients who stay overnight in the hospital. That fund was set up initially to offset uncompensated care hospitals were paying for prior to the ACA going into effect, he added.

None of that expansion money comes from the Colorado general fund, Williams said. What does come out of the general fund is money to subsidize traditional Medicaid patients, those who qualified for Medicaid before the expansion was added; people with incomes below 100 percent of the federal poverty level. The number of traditional Medicaid participants increased with the ACA because as people started applying for individual health insurance online through the ACA, they discovered that they qualified for Medicaid. In those cases, the federal government pays 50 percent of their costs, and the state pays the other half.

Doug Bollman, managing partner at Taggart Insurance in Boulder, works in the small group insurance market as a broker. He said that in general, that market isn’t seeing double-digit increases right now.

“My personal opinion is that with the ACA coming into effect and getting a broader base of policyholders, that has helped stabilize some of the rates,” he said.

The federal government has indicated that it might pull out of the subsidies it is paying out to the ACA carriers, causing them to increase their rates to cover that deficit, he added.

“That is the biggest potential trigger for rate increases if that were to happen,” Bollman said.

Businesses aren’t sure what to expect because the Republican majority seems determined to eliminate the ACA.

Bollman says he is still advising clients to continue to follow the ACA guidelines. Until something officially changes, they have got to follow the existing law, he added.

“We’re seeing a lot of insurance companies renewing programs at rates similar to what they had in previous years and, in some cases, having to increase deductibles or do different things in plans to keep them relatively stable. We’re not seeing any big aberrations,” Bollman said.

Uncertainty about the fate of the Patient Protection and Affordable Care Act in Washington, D.C., and higher medical and prescription costs are fueling some double-digit percentage premium increases in the individual plan market for the 2018 plan year. The small business group market is seeing an average of 7.46 percent increases.

Uncertainty about the fate of the Patient Protection and Affordable Care Act in Washington, D.C., and higher medical and prescription costs are fueling some double-digit percentage premium increases in the individual plan market for the 2018 plan year. The small business group market is seeing an average of 7.46 percent increases.

And while finalized rates aren’t out yet — the Colorado Division of Insurance won’t release those until September — insurance carriers in the state’s individual market have asked for between a 12.1 percent increase and a…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!