NoCo housing market becomes a tale of 3 cities

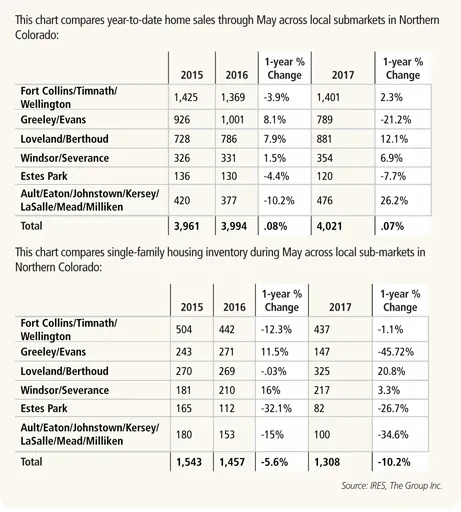

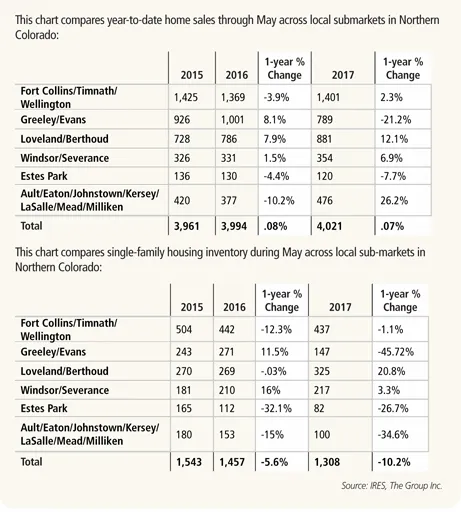

One of the best ways to forecast shifts in the local real estate market is to track the fluctuations in housing inventory. And at least for the time being, differences in inventory — the supply of homes for sale — are influencing why we see Northern Colorado’s three largest submarkets moving in three different directions.

One of the best ways to forecast shifts in the local real estate market is to track the fluctuations in housing inventory. And at least for the time being, differences in inventory — the supply of homes for sale — are influencing why we see Northern Colorado’s three largest submarkets moving in three different directions.

Here’s what we mean:

• In the Loveland-Berthoud area, availability of detached homes for sale was up 12.5 percent in May compared with May 2016. And the supply of attached homes,…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!