Funds’ survivorship bias worse than you think

Survivorship bias is a problem with the way mutual-fund returns are reported. Funds that are liquidated or merged into other funds are eliminated from the averages. Only the surviving funds are included when the aggregate returns are reported by the mutual-fund reporting services or the newspapers. Understanding survivorship bias is important because it overstates the returns of the surviving funds by 1 percent or more per year as stated by Mark Carhart and others in their paper titled “Mutual Fund Survivorship.”

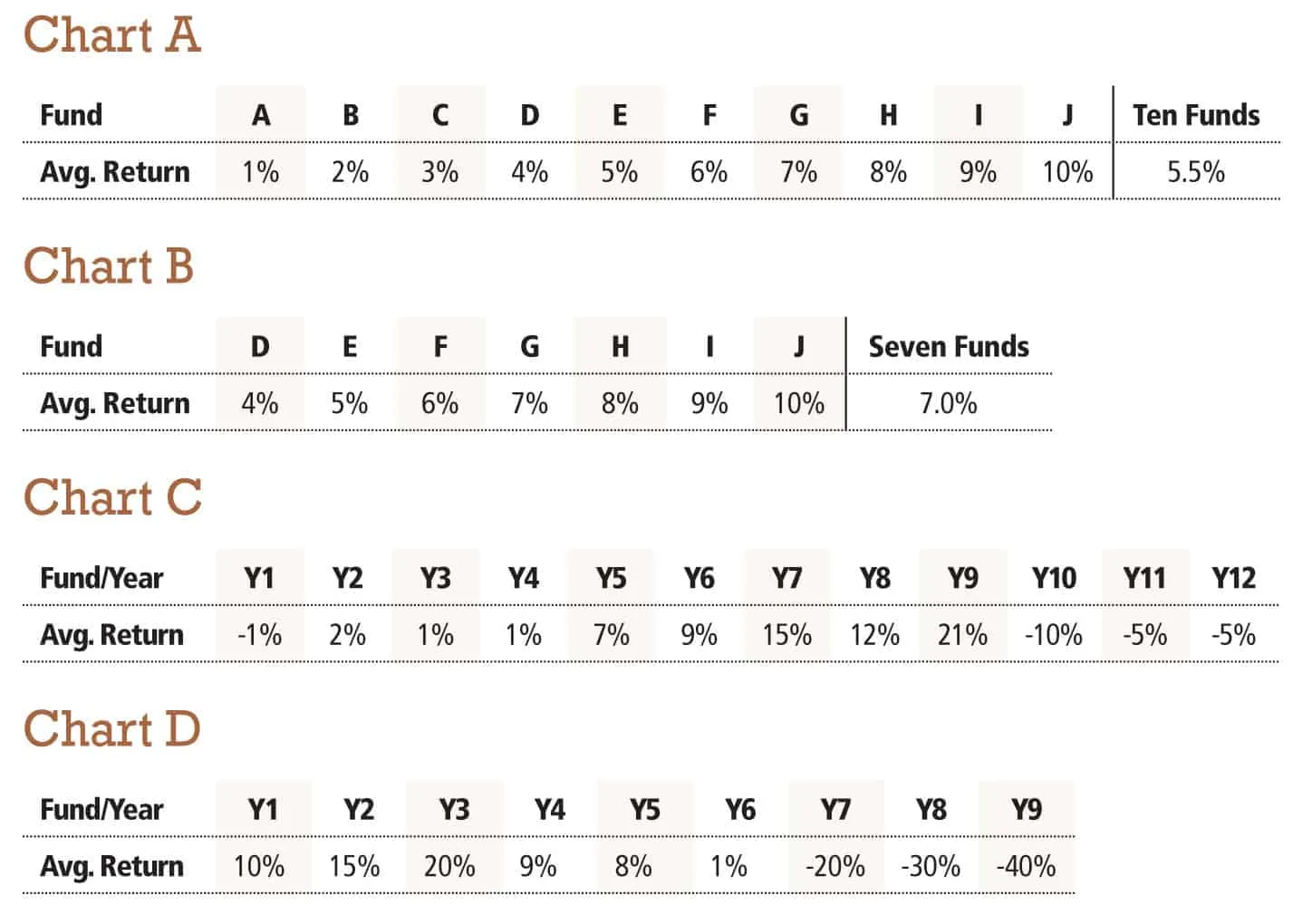

Let’s look at a specific example. Say 10 funds are started by a fund company.…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!