Economy sends conflicting signals

Rising inflation, low unemployment confound economic forecasting

First the bad news: Interest rates are soaring. Inflation continues to climb. Gross domestic product is declining nationally and in Colorado. Business and consumer confidence are plummeting, right alongside the stock market.

The economy is suffering and either in — or on the precipice of — a recession, right?

But then again: Unemployment stands at near record lows. Bankruptcies remain well off their peaks. Wage growth is strong. Housing appreciation remains solid, though off the frenetic pace of 2021 and early 2022.

The economy is booming, right?

If these conflicting numbers cause your head to flop around like a bobblehead, you’re not alone. Economists could probably benefit from a visit to a chiropractor, too.

SPONSORED CONTENT

“These are really interesting times to be examining the economy because some of these metrics are moving in different directions,” said Brian Lewandowski, executive director of the Business Research Division at the University of Colorado Leeds School of Business. “I don’t remember a time where we had such a strong signal from the labor market, even as some components of the economy are slowing. We went through the two consecutive quarters of negative GDP growth, yet we’re still at a point in time where we have job openings really outpacing the number of available workers.

“To me, that’s still a continued signal of demand for workers, despite some slowing components within the economy.”

GDP falls, but what does it mean?

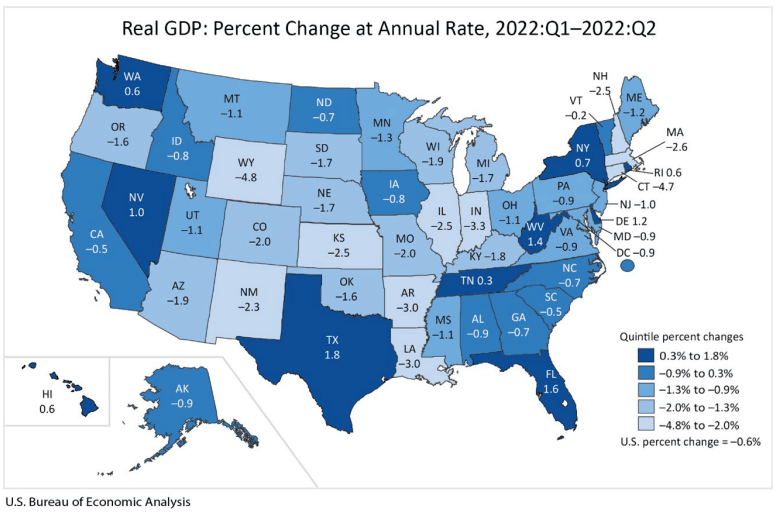

Nationally, real GDP decreased at an annualized rate of 1.6% in the first quarter of 2022, according to the latest estimate from the U.S. Department of Commerce’s Bureau of Economic Analysis. Second-quarter real GDP decreased by 0.6%.

Real GDP is an inflation-adjusted measure reflecting the value of goods and services produced in an economy.

One traditional measure of a recession is two consecutive quarters of negative economic growth, but the National Bureau of Economic Research, a private, non-partisan organization that has responsibility for determining when a recession begins and ends, has made no such determination regarding recent economic trends.

The NBER’s Business Cycle Date Committee determined on Nov. 28, 2008, that the nation had entered a recession in December 2007 — almost a year’s lag time.

Colorado real GDP climbed 2.9% in the first quarter of 2022 — a revision from the earlier announcement of a 1.9% decline — but preliminary data released Friday indicate that the state economy contracted by 2% in the second quarter. Real GDP declined in 40 U.S. states and the District of Columbia. [See related story.]

Texas performed the best, recording a GDP gain of 1.8%, while Wyoming fared the worst, with a 4.8% decline.

Looking at the national GDP data, Lewandowski said the first two quarters of 2022 included positive signs, with increases in investment and consumer spending. But the economy was dragged down by a worsening trade deficit and a decrease in government spending.

“I would say, fundamentally in Q1, it was still a decent GDP report,” he said.

The second quarter, Lewandowski noted, saw an improving trade deficit, with consumption continuing to increase, even as government spending and investment decreased.

“Now, as we’re fast-forwarding through the year, there is a lot more tumult and uncertainty in the market,” he said, noting declines in the stock market and economic slowdowns in Europe and elsewhere around the globe.

“We’re seeing the dollar strengthening at a time when we need to see more U.S. exports and fewer imports,” he said.

Business Confidence Index drops, again

Colorado’s second-quarter drop in GDP goes a long way to explaining recent drops in the Leeds Business Confidence Index. The fourth-quarter index, released Thursday, fell to just 39.8, representing the fourth-lowest figure in the index’s 20-year history.

The index reflected responses from 163 Colorado business leaders, who were surveyed on the national economy, the state economy, industry sales, industry profits, industry hiring and capital expenditures. A score of 50 is considered neutral.

“The national economy has had two quarters of negative GDP,” Rich Wobbekind, faculty director and senior economist at the BRD, said in announcing the latest survey results. “Behind that, there’s talk about a recession, very high inflation and a strong monetary response from the Federal Reserve. Amongst all of that, there is still very strong employment growth. We also observe other things in the employment market that indicate strength in the economy.”

Unemployment shows labor demand

Even as the economy contracts and confidence wanes, unemployment in August remained low in Colorado, including the Boulder Valley and Northern Colorado:

- Boulder County: 2.6%.

- Broomfield County: 2.8%.

- Larimer County: 2.8%.

- Weld County: 3.6%.

- Colorado: 3.4%.

Lewandowski said the state has outperformed expectations in terms of job growth.

“We underestimated the number of jobs that we would grow in the state in 2022,” he said, “and we’ve been revising up our number as the year has progressed.

He predicted that 2023 would be a slower year for job growth in Colorado.

“Part of that will still be supply-driven, where we still have a shortage of workers, but I think part of it will be demand-driven, where companies won’t be on the same growth trajectory that they were on, so they won’t need as many workers for the job that they’re doing,” he said.

Colorado’s low unemployment in a time of inflation is not necessarily a good thing, as companies compete for workers — in part — through higher wages.

“It can contribute to some of the inflation pressures, and, also, it’s sort of circular because as inflation remains persistently high, and people expect inflation to remain persistently high, then they demand higher wages. And that’s where we get into the wage spiral, which makes it even harder to combat inflation,” Lewandowski said.

Martin Shields, an economist with Colorado State University, said it’s unusual for unemployment to be declining as GDP is falling.

“That’s a little bit inconsistent with the GDP numbers,” he said. “If we’re seeing a loss of GDP, we tend to see people getting laid off, oftentimes, and unemployment increase. So there’s a little bit of a disconnect.”

He speculated that one reason that GDP has declined is because of supply-chain and labor-force shortages. Workforce numbers have declined since the COVID-19 pandemic, with some people retiring, taking time off or leaving the workforce altogether.

“One of the reasons GDP is falling just might be a lack of a workforce,” he said. “GDP would be higher if we had more people working, but we don’t have enough people working. That’s, I think, probably where some of the explanation of negative GDP … businesses just can’t produce as much as they want to in the time frame that they want to because they don’t have the workforce.”

Economists speak of “natural unemployment” of 4% to 5%, he noted, factoring in routine resignations, firings or layoffs.

“It really is odd that we would be talking about a recession and negative GDP growth in an era of two and a half or three percent unemployment,” he said.

The Fed has been hiking interest rates to cool inflation, but the hot job market contributes to inflation. After five rate hikes this year, the Fed projects that unemployment will increase from 3.7% nationally to 4.4% in 2023.

Here are some other key metrics:

- Colorado new business filings with the Secretary of State declined 1.7% in the second quarter year over year, and dropped 7.8% from the previous quarter.

- Bankruptcies in Colorado are down 24% year to date through September, compared with the same period in 2021, but filings have leveled off in recent months, with August filings down only 5.7% compared with the year-ago period, and September filings down only 2.8% from September 2021.

- Stocks have entered bear-market territory, down more than 20% from their high points. The Dow Jones Industrial Average declined by 9% in September alone. The Nasdaq has declined by more than 30% in 2022 thus far. The S&P 500 has lost almost 24%.

- Interest rates continue to climb. The Federal Reserve has implemented five hikes in the federal funds rate as it battles inflation, including a 25-basis-point increase in March, a 50-basis-point increase in May and three consecutive 75-basis-point increases in June, July and September.

Housing market cools

Perhaps the most-noticeable effect of rising interest rates is a cooling of the housing market. Gone for now are the days of dozens of offers for a new listing. Appreciation has slowed, and homes are on the market for longer.

The latest data from Information and Real Estate Services LLC, the multiple-listing service for the region, showed double-digit year-over-year increases in median sales prices in August for most cities in the region.

But listings also are up, creating greater inventory for buyers. But rising interest rates are threatening would-be buyers’ ability to afford a home.

The 30-year fixed-rate mortgage averaged 6.7% as of Sept. 29, according to data released Thursday by Freddie Mac.

“Obviously, when the Fed is increasing interest rates, that’s the sector [housing] that’s going to be hypersensitive to that,” Shields said.

He said that anecdotal evidence from real estate brokers is that the market is slowing, but not with price depreciation, just slower appreciation.

“Yes, it’s slowing down,” he said, “but they’re not seeing price falls. They’re just seeing a slowdown in price appreciation that’s being offset by the higher interest rates.”

Impact on business

John Tayer, president and CEO of the Boulder Chamber, said the business community continues to grapple with the effects of the COVID-19 pandemic.

“I would say that they’re juggling a unique set of factors that are defined by a once-in-a-lifetime experience,” he said, referencing COVID, workforce shortages, supply-chain issues, and the war in Ukraine and its impact on oil and gas prices.

“To me, these are dynamics that would challenge a business whatever broader economic condition that you’re facing,” he said.

At the same time, he said, demand for products and services remains strong.

“We’re not seeing that there is a deficit in demand for their services and their output,” he said. “It’s full steam ahead on meeting the demand. There’s cautiousness about the implications of the economic conditions, and there’s just a whole set of unique challenges that are associated with the fallout from the COVID experience.”

On the one hand, Tayer noted, “There is an exuberance about the freedom that folks are feeling because of the lifting of COVID restrictions and the pent-up demand associated with that. To me, that’s reflected in the character of what we’re seeing at the local level in our economic activity.”

But workforce shortages are constraining business’ ability to meet demand. Many restaurants, for example, remain closed on certain days or have limited their hours because they don’t have enough workers.

“The consequence, though, of that hangover from COVID is that workforce and supply chain is a concern across the board in our service and retail sectors.That does impinge on their ability to operate at full capacity,” Tayer said.

Boulder’s office market also is adjusting to the reality of a remote workforce, driving up office vacancy rates.

“That is a factor not only for the owners of that office real estate but also for the businesses in our community that rely on that traffic to bolster their business,” Tayer said.

Tayer said the only area where he sees some “restraint” is in future investment, with “a little bit more hesitation in financing longer-term investments.”

So what about a recession?

Given all of these metrics, it’s perhaps understandable that the NBER takes its time when determining whether a recession has begun. Data change — witness Colorado’s first-quarter GDP performance.

And it’s not all about gross domestic product but about “a whole host of other metrics,” Lewandowski noted, such as industry employment, household employment, industrial production, wholesale trade, retail sales and income.

“GDP oftentimes embodies a lot of those metrics,” Lewandowski said … When we break that down, [with] most of those metrics, we’re still moving in a positive direction. They’re still in a growth phase.”

The NBER has its work cut out for it as it examines the latest data, he said.

“I think that it’ll be sort of a difficult discussion because so many of these metrics are still growing,” Lewandowski said. “How could you say we were in a recession if there wasn’t any sort of broad economic decline?

“Q3, I would be shocked if Q3 was negative when it comes up,” he added. “I fully expect a positive GDP number when Q3 is released.”

Lewandowski said one area of potential decline in the third quarter could be investment, as rising interest rates could cause consumers and businesses to curtail investment in construction, new equipment, software and other expenditures.

“If interest rates are really weighing on households and on businesses, I think they will put off new investment,” he said. “That’s where that pipeline could start to get a little quieter.”

Shields said that if a recession comes, it could be caused by the labor shortage affecting businesses’ ability to produce goods and services, not some broader, traditional economic downturn.

“Those are two different beasts,” he said.

He added that he’s unaware of any historic recession that’s been driven by a labor shortage and businesses’ inability to meet demand because of lack of workers. Other recessions have been due to a financial crisis, oil-price shock, interest-rate shock or some other factor, he said.

“I’ve never seen a recession where the unemployment rate is 4%,” he said. “Something else is going on.”

First the bad news: Interest rates are soaring. Inflation continues to climb. Gross domestic product is declining nationally and in Colorado. Business and consumer confidence are plummeting, right alongside the stock market.

The economy is suffering and either in — or on the precipice of — a recession, right?

But then again: Unemployment stands at near record lows. Bankruptcies remain well off their peaks. Wage growth is strong. Housing appreciation remains solid, though off the frenetic pace of 2021 and early 2022.

The economy is booming, right?

If these conflicting numbers cause your head to flop around like a bobblehead, you’re not alone. Economists…