Reward vs. risk: Decision time nears for West Greeley Project

City Council plans Tuesday vote on massive arena project

GREELEY — Describing the projected revenue and dazzling array of attractions that the $1.1 billion West Greeley Project would include is the easy part.

Describing the mind-bogglingly complex and extraordinarily risky way it would be financed is a lot harder.

That’s the task facing Greeley’s City Council and staff as they prepare for Tuesday night’s first series of votes to set the wheels in motion for the massive development being proposed by Martin Lind’s Windsor-based Water Valley Co., and plan to make final decisions in May.

SPONSORED CONTENT

Noted council member Melissa McDonald, “I struggle to try to explain it to residents.”

Planned at Weld County Road 17 and U.S. Highway 34, the core entertainment district dubbed “Catalyst” would include a new arena and home for Lind’s Colorado Eagles minor-league hockey team, three sheets of ice for youth hockey programs, a high-end 351-room hotel, spa and conference center, a 100,000-square-foot 12-slide water park that Lind says would attract 350,000 visitors a year, a central plaza as a gathering space designed for community events and socializing, and a “Cascadia Falls” water feature with an adjoining amphitheater.

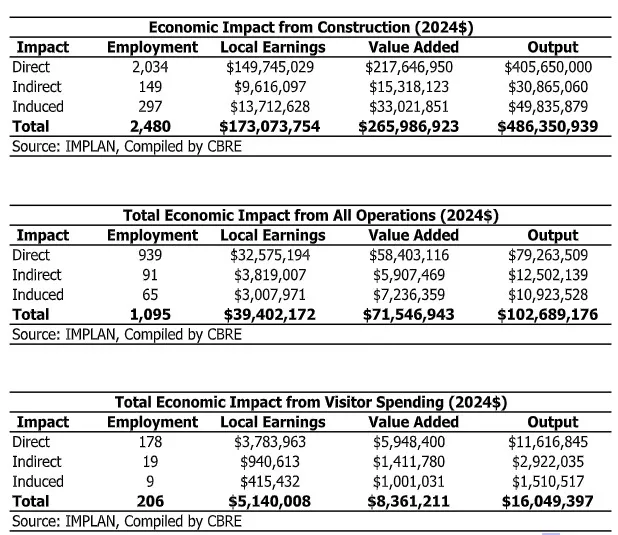

The city and developer project that 2,500 jobs would be created during construction of the project, with 1,300 permanent jobs once the entertainment district is built out, and visitor spending topping $17 million annually.

Catalyst and Cascadia

The name “Catalyst” suggests that the project would be the catalyst for development on the west side of Greeley that would provide significant social and economic benefits to the city and its residents, including job creation, public transportation options and increased tax revenue.

A key part of that surrounding development would be “Cascadia,” Water Valley’s mixed-use project that is anticipated to include 11,248 single-family units, 4,980 multifamily units, 1.65 million square feet of retail space and more than 8.929 million square feet of non-retail commercial space. Lind said the residential element would offer “a range of high-quality housing options across the spectrum. This supports the city’s goal of providing accessible and affordable housing for all residents.”

He projected that by 2040, the development would generate annual average general sales tax revenue of $21.94 million, annual average use tax revenue of $5 million and annual average property tax revenue at $16.85 million based on a rate of 11.274 mills.

Besides developing Cascadia, Lind has promised to build ample parking, an intermodal transportation hub, a center-loading bus station and overpass at 131st Avenue, and a redesigned interchange at U.S. 34 and WCR 17.

Lind envisions that the total development would lure other commercial development to West Greeley, including less-expensive hotel options. But city officials acknowledge that the arena and entertainment district is the key – the catalyst – to the success or failure of everything else.

“This is a city-owned project if council does proceed to move forward,” City Manager Raymond Lee reminded council members at their last full meeting April 1. “This is not a project that will be owned by the developer, but owned by the city, and the revenue from this project is ultimately used to pay back the debt that is issued on this project.”

Therein lies the risk. The City of Greeley is being asked to provide “moral obligation funding,” a financing mechanism through which a government pledges a moral — but not legally binding — commitment to a project or debt.

But some council members and a parade of area residents who spoke during public-comment periods have repeatedly decried the financial risk of a project that could leave the city being responsible for a potentially failed project such as Broomfield’s 1stBank Center, which is being demolished after just 19 years.

“It seems as though Greeley is the only entity taking the risks here,” noted one area resident during the April 1 council meeting. “How much money is the developer willing to invest, or is Greeley the only cosigner of the loan? If there is not enough revenue to cover the loan, is he going to be liable as well, or can he just walk away and leave us holding the note?”

How it would work

As outlined by John Hall, Greeley’s director of economic development and urban revitalization, the financing plan for the West Greeley Project has four major components:

- Issuance of $115 million in Certificates of Participation, or COPs, which would be used in stages to fund pre-development activities from schematic designs all the way through earth moving.

- Bond financing of around $832 million through a 501(c)(3) nonprofit, with the city having a moral obligation on the reserve fund by maintaining it at $33.2 million on an annual basis. For any year in which the project didn’t generate revenue, the city would be obligated to make sure that reserve fund remains whole.

- Annual economic-development payments of $12 million, increasing by 2% annually.

- Formation of a general improvement district that would provide $129 million for onsite infrastructure and amenities, including $55 million of enterprise funds for water and wastewater improvements that would be repaid from the GID over time.

By 2032, the city estimates, the bulk of that payment would be covered by revenue from the project, and by 2038 more-than-sufficient revenue should be available to cover the economic development efforts.

Definition of terms

What is a Certificate of Participation?

A Certificate of Participation (COP) is a form of financing used by governments to fund public projects, such as school buildings or infrastructure, where they don’t have immediate funds.

What is a Moral Obligation Bond?

A moral obligation bond is a type of municipal bond where the governmental body issuing the bond has a moral, but not legal, obligation to repay the debt if dedicated revenues pledged for repayment are insufficient.

What is a Pre-Development Services Agreement?

A predevelopment services agreement outlines the responsibilities and costs of a developer’s pre-construction services for a real estate project.

First on Tuesday’s City Council agenda will be an ordinance approving a pre-development services agreement, or PDSA, with a Water Valley entity called Trollco Inc. to include “the design and construction of a new arena, ice center, hotel, water park and supporting public improvements, with such master developer services to be compensated through a fee-for-services arrangement.”

The council also will consider on first reading an ordinance concerning the financing of that agreement as well as the lease-purchase agreement for the entertainment district.

The purpose of the PDSA, according to city documents, “is to memorialize terms and agreements between the city and The Water Valley Co. prior to the execution of design and construction contracts and development agreements. The PDSA provides the framework for [Water Valley] to serve as the city’s fee developer to provide the conceptual, preliminary and final planning for the Entertainment District project (the Catalyst Project) and certain terms regarding the broader development of the surrounding area (the Cascadia Project).”

As the fee developer, Water Valley would be paid an estimated 3% of the total development costs plus a 0.5% incentive.

The plan calls for the city to use COPs, a form of lease-purchase financing, to purchase the 100.59 acres for the $850.5 million entertainment district from Water Valley.

“The COPs are expected to be executed and delivered in the amount of $115 million,” according to city documents, which note that COPs for the construction of City Center South were approximately $30 million. Because of the size of the required COPs for the West Greeley Project, the documents say, “multiple city properties will be encumbered,” or put up as collateral, although “not simultaneously, but rather each piece of collateral that supports the scheduled COP execution and delivery will only be encumbered at the time of such execution and delivery. The COPs are expected to be paid off when the conduit bonds are Issued.”

Those bonds, totaling around $832 million, would be issued, probably next year, through a 501(c)(3) borrower, with repayment from the project’s net operating income, sales and lodging tax rebates, public improvement fees and city economic-development payments.

Greeley has contracted with Baton Rouge, Louisiana-based Provident Resources Group to manage the arena, plaza and water-park hotel during the term of the bonds and to repay the bonds as the borrower.

Development costs for the Catalyst Project are estimated at $850.53 million.

The city would only release $5.5 million to be escrowed for the purchase of the Entertainment District property and $6 million for other eligible costs until the terms of the Eagles’ lease have been negotiated and agreed upon.

The Eagles will pay rent to the city for use of the arena, with a lease term to be at least 30 years with an option to renew for two five-year extensions. The city deems that long-term lease “essential to the financial viability of the entertainment district. The Colorado Eagles are owned by Lind through an entity called Larimer County Sports LLC. Because Lind’s Water Valley Co. does not own the Eagles, the city proposal says, it’s important to include terms regarding the Eagles’ lease in the PDSA and to have a lease with Larimer County Sports in addition to adding it as both a signatory and a third-party beneficiary to the PDSA.

The expected cost of supporting improvements would likely be financed with General Improvement District bonds and water and sewer enterprise revenue bonds.

Water Valley would submit to the city a petition to establish a General Improvement District, and the city council would serve as that district’s ex-officio board.

For incentives, the council would be directed to consider rebates on sales taxes and public accommodations.

For Cascadia, Water Valley would commit to use its best efforts to attract residential, retail and certain types of commercial development, and the city would be allowed to step in to help.

According to city documents, “the PDSA aims to mitigate risk, but all risk can’t be eliminated” including the city’s ability to make the economic-development payments, non-performance by Water Valley, the performance of the general improvement district and the city’s moral obligation.

The city and Water Valley estimate that the pre-development phase would be funded by COPs for 18 to 24 months until the bonds can be issued. Construction would begin next year and extend through fall 2028, coinciding with the expiration of the Eagles’ current lease at Blue Arena in the Larimer County-owned Ranch Events Complex east of Loveland. Lind pitched the plan for moving the Eagles to Greeley officials last summer after negotiations broke down with Larimer County and his “request for proposals” agreement was terminated.

Other projects considered

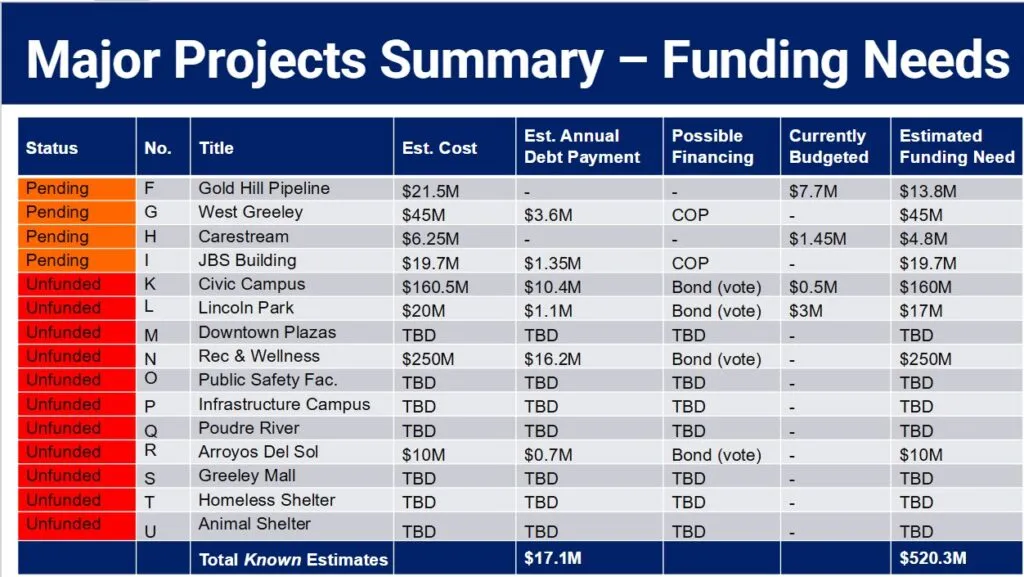

Lurking over the council’s deliberations on the West Greeley Project is a formidable list of other needs, which were brought into sharp focus during a presentation at a City Council work session last Tuesday.

For example, the city wants to redevelop the 38-year-old Union Colony Civic Center, the 40-year-old Recreation Center and the 46-year-old Active Adult Center with a modern joint facility at an estimated cost of $250 million.

It’s mulling the estimated $6.25 million purchase of the 438-acre Carestream facility near Windsor in unincorporated Weld County as an economic-development opportunity, as well as the $15.7 million acquisition of a JBS building on Promontory Circle to aid in that company’s expansion.

Also being considered are redevelopment of downtown Greeley’s Lincoln Park and redesign of the Eighth and Ninth street plazas, repurposing of the 1970s-era Greeley Mall, and improvements to the airport, homeless shelter and animal shelter.

Greeley is scrambling to find new funding to extend a 60-inch water-transmission pipeline from Windsor to the city’s Gold Hill pump station. Around $13.8 million of that project’s $21.5 million cost was to be covered by a grant from the Federal Emergency Management Agency’s Building Resilient Infrastructure and Communities (BRIC) program, but the Trump administration announced earlier this month that the grant had been rescinded because the program would be ended.

Topping the wish list, however, is an estimated $125 million to $160 million to build a new City Hall and associated offices downtown, plus renovation of spaces at sites such as the former Atmos building on 11th Avenue to house the city’s administrative staff while the new facility is being constructed.

Asked by council member Tommy Butler at the April 1 meeting whether the city could afford to simultaneously tackle both that project and West Greeley, city manager Raymond Lee responded that “I would not recommend doing this project at the same time using the same financial model.”

Echoing several residents’ pleas during that meeting’s public comment period, council member Deb DeBoutez asked, “Why didn’t we talk about asking voters about this back in November?

“The lowest risk is to ask voters for a tax increase,” she said, adding that as currently proposed, “everything is on the back of the city of Greeley.”

Lee responded that “it’s always the council’s right” to send an issue to the municipal ballot, but because of the approaching expiration of the Eagles’ lease at Blue Arena, “there’s a certain timeframe to get this project done.”

When Lind told council members that “you have to have risk to have reward,” council member Johnny Olson answered, “Our risk is on you.”

Describing the projected revenue and dazzling array of attractions that the $1.1 billion West Greeley Project would include is the easy part. Describing the mind-bogglingly complex and extraordinarily risky way it would be financed is a lot harder.