Hemp acreages explode with Farm Bill passage

Cannabis: The Next Frontier

In the past year, nearly 2,000 people have registered nearly 86,000 acres of land in Colorado on which to grow industrial hemp.

Of those acres, farmers have planted approximately 45,000 acres, hoping to cash in on a crop that can be used in what seems to be an endless list of products — from health products to concrete-like material used in construction.

There are also 13.8 million square feet of indoor space in the state registered to grow industrial hemp, which is grown from a variety of strains of the cannabis plant that has less than 0.3 percent of THC, the psychoactive ingredient that is found in marijuana.

There are also 13.8 million square feet of indoor space in the state registered to grow industrial hemp, which is grown from a variety of strains of the cannabis plant that has less than 0.3 percent of THC, the psychoactive ingredient that is found in marijuana.

SPONSORED CONTENT

Electric Vehicle Revolution: Install EV Chargers Now or Lose Tenants Tomorrow

Ignoring the shift towards electric vehicles is risky. Mac Electric offers an EV charging feasibility study to answer commercial property owners' questions.

Jessica Quinn, the registration and compliance coordinator for the Colorado Department of Agriculture’s Industrial Hemp Program, said, “We are showing about 45,000 planted acres, but that number is not solid. We will not have that nor will we have harvested acres for another month or so as we are still getting 60 to 80 reports in daily, right now.” Quinn said the state currently does not break down statistics by county.

By comparison, in 2017 there were 386 licensed growers, about 12,000 outdoor acres and 2.35 million square feet of space registered to grow hemp in Colorado.

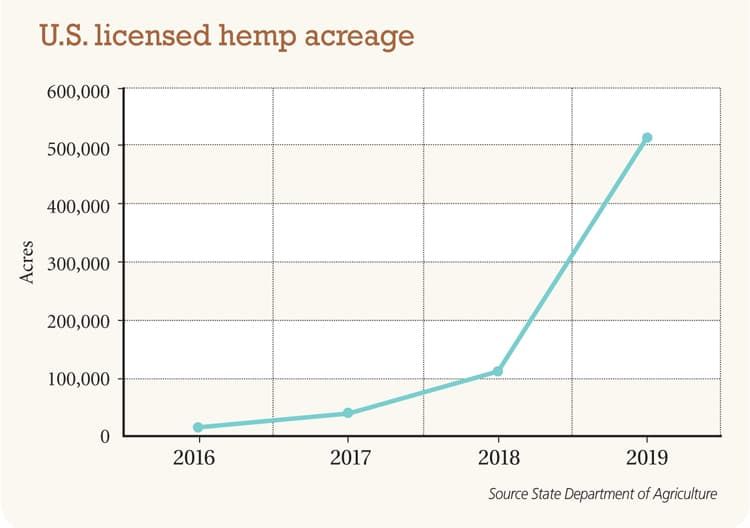

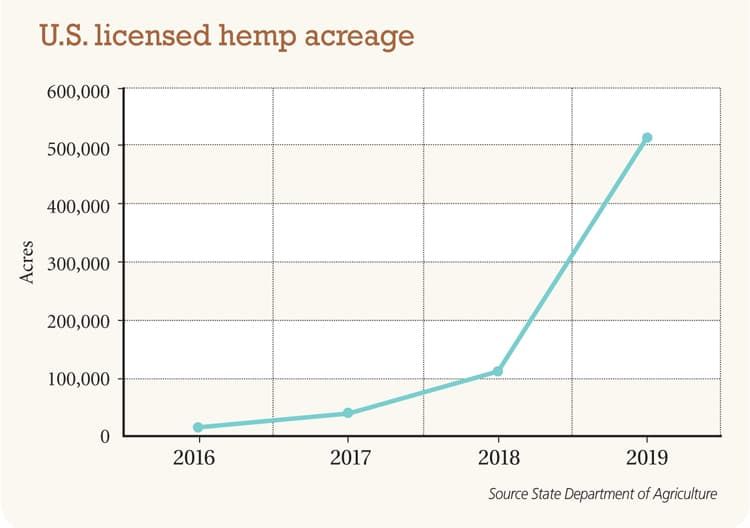

Since the passage of the 2018 Farm Bill, hemp cultivation in the United States, according to a report by Vote Hemp, a national hemp advocacy group, the number of acres of hemp licensed across 34 states totaled 511,442 in 2019 — more than quadruple the number of acres licensed from the previous year. State licenses to cultivate hemp were issued to 16,877 farmers and researchers, a 476 percent increase over 2018.

Eric Steenstra, president of Vote Hemp, said in a statement that licensing of fields is a good indicator to show intent …“but we know from previous years that significantly less hemp is planted than what is licensed due to a variety of factors including access to seed and/or clones, a lack of financing as well as inexperience. This will be the case again for 2019.”

Steenstra estimates that 230,000 acres of hemp will actually be planted and 50 percent to 60 percent of that will be harvested due to crop failure and other factors resulting in 115,000 to 138,000 acres of harvested hemp.

(The complete 2019 U.S. Hemp License Report is available online at https://www.votehemp.com/u-s-hemp-crop-report/.)

Colorado was a pioneer in the hemp industry, legalizing hemp production in 2014. But Colorado farmers were facing challenges regarding the infrastructure needed to process, transport and market hemp, as well as bank and finance operations. But since the passing of the Farm Bill, lifting federal prohibition on hemp farming, there is a federal process evolving that will strengthen to hemp industry.

The Colorado Department of Agriculture is partnering with state, local and tribal agencies, as well as industry experts in cultivation, testing, research, processing, finance and economics to establish a statewide initiative known as the Colorado Hemp Advancement and Management Plan, or CHAMP. This yearlong effort is expected to yield a plan by early 2020.

Steenstra said in a prepared statement that several key states including Colorado do not license processors so processing capacity is actually significantly higher. The growth in processors is largely for extraction and positions the hemp industry well to meet market demand for extracts but more investment is needed for fiber and grain processing.

Small operators in Colorado have been processing hemp for a variety of uses but have been unable to keep up with a burgeoning demand. Seeing the demand is not being met, Paragon Processing LLC in August opened a 250,000-square-foot hemp processing plant in Colorado City, purported to be the largest such plant in the country.

The 2018 Farm Bill, signed into law by President Trump on Dec. 20, 2018, includes a section that removes hemp from the Controlled Substances Act, places full federal regulatory authority of hemp with United States Department of Agriculture and allows state departments of agriculture to submit hemp program plans for approval and regulate hemp cultivation per their state specific programs.

Local growers are waiting for the USDA to release new federal regulations for hemp cultivation this fall, and states with approved plans can begin regulating hemp cultivation under the new Farm Bill provisions starting in 2020. As of Sept. 19, the USDA’s draft hemp rules were awaiting White House approval.

The 2018 Farm Bill asserts a ‘whole plant’ definition of hemp, including plant extracts; and removes roadblocks by authorizing and encouraging access to federal research funding for hemp, and removing restrictions on banking, water rights and other regulatory roadblocks the hemp industry currently faces. The bill also authorizes crop insurance for hemp.

Loans and Crop Insurance

While the Farm Bill encourages access to bank loans and crop insurance for hemp farmers, the reality has been slow to catch on.

Damian Farris, co-owner of Colorado Cultivars USA LLC, based in Eaton, said loans are hard to find and insurance that hemp farmers can afford is scarce.

“Loans are still far out there,” he said, adding that underwriters are waiting for the USDA to write the rules.

Farris said “the few policies being offered for crop insurance are very pricey. And right now, they are not USDA-backed.”

Colorado hemp farmers will be eligible for federal crop insurance in 2020, if they were part of the state’s 2014 pilot program.

USDA’s Risk Management Agency in August said the coverage for hemp grown for fiber, flower or seeds will be available to producers who are in areas covered by USDA-approved hemp plans or who are part of approved state or university research pilot programs.

“Numerous producers are anxious for a way to protect their hemp crops from natural disasters,” said RMA administrator Martin Barbre. “The Whole-Farm Revenue Protection policy will provide a safety net for them. We expect to be able to offer additional hemp coverage options as the USDA continues implementing the 2018 Farm Bill.”

WFRP allows coverage of all revenue for commodities produced on a farm up to total insured revenue of $8.5 million. A hemp producer must comply with applicable state, tribal or federal regulations for hemp production and have a contract for the purchase of the insured industrial hemp. Plants that contain more than 0.3 percent of THC will not be insurable.

Products

Examples of products that are made from hemp fibers or infused with hemp CBD extracts include shoes, socks, pants, shirts, hoodies and hats, shopping bags and rucksacks, rope, yarn, wash cloths and towels, paper products, twine, nets, tarps, pet bedding and mulch.

Hemp fiber can be used to create environmentally friendly packaging materials and hard bio-plastics that can be used in everything from airplanes to car parts. Hemp houses are also on the rise, as hempcrete, which is energy-efficient, nontoxic, and resistant to mold, insects and fire, has many advantages to synthetic building materials, lumber and concrete. It is a mixture of water, lime and the woody portion of the hemp stalk broken into small pieces.

Hemp bast fiber, the fiber that grows on the outside of the plant’s stalk giving it strength, has shown promising potential to replace graphene in supercapacitor batteries, which could then be used to power electric cars and handheld electric devices and tools.

Biofuels can be made from hemp. The biodiesel product it produces is called hempoline.

Wellness products include pain-relief creams, anti-blemish creams, skin lotions, topical salves, dietary supplements, therapeutic soaps and CBD gummies. There also are treats for dogs and cats to ease the pain of arthritis and anxiety.

In the past year, nearly 2,000 people have registered nearly 86,000 acres of land in Colorado on which to grow industrial hemp.

Of those acres, farmers have planted approximately 45,000 acres, hoping to cash in on a crop that can be used in what seems to be an endless list of products — from health products to concrete-like material used in construction.

There are also 13.8 million square feet of indoor space in the state registered to grow industrial hemp, which is grown from a variety of…

There are also 13.8 million square feet of indoor space in the state registered to grow industrial hemp, which is grown from a variety of…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!