Local, regional banks strive to hold own as nationals increase market share

Banks in the Boulder Valley and Northern Colorado continue their recovery from the Great Recession, which saw bank failures nationwide reach levels not seen since the Great Depression.

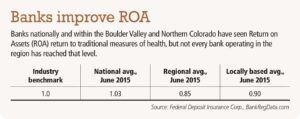

A BizWest analysis of banking data from June 2008 — when the banking crisis was in full swing — and June 2015, published by the Federal Deposit Insurance Corp., reveals a sector that has slowly built capital reserves, eliminated problem loans and improved earnings, although most have not yet returned to traditional industry benchmarks of profitability.

“We’re certainly continuing to see slow and steady progress toward improvement,” said Jim Swanson, president of Bank Strategies LLC, a Golden-based banking consulting firm. “Average ROA (return on assets) is back up close to 1 percent. It’s seen steady improvement since the recession. We’re not back to what it was pre-recession.

SPONSORED CONTENT

Federal District Court Rules Corporate Transparency Act Unconstitutional . . . But Most Small Businesses Must Still Comply

Lyons Gaddis Real Estate and Business Attorney Cameron Grant shares important details of the Corporate Transparency Act (CTA).

“That’s kind of a question for debate that’s out there now,” he added. “Is this, the level we’re at now, kind of the new normal? Are lower earnings the norm?”

ROA rebounds

Return on assets, which measures net income divided by total assets, totaled 1.03 percent nationwide in the second quarter of 2015, according to BankRegData.com. Generally, an ROA of 1 percent or higher is considered healthy. During the depths of the financial crisis, nationwide ROA fell to a negative 1.10 percent in the fourth quarter of 2008, according to the website.

Banks operating in the Boulder Valley and Northern Colorado — including national, regional and local banks — averaged below the 1 percent benchmark as of June 30, 2015, at 0.85 percent, according to an analysis of data from the FDIC. A minority of the 47 banks operating in the combined region — 18 — recorded ROA of at least 1 percent, and five of those are based in the four-county region of Boulder, Broomfield, Larimer and Weld counties.

Among locally based banks, standouts include AMG National Trust Bank, based in Boulder, 1.63 percent; Bank of Colorado, based in Fort Collins, 1.04 percent; Farmers Bank, based in Ault, 1.35 percent; Flatirons Bank in Boulder, 1.02 percent; and Verus Bank in Fort Collins, 1.76 percent.

Eric Hoffner, president of Farmers Bank, said the banking sector has “obviously recovered very well.”

But it’s also a sector that has undergone wrenching change. Gone from the market are once-familiar names such as Bank of Choice, Colorado Capital Bank, First Community Bank, Mile High Banks, FirsTier Bank, Liberty Savings Bank, New Frontier Bank, New West Bank, Signature Bank, Pueblo Bank & Trust Co., United Western Bank, Wachovia Bank and Washington Mutual Bank.

Arrived are Citywide Banks, First-Citizens Bank, Great Western Bank, High Plains Bank, NBH Bank (Community Banks of Colorado), Northstar Bank, Sunflower Bank, Wray State Bank and — soon — Bank of America, set to open its first Boulder branch on 28th Street.

Surge of the nationals

Bank of America’s pending arrival demonstrates another trend in local banking: a surge in market share for the big nationals. Banks with national footprints made up 45.7 percent of the Boulder Valley market in June 2008, according to FDIC data. That included national banks such as JPMorgan Chase, Keybank, U.S. Bank, Wachovia Bank, Washington Mutual and Wells Fargo.

But nationals’ share of the Boulder Valley market — Boulder and Broomfield counties — jumped to 52.65 percent as of June 30.

Even bigger growth was experienced in Larimer and Weld counties, with national banks growing from 20.48 percent of the market in June 2008 to 29.76 percent this year.

Most of the gains in market share came from two nationals: JPMorgan Chase and Wells Fargo. JPMorgan gained more than five percentage points in the Boulder Valley and four percentage points in Northern Colorado, while Wells Fargo surged, adding almost 11 percentage points in the Boulder Valley and more than six in Northern Colorado. U.S. Bank gained modestly in both markets, while Keybank actually showed slight losses in market share in both regions.

Larry Wood, senior commercial banking manager and vice president for First National Bank, said nationals have been very aggressive in competing for contracts for governmental business, including counties and municipalities, which has helped fuel their growth with large deposits.

Additionally, national banks tend to have technological offerings, such as robust mobile and online banking platforms, of interest to millennials, he said, something also offered by First National.

“That’s why we haven’t lost much market share,” Wood said, “but some of the smaller banks, they just can’t offer a lot of that.”

First National Bank largely has held its own in terms of market share, dropping from 5.65 percent in the Boulder Valley in June 2008 to 3.79 percent in 2015; in Northern Colorado, the bank has almost exactly the same market share as it did seven years ago, 18.93 percent in 2015, compared with 18.95 percent in 2008.

Shawn Osthoff, president of Bank of Colorado, said the surge of nationals in Northern Colorado — gaining 10 percentage points in the past seven years — can be traced to a variety of factors. He agreed with Wood that nationals are pursuing governmental business, and he noted that Northern Colorado saw its share of bank failures, and those deposits shifted to a lot of institutions, including nationals.

“These large nationals have so many more locations, so convenience might be the biggest thing,” he said. “It’s a very competitive environment.”

Locals stake their claims

Several locally based banks were shut down, with their assets sold in the past seven years. Many of those that remain have succeeded in increasing market share, even in the face of competition from nationals.

Of 12 banks based in the Boulder Valley or Northern Colorado, nine have increased their market share. Flatirons Bank in Boulder has more than doubled its market share, to 1.07 percent. Verus Bank in Fort Collins has jumped from the 1.39 percent combined market share of Fort Collins Commerce Bank, Larimer Bank of Commerce and Loveland Bank of Commerce, to 2.17 percent this past June.

Bank of Colorado jumped from 4.18 percent market share in Larimer and Weld counties to 7.6 percent. That was due in part to its acquisition of New West Bank, which accounted for 1.34 percent of the Northern Colorado market in June 2008.

“We’ve also had good organic growth,” Osthoff said.

Economy helps bank health

Osthoff said banks’ performance has improved along with the economy. “I think, in general, the health of our industry and the banking sector has tremendously improved since 2008,” he said.

Improve it has. Deposits have surged in the Boulder Valley and Northern Colorado since June 2008. Boulder Valley deposits jumped to $9.66 billion this year, compared with $6.5 billion seven years ago. That’s an increase of 48.6 percent. In Northern Colorado, deposits jumped to $10.23 billion, up from $8.27 billion, an increase of 23.7 percent.

Those increased deposits have helped to fuel a banking revival.

A report by Bank Strategies LLC found that only one Colorado bank scored a Texas Ratio — a measure of banks’ credits problems — of higher than 100 percent as of June 30. Banks that score above 100 percent are considered at greater risk of failure.

That bank, Premier Bank in Denver, scored 469.96 percent, and was shut down by the Colorado Division of Banking on July 10. Advantage Bank in Loveland scored 48.10 percent, the highest of any locally based bank but still well short of the danger zone.

In Northern Colorado, a variety of factors have contributed to improvements in banking, such as population growth and energy development, said Hoffner of Farmers Bank. But the region also is susceptible to downturns in those sectors. In the agribusiness sector, low cattle and commodity prices are hurting the economy, making it unlikely that farmers and ranchers will make large capital purchases, such as new equipment.

“If you look at all commodities, including cattle and corn, everything is down right now,” he said. “Those guys are having a much tougher year.”

Additionally, lower energy prices are beginning to be felt in the economy, with layoffs, reduced equipment purchases and other factors.

So what next?

Performance of the banking sector will be influenced by the Federal Reserve’s expected interest-rate hike. How large the expected increase will be — and how aggressively the Fed chooses to boost rates — will have both positive and negative effects on the banking sector.

“It will be a good test of how well the banks have done in terms of situating their balance sheets to take advantage of a change in rates,” Swanson said.

Higher interest rates will be positive for most banks, as they will be able to pass those higher rates on to customers, while delaying paying out higher rates on deposits, at least for awhile. But if an institution has engaged in too much fixed-rate lending, their ability to take advantage of higher rates will be limited.

Additionally, if the economy stays favorable, bankers will need to “sharpen those skills of raising deposits to fund that growth,” Swanson said. “When your skills are a little rusty, that’ll be a challenge.”

Christopher Wood can be reached at 303-630-1942, 970-232-3133 or cwood@bizwestmedia.com.

| Boulder Valley | Northern Colorado | |||||||

| Name | Deposits, June 2008 (000s) | Market share, June 2008 | Deposits, June 2015 (000s) | Market share, une 2015 | Deposits, June 2008 (000s) | Market share, June 2008 | Deposits, June 2015 (000s) | Market share, June 2015 |

| Academy Bank, National Association | 8,210 | 0.13% | 4,525 | 0.05% | 18,369 | 0.22% | 16,202 | 0.16% |

| Adams Bank & Trust | 0 | 14331 | 0.0015 | 24728 | 0.003 | 80026 | 0.0078 | |

| Advantage Bank (1) | 67444 | 0.0104 | 0 | 238231 | 0.0288 | 239612 | 0.0234 | |

| Amfirst Bank, National Association | 2729 | 0.0004 | 12923 | 0.0013 | 0 | 0 | ||

| AMG National Trust Bank | 72291 | 0.0111 | 246960 | 0.0256 | 0 | 0 | ||

| ANB Bank/American National Bank (2) | 34837 | 0.0054 | 50574 | 0.0052 | 0 | 18721 | 0.0018 | |

| Bank of Colorado | 0 | 0 | 345754 | 0.0418 | 777430 | 0.076 | ||

| Bank of Estes Park/First National Bank of Estes Park (3) | 7978 | 0.0012 | 6842 | 0.0007 | 66849 | 0.0081 | 96603 | 0.0094 |

| Bank of the West | 236987 | 0.0364 | 400785 | 0.0415 | 117193 | 0.0142 | 162890 | 0.0159 |

| BOKF, National Association/ | ||||||||

| Colorado State Bank and Trust, N. A. | 25225 | 0.0039 | 31670 | 0.0033 | 0 | 0 | ||

| Cache Bank and Trust | 0 | 0 | 111945 | 0.0135 | 119139 | 0.0116 | ||

| Centennial Bank | 0 | 54505 | 0.0056 | 0 | 0 | |||

| Citywide Banks (1) | 0 | 45232 | 0.0047 | 0 | 0 | |||

| CoBiz Bank | 261474 | 0.0402 | 301727 | 0.0312 | 0 | 7014 | 0.0007 | |

| Colorado Capital Bank (4) | 36717 | 0.0056 | 0 | 0 | 0 | |||

| Colorado Community Bank | 0 | 0 | 139295 | 0.0168 | 0 | |||

| Colorado East Bank & Trust | 0 | 0 | 117884 | 0.0143 | 191254 | 0.0187 | ||

| Compass Bank | 92548 | 0.0142 | 229435 | 0.0237 | 34422 | 0.0042 | 146729 | 0.0143 |

| Equitable Savings and Loan Association | 0 | 0 | 2179 | 0.0003 | 2934 | 0.0003 | ||

| Farmers Bank | 0 | 0 | 179036 | 0.0217 | 198685 | 0.0194 | ||

| First Community Bank (5) | 268582 | 0.0413 | 0 | 59511 | 0.0072 | 0 | ||

| First FarmBank | 0 | 0 | 25315 | 0.0031 | 95123 | 0.0093 | ||

| First National Bank/First National Bank of Omaha | 367534 | 0.0565 | 366296 | 0.0379 | 1567207 | 0.1895 | 1936516 | 0.1893 |

| First National Bank of Wyoming (6) | 0 | 0 | 12998 | 0.0016 | 0 | |||

| First Western Trust Bank | 7506 | 0.0012 | 71846 | 0.0074 | 32783 | 0.004 | 93523 | 0.0091 |

| First-Citizens Bank & Trust Company | 0 | 19104 | 0.002 | 0 | 14824 | 0.0014 | ||

| FirstBank (7) | 735348 | 0.1131 | 1375709 | 0.1424 | 304608 | 0.0368 | 790754 | 0.0773 |

| FirsTier Bank (8) | 166030 | 0.0255 | 0 | 23159 | 0.0028 | 0 | ||

| FlatIrons Bank | 31603 | 0.0049 | 103574 | 0.0107 | 0 | 0 | ||

| FMS Bank | 0 | 0 | 0 | 37259 | 0.0036 | |||

| Great Western Bank | 0 | 390399 | 0.0404 | 0 | 243125 | 0.0238 | ||

| Guaranty Bank and Trust Company | 252965 | 0.0389 | 337979 | 0.035 | 300602 | 0.0364 | 344157 | 0.0336 |

| High Plains Bank | 0 | 9004 | 0.0009 | 0 | 0 | |||

| Hillcrest Bank | 0 | 0 | 5570 | 0.0007 | 0 | |||

| JPMorgan Chase Bank, National Association | 796916 | 0.1226 | 1720303 | 0.1781 | 357028 | 0.0432 | 874758 | 0.0855 |

| Keybank National Association | 100348 | 0.0154 | 133339 | 0.0138 | 141183 | 0.0171 | 137818 | 0.0135 |

| Liberty Savings Bank, F.S.B. (9) | 36398 | 0.0056 | 0 | 0 | 0 | |||

| NBH Bank/Bank of Choice (10) | 0 | 0 | 418501 | 0.0506 | 237833 | 0.0232 | ||

| New Frontier Bank (11) | 159217 | 0.0245 | 0 | 1471698 | 0.178 | 0 | ||

| New West Bank | 0 | 0 | 110514 | 0.0134 | 0 | |||

| North Valley Bank | 6205 | 0.001 | 9558 | 0.001 | 0 | 0 | ||

| Northstar Bank Colorado (8) | 0 | 11368 | 0.0012 | 0 | 135439 | 0.0132 | ||

| Points West Community Bank | 0 | 0 | 14626 | 0.0018 | 81720 | 0.008 | ||

| Signature Bank | 0 | 0 | 57944 | 0.007 | 0 | |||

| Summit Bank & Trust | 23927 | 0.0037 | 67963 | 0.007 | 3294 | 0.0004 | 22915 | 0.0022 |

| Sunflower Bank, National Association | 0 | 14108 | 0.0015 | 0 | 0 | |||

| TCF National Bank | 12672 | 0.0019 | 49224 | 0.0051 | 0 | 0 | ||

| The First National Bank of Santa Fe/Mile High Banks (12) | 466523 | 0.0717 | 166371 | 0.0172 | 41272 | 0.005 | 26291 | 0.0026 |

| The Home State Bank | 0 | 36307 | 0.0038 | 473126 | 0.0572 | 667858 | 0.0653 | |

| The Pueblo Bank and Trust Company (13) | 6706 | 0.001 | 0 | 0 | 0 | |||

| The Rawlins National Bank | 1165 | 0.0002 | 10793 | 0.0011 | 0 | 0 | ||

| U.S. Bank National Association | 292604 | 0.045 | 589330 | 0.061 | 169729 | 0.0205 | 383198 | 0.0375 |

| United Western Bank (14) | 11920 | 0.0018 | 0 | 10704 | 0.0013 | 0 | ||

| Valley Bank & Trust (Brighton) | 18755 | 0.0029 | 0 | 37139 | 0.0045 | 56420 | 0.0055 | |

| Valley Bank and Trust Co. (dba Western States Bank) | 0 | 0 | 50263 | 0.0061 | 108959 | 0.0107 | ||

| Vectra Bank Colorado, National Association | 110990 | 0.0171 | 135895 | 0.0141 | 0 | 0 | ||

| Verus Bank of Commerce/Fort Collins Commerce Bank/Larimer Bank of Commerce/Loveland Bank of Commerce | 0 | 0 | 116085 | 0.0139 | 222271 | 0.0217 | ||

| Wachovia Bank, National Association | 623606 | 0.0959 | 0 | 211612 | 0.0256 | 0 | ||

| Washington Mutual Bank (15) | 76285 | 0.0117 | 0 | 42861 | 0.0052 | 0 | ||

| Wells Fargo Bank, National Association | 1082195 | 0.1664 | 2643911 | 0.2736 | 813465 | 0.0984 | 1648409 | 0.1611 |

| Wray State Bank | 0 | 0 | 0 | 13011 | 0.0013 | |||

| TOTAL | 6502440 | 9661890 | 8268682 | 10229420 | ||||

Banks in the Boulder Valley and Northern Colorado continue their recovery from the Great Recession, which saw bank failures nationwide reach levels not seen since the Great Depression.

A BizWest analysis of banking data from June 2008 — when the banking crisis was in full swing — and June 2015, published by the Federal Deposit Insurance Corp., reveals a sector that has slowly built capital reserves, eliminated problem loans and improved earnings, although most have not yet returned to traditional industry benchmarks of profitability.

“We’re certainly continuing to see slow and steady progress toward improvement,” said…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!