New bank branches popping up across area

Bank representatives say they’re lured to our neck of the woods by its high average income and its stable residential real estate market, which declined a lot less in value than did markets in many other places in the nation.

Boulder’s per-capita personal income is $51,893, the 13th highest in the nation, according to Census Bureau statistics from 2011. Denver’s is $48,980, the 19th highest statistical area in the country, according to statistics.

SPONSORED CONTENT

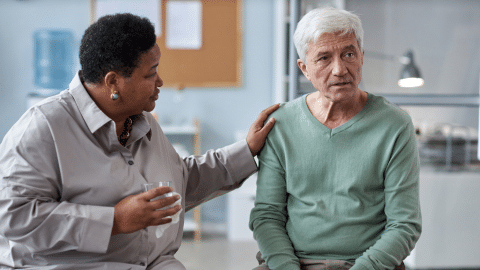

Prioritizing mental health in hospice care

Prioritizing mental health support alongside physical comfort, Pathways hospice care aims to enhance the quality of life for patients and their families during one of life's most challenging transitions.

Home State Bank opened a Lafayette office at the beginning of the year with eight employees, recording as much as $23 million in loans and $6 million in deposits so far in 2013. The family-owned bank based in Loveland has $699 million in assets.

Sunflower Bank plans to open three new bank branches in Longmont around October, according to Dan Allen, regional president of Northern Colorado for the Salina, Kansas-based bank.

Allen and two other former executives of Mile High Banks were snapped up by Sunflower. More people will be hired before the new branches open, Allen said. Details of the new branch locations have not been released.

The family-owned bank has $1.7 billion in assets and 33 locations in Kansas, Colorado and Missouri.

Solera National Bancorp Inc. (OTCQB: SLRK) in Lakewood said a couple of weeks ago that it would expand its loan-servicing office in Boulder into a full-blown bank branch. Four mortgage loan officers currently work there, and the bank has $169 million in assets.

All of the new bank branches are competing with 31 other bank branches that serve Boulder and Broomfield counties.

Is there enough business to go around?

Don’t forget that Mile High Banks in Longmont is going gangbusters now after being recapitalized with as much as $90 million by Strategic Growth Bancorp bank holding company in El Paso, Texas.

Mile High Banks is off of the Federal Deposit Insurance Corp.’s watch list – another good sign in a list of positive indicators for the bank.

Mile High Banks’ stock was bought by Strategic Growth Bancorp for $5.5 million as Mile High’s parent company Big Sandy Holding Co. in Limon went through voluntary Chapter 11 reorganization. Mile High Banks operated independently from the holding company, executives said at the time.

Ad ban lifted

Here’s a new thought about how startup companies can go about wooing potential investors these days.

Federal regulators have lifted a ban on advertising by which startup companies were bound. Such companies are expected to be able to advertise to “accredited investors” by the end of September.

They’ll be looking for folks with a net worth of more than $1 million outside of their primary residences or income of more than $200,000 in each in the previous two years.

“That’s a big deal” in Boulder County, according to Chris Hazlitt, one of the most in-the-know lawyers on start-ups in the region and a partner at Bryan Cave LLP’s Boulder office.

By lifting the general solicitation ban, “an entire new universe of potential investors is opened up,” Hazlitt said.

Crowdfunding websites such as Kickstarter.com and IndieGogo.com have helped some local companies raise hundreds of thousands of dollars.

While there doesn’t seem to be any direct link between the two, at first glance, the advertising ruling is a big deal to crowdfunders, said Jonathan Beninson, a founder of First Funder Inc., a Boulder crowdfunding company.

“The marketing and advertising component for crowdfunding outweighs the fundraising component,” Beninson said. “Ultimately what it comes down to is reaching out to people in a way that is significantly less expensive than regular advertising.”

Small businesses boosted

Startup companies are just a few of the companies locally that have taken advantage of small-business lending available from the federal government in recent years.

Colorado banks making small-business loans increased their lending by $25.6 million in the first quarter of 2013, compared with the same quarter in 2012, according to the U.S. Treasury Department.

CIC Bancshares Inc., the Denver parent holding company of Centennial Bank in Boulder, and the Colorado Enterprise Fund Inc. in Denver, which has focused on loans to natural and organic food companies locally, are both on the Small Business Lending Fund list.

Beth Potter can be reached at 303-630-1944 or bpotter@bcbr.com.

Bank representatives say they’re lured to our neck of the woods by its high average income and its stable residential real estate market, which declined a lot less in value than did markets in many other places in the nation.

Boulder’s per-capita personal income is $51,893, the 13th highest in the nation, according to Census Bureau statistics from 2011. Denver’s is $48,980, the 19th highest statistical area in the country, according to statistics.

Home State…

THIS ARTICLE IS FOR SUBSCRIBERS ONLY

Continue reading for less than $3 per week!

Get a month of award-winning local business news, trends and insights

Access award-winning content today!